Kalshi resumes taking bets on U.S. election after appeals court lifts freeze

KalshiEx offered customers contracts that bet on congressional election outcomes. The Commodity Futures Trading Commission objected.

The commodities exchange KalshiEx resumed taking bets on the outcome of the 2024 congressional election Wednesday, hours after a federal appeals court in Washington, D.C., lifted a legal freeze on such contracts.

And Kalshi's website says the exchange on Thursday will begin accepting bets on the outcome of the presidential election between Republican nominee Donald Trump and Vice President Kamala Harris.

The appeals court in a decision rejected an effort by the Commodity Futures Trading Commission to prohibit Kalshi from offering "Congressional Control Contracts" while the federal agency appealed a lower court's ruling that had given a green light for such bets.

The CFTC is continuing to appeal that lower court ruling, and later Wednesday asked the appeals court to expedite its case, and schedule oral arguments for early December, a month after Election Day.

Kalshi's website as of Wednesday evening showed two types of events-based contracts related to the control of each chamber of Congress.

A total of $45,000 of contracts had been purchased as of 9:44 p.m. ET on contracts related to "Which Party will win the Senate," with 75% of those bets predicting Republicans will regain control of that chamber, and 25% predicting that Democrats will retain their majority.

Another $20,000 had been wagered on "Which party will win the House," with 63% of the bets on Democrats regaining control, and the remainder on Republicans.

A separate page on the exchange's site featured the question, "Who will win the Presidency?" but was not accepting bets on either Trump or Harris, as of Wednesday evening.

Instead, that page had a link that said, "Notify me," with a countdown clock showing fewer than 19 hours remaining on it. The link connects to pages where users can create Kalshi accounts.

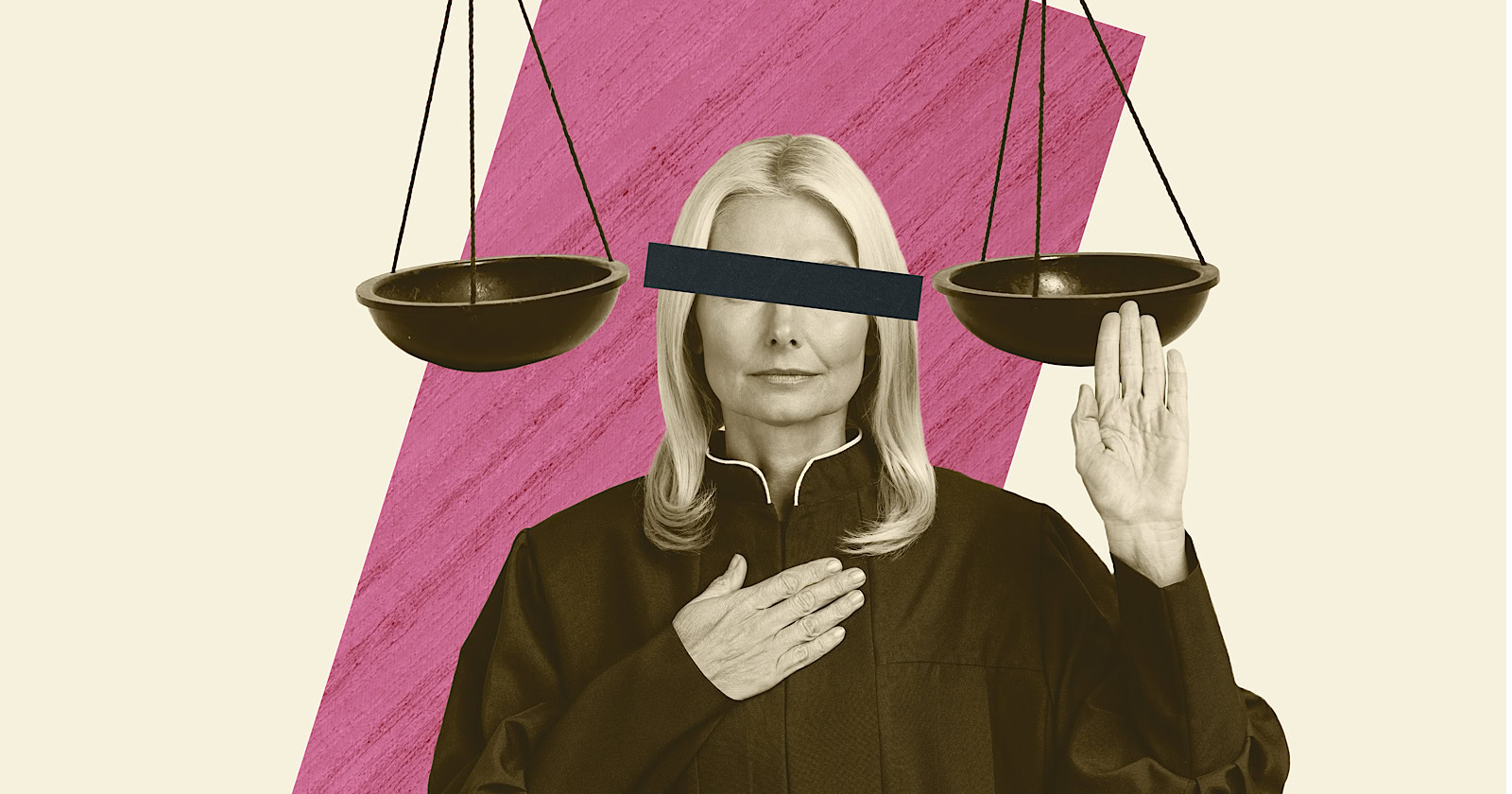

'Irreparable harm'

The CFTC in legal filings argues that the contracts might cast doubt on the integrity of elections.

But in its ruling Wednesday, a three-judge panel of the U.S. Appeals Court for the District of Columbia Circuit said the CFTC "has failed to at this time to demonstrate that it or the public will be irreparably injured" without a stay on the contracts being offered during its appeal;

Judge Patricia Millett, who wrote the 15-page ruling, said the agency could renew its emergency bid to block the contracts pending resolution of the appeal "should substantiating evidence arise."

There were no dissents on the decision in favor of KalshiEx, which offers customers contracts that can hedge the risk of certain events occurring.

The contracts at issue in the case are bets on predictions of which political party will control the Senate and the House of Representatives at a future, specified date.

On Wednesday, Kalshi's co-founder Tarek Mansour in a social media post touting the ruling suggested the exchange might offer contracts on the outcome of the U.S. presidential election. Kalshi would allow individuals or entities to invest up to $100 million per congressional contract, he wrote.

The CFTC opposes the contracts because of concerns they could be used by foreign individuals or governments "directly or indirectly to manipulate the election-contract market," despite Kalshi's claim that only U.S. residents would be allowed to invest, the ruling noted.

But Millett wrote, "While the question on the merits is close and difficult, the Commission cannot obtain a stay at this time because it has not demonstrated that it or the public will be irreparably harmed while its appeal is heard."

"That failure is fatal to the Commission's stay request because a showing of irreparable harm is a necessary prerequisite for a stay," the judge wrote.

The CFTC declined to comment on the ruling, but noted that "this is for our request for an emergency stay. Not the appeal itself."

KalshiEx did not immediately respond to a request for comment.

The non-profit investor advocacy group Better Markets blasted the appeals panel's decision.

"The court's order will allow betting on an incredibly close and contentious race just weeks before the election. That makes this a sad and ominous day for election integrity in the United States," said Stephen Hall, legal director of Better Markets.

"The Court concluded that the CFTC had failed to show that the agency or the public would be irreparably harmed if trading went ahead while the appeal is heard. Yet, the Court conceded the various threats of election and market manipulation posed by the contract," Hall said.

"Moreover, it acknowledged that the merits were 'close and difficult,' suggesting the CFTC has a decent chance of winning ultimately. The record clearly includes concrete examples of election interference, which substantiates the threat of irreparable harm. Under these circumstances, and with so much at stake, the Court could have and should have gone the other way."

Elections vs. gaming

The CFTC had barred KalshiEx from listing its congressional contracts on the exchange, which the commission regulates, on the ground that they would violate the laws of many states that ban gambling on elections.

This illustration photo shows money and gambling dice in front of a screen showing political market odds, in Los Angeles on November 1, 2023.

Chris Delmas | Afp | Getty Images

But Judge Jia Cobb in U.S. District Court in Washington, D.C., ruled last month that the the regulator had erred in finding that KalshiEx's congressional contracts involved gaming or gambling.

Cobb's ruling was in effect for only about eight hours before the D.C. appeals court stayed it at the request of the CFTC.

But KalshiEx had accepted an unknown number of bets on the congressional elections during that time.

That administrative stay was lifted in Wednesday's ruling.

The CFTC rejected Kalshi's application to offer the contracts in September 2023.

The commission, among other things, found that the contracts were unlikely to be used for commercial-risk hedging, and also that they could threaten the integrity of elections by "creating monetary incentives for voters to support particular candidates or incentivizing the spread of misinformation," the appeals court ruling noted.

The CFTC also cited a "special rule" under the Commodity Exchange Act, which allows the commission to review and ban certain types of event contracts if it determines they are contrary to the public interest. The types of activities subject to that ruling including "gaming," as well as terrorism, assassination, war, or activity that is illegal under any federal or state law.

Kalshi sued the CFTC in November challenging the order as arbitrary and capricious.

In her subsequent ruling in the exchange's favor, Judge Cobb found that under the special rule of the Commodity Exchange Act, " 'gaming' must refer to the 'act of playing a game' or playing games for stakes,'" the appeals court decision noted.

"The district court also ruled that the term 'involve' refers to the 'event being offered and traded' under a contract, not the contract itself," the appeals court panel said. "Thus, because the underlying events in the Congressional Control Contracts—'elections, politics, Congress, and party control'—are not themselves unlawful under state law, the contracts did not "involve" 'illegal or unlawful activity.' "

Koichiko

Koichiko