Meta Posts Solid Results in Its Q4 and Full-Year Update

Meta continues to go from strength to strength.

Meta has posted its latest earnings results, covering Q4 2024, and despite the ongoing and consistent predictions of the collapse of Zuckerberg’s Facebook empire, the actual data shows that Meta continues to go from strength to strength.

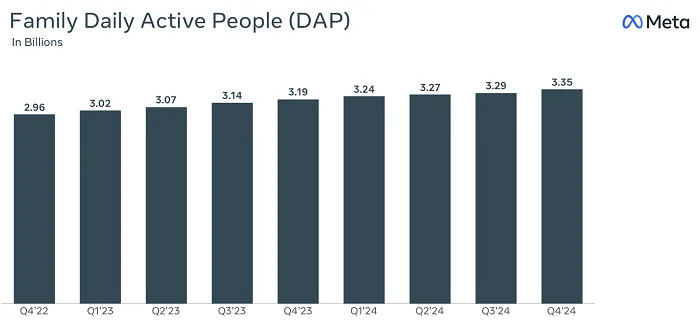

First off, on usage, Meta added more actives in Q4, taking it to 3.35 billion users across its apps.

The steady rise of Threads may have helped in this respect, though Facebook remains its most popular surface. But then again, Instagram now has more users than Facebook in Europe, though either way, combined, Meta continues to expand its audience, which will provide more opportunity for marketers, and more ad dollars for the company.

On that front, Meta recently announced the initial test of Threads ads, which will help it further build on this element:

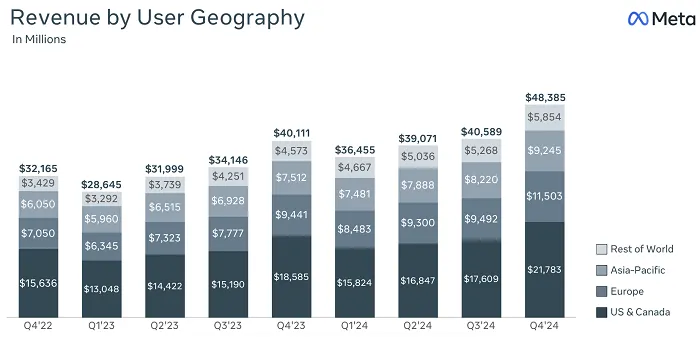

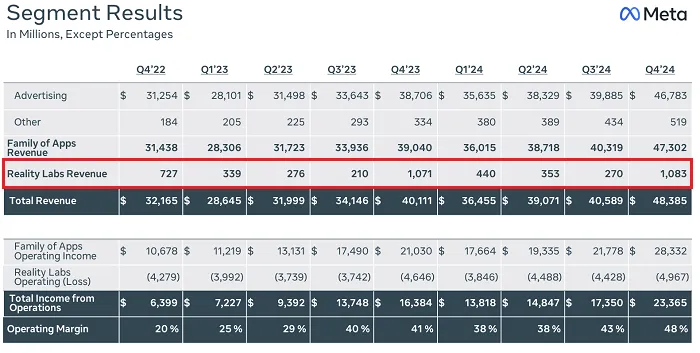

Meta brought in a massive $48.39 billion in revenue for Q4, taking it $164.5 billion for the full year. For comparison, Meta brought in $134.9 billion in 2023.

The vast majority of the company’s intake still comes from ads (96%), with its other bets only just starting to gain any significant traction in the market.

But they also contributed to its numbers this time around:

Reality Labs, its VR and AR division, reached a new revenue record in Q4, as more people purchased Ray Ban Meta glasses and VR units.

Indeed, Ray Ban Meta sales have exceeded expectations, and will continue to become a bigger contributor to Meta’s bottom line as their functionality expands (eventually into AR as well), while the Quest app reached the top of the App Store charts at Christmas, reflecting the number of Quest units that Santa delivered.

It’s still losing money on these bets overall (Meta projects that it will spend $65 billion on AI development alone this year, while you can see the ongoing losses for Reality Labs in the above listing), but we are seeing the initial seeds of promise for Meta’s vision, and where that investment could eventually lead for the company.

And where it could lead is market dominance, especially in VR, where it really doesn’t have a rival as yet.

And as the company’s intake continues to grow, with its overall revenue up 22% year-over-year, now is the time for Meta to make these key investments in its future.

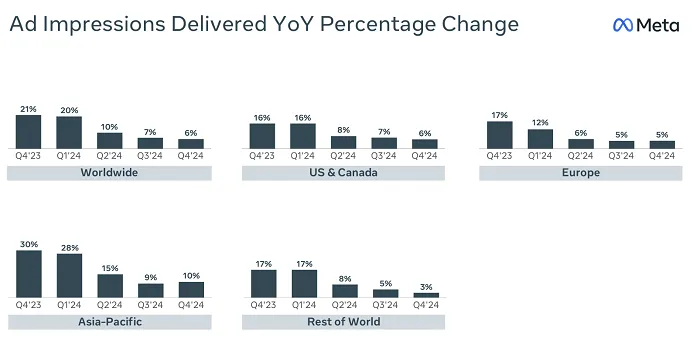

Meta’s also getting smarter with its ads, and presenting more of them in-stream.

And again, that’s before you factor in Threads, which, at 300 million users, and rising, presents another huge canvas for Meta’s promotions.

(Update: In a separate post, Zuckerberg also announced that Threads is now up to 320 million active users.)

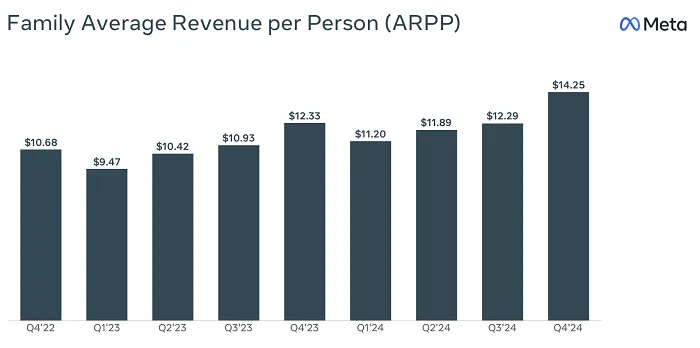

Which will further boost its revenue per user figures:

This chart should make all Meta investors happy, and while some users have complained about the rising number of ads in Meta’s apps, that clearly hasn’t impacted overall usage, with all of its key metrics trending up at this stage.

Though that could still change as a result of Meta’s revised moderation strategy, in moving to a Community Notes approach, and retiring third-party fact-checking. Some people are now looking to leave Meta’s apps in protest over what they see as Zuckerberg bowing to President Trump’s demands on this front.

But at the same time, Zuckerberg’s decision-making here will likely be good for business, with the company hoping to gain favor to help maximize its expansion into Europe, develop next-level AI models, and push ahead with VR development.

It’s also hoping to avoid the impacts of foreign tariffs on imports, with many of its wearables components made in China, and other regions. Trump’s vow to increase tariffs to seek more favorable deals for the U.S. could have a major impact here, particularly on Meta’s AR glasses, which it’s still working to reduce the cost of, in order to make them a more appealing consumer product.

As such, if Meta can get an in with the Trump team, that could have a range of benefits, and reports have suggested that Zuckerberg himself is looking to buy a house in Washington to strengthen these ties.

So while you may not like it, Zuckerberg’s moves do make sense. The question then is whether the increased risks of misinformation as a result of this shift outweigh the broader benefits for the business.

And also, if Zuck and Co. really care about that either way.

In terms of other impacts, Meta’s also still grappling with EU regulations, which recently saw it fined another $841 million for antitrust violations. It’s also still rationalizing its staff, with another round of job cuts in October, though its overall headcount actually increased by 10% in 2024.

On the flip side, in terms of potential gains, Meta stands to benefit a lot from the confusion around TikTok’s status in the U.S., with more brands and creators looking to shift away from the platform for more stability.

Meta’s also developing a plan to deploy AI bot profiles in its apps, which sounds strange, but could also end up boosting in-app revenue, by providing more users with the dopamine hit of extra engagement.

Overall, it’s a great result for Meta, underlining its key strengths, and its solid market positioning. It’s arguably leading the way in the three key areas of tech development, in AI, AR, and VR connection, while it’s also still bringing in more money despite its focus on the next stage.

And while not all of its decisions have been popular, the data doesn’t lie, and Meta looks to be making the right moves to propel the business forward.

The user impacts are another question, and too often these are only raised with any force in retrospect. But as a business report, there are few companies with better prospects.

MikeTyes

MikeTyes