Microsoft stock pops 9% on earnings beat as Azure annual revenue tops $75 billion

For the first time, Microsoft disclosed a dollar figure for its Azure cloud business.

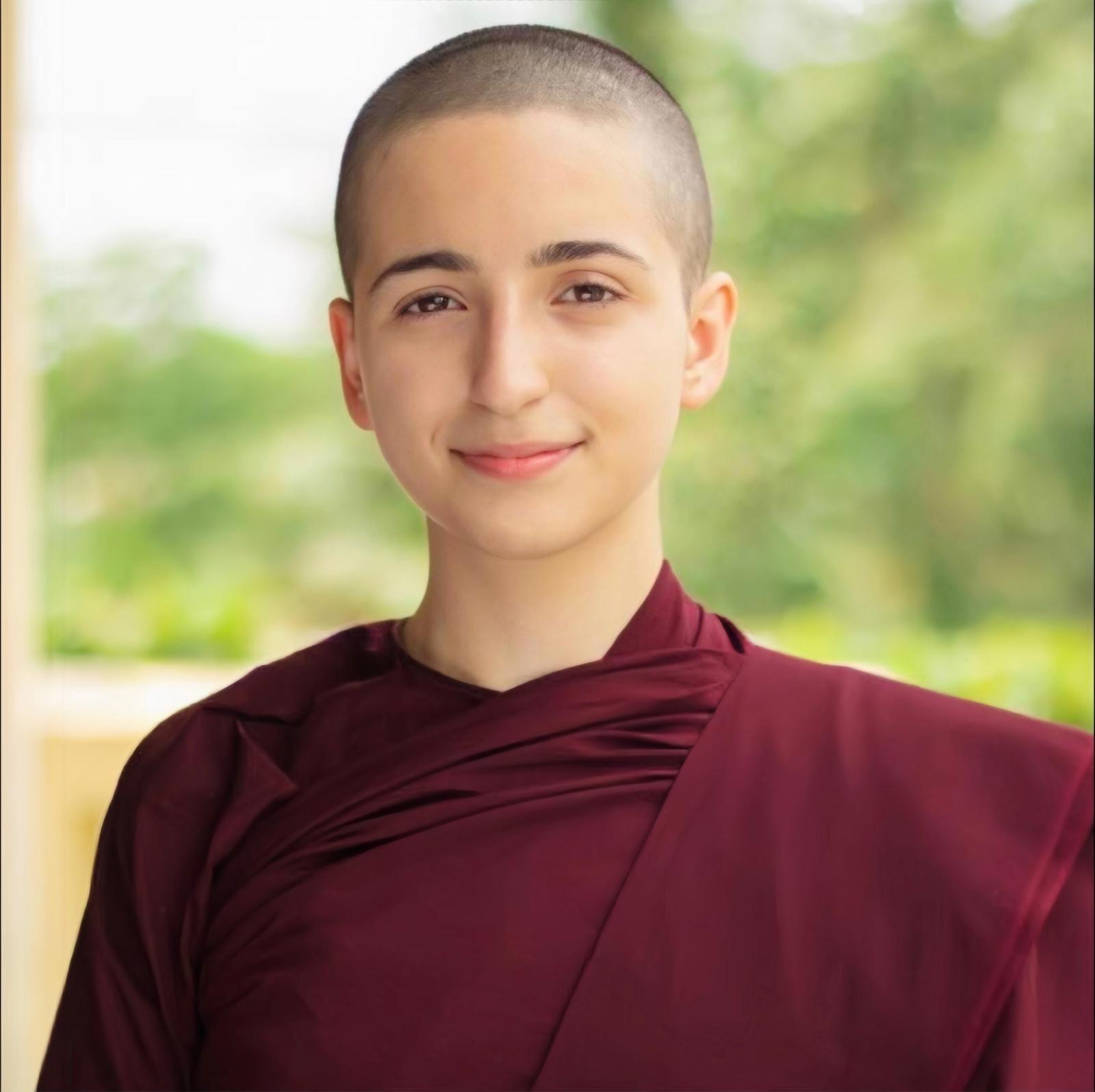

Microsoft CEO Satya Nadella speaks at an event commemorating the 50th anniversary of the company at Microsoft headquarters in Redmond, Washington, on April 4, 2025.

David Ryder | Bloomberg | Getty Images

Microsoft shares jumped 9% in extended trading on Wednesday after the company reported better-than-expected earnings and revenue for the fiscal fourth quarter.

Here's how the company performed in comparison with LSEG consensus:

Earnings per share: $3.65 vs. $3.37 expectedRevenue: $76.44 billion vs. $73.81 billion expectedMicrosoft's finance chief, Amy Hood, called for $74.7 billion to $75.8 billion in fiscal first-quarter revenue. The middle of the range, at $75.25 billion, surpassed LSEG's $74.09 billion consensus. The company sees 37% Azure growth at constant currency. StreetAccount's consensus was 33.7%.

The company's fiscal first-quarter implied operating margin of 46.6% is wider than the 45.7% consensus among analysts surveyed by StreetAccount. Hood's forecast included over $30 billion in capital expenditures.

Hood said Microsoft sees over $30 billion in fiscal first quarter capital expenditures and assets acquired through finance leases, which would work out to annual growth above 50%. Analysts surveyed by Visible Alpha had expected $24.23 billion.

Capital expenditures will grow in the new fiscal year, but more slowly than in the 2025 fiscal year that ended in June, Hood said.

The company continues to face data center infrastructure shortages as it ramps up capacity for running artificial intelligence models.

"I talked about it, my gosh, in January, and said I thought we'd be in better supply-demand shape by June," Hood said. "And now I'm saying I hope I'm in better shape by December."

If the spending were to be the same for each quarter of the new 2026 fiscal year, the total would be over $120 billion, indicating 36% growth, compared with Visible Alpha's $100.50 billion consensus.

For the fiscal fourth quarter, which ended on June 30, revenue increased 18% in the fiscal fourth quarter ending June 30, up from $64.7 billion a year earlier, according to a statement. That's the fastest growth in more than three years. Net income increased to $27.23 billion from $22.04 billion a year ago.

The company's Intelligent Cloud unit, which includes the Azure cloud, produced $29.88 billion in revenue, up about 26% and beating the StreetAccount consensus of $28.92 billion.

For the first time, Microsoft disclosed the scale of its Azure business in dollars. In fiscal 2025, revenue from Azure and other cloud services exceeded $75 billion, up 34% from the prior year.

During the fiscal fourth quarter, revenue from Azure grew 39%. Analysts polled by StreetAccount and CNBC had anticipated Azure growth of 34.4% and 35.3%, respectively.

The company's Productivity and Business Processes segment, which is home to Office productivity software and LinkedIn, delivered $33.11 billion in revenue, topping the $32.12 billion consensus among analysts polled by StreetAccount.

Microsoft's AI bet, which includes its OpenAI stake and billions worth of Nvidia chips, is adding to business software sales. The company said adoption of the Microsoft 365 Copilot led to higher revenue per user for Microsoft 365 commercial cloud products such as Office productivity software bundles.

Microsoft said its Copilot products, including the Microsoft 365 Copilot for commercial customers and the Copilot consumer assistant in Windows, have 100 million monthly active users, CEO Satya Nadella said on a conference call with analysts.

The More Personal Computing unit, which encompasses Windows, search advertising, devices and video games, totaled $13.45 billion. The number was up 9% and higher than StreetAccount's $12.68 billion consensus.

Microsoft said sales of devices and of Windows operating licenses to device makers increased 3%. Gartner, a company that researches the technology industry, estimated that PC shipments went up 4.4% in the quarter.

Microsoft and its megacap tech peers are racing to build data centers packed with chips for developing artificial intelligence models and running increasingly hefty workloads. Microsoft had $24.2 billion in capital expenditures and assets acquired through finance leases for the quarter, up 27% from a year earlier.

Last week, Alphabet, the parent company of Google, bumped up its 2025 capital spending forecast by $10 billion to $85 billion.

Meta said on Wednesday that capital expenditures will come in between $66 billion and $72 billion for the year, raising the low end of its previous estimate from $64 billion.

During the quarter, Microsoft celebrated its 50th anniversary, laid off more than 6,000 people and introduced a GitHub feature for assigning coding tasks to the Copilot assistant. The company also said LinkedIn chief Ryan Roslansky would take on added responsibility running Office productivity applications.

Microsoft said it had $1.71 billion in other expense during the quarter. That includes recognized losses on equity method investments such as OpenAI. Other expense in the prior quarter totaled $623 million.

As of Wednesday's close, Microsoft shares were up 22% for the year and trading near a record, while the S&P 500 index had gained about 8%. Microsoft stock was trading above $550 after hours, pushing its market capitalization to about $4.1 trillion. That makes it the second company after Nvidia to cross the $4 trillion mark.

Don’t miss these insights from CNBC PRO

Koichiko

Koichiko

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826491/PXL_20250106_223233485.jpg)