Minimal Bitcoin On-Chain Resistance Ahead: Price Set For New ATH?

On-chain data suggests minimal resistance for Bitcoin, which could facilitate a rally toward a new all-time high (ATH). Almost All Bitcoin Investors Are Back In The Green With Latest Recovery According to data from the market intelligence platform IntoTheBlock,...

On-chain data suggests minimal resistance for Bitcoin, which could facilitate a rally toward a new all-time high (ATH).

Almost All Bitcoin Investors Are Back In The Green With Latest Recovery

According to data from the market intelligence platform IntoTheBlock, resistance looks light in the price ranges ahead. In on-chain analysis, the strength of support and resistance levels is based on the number of investors who last bought their coins at them.

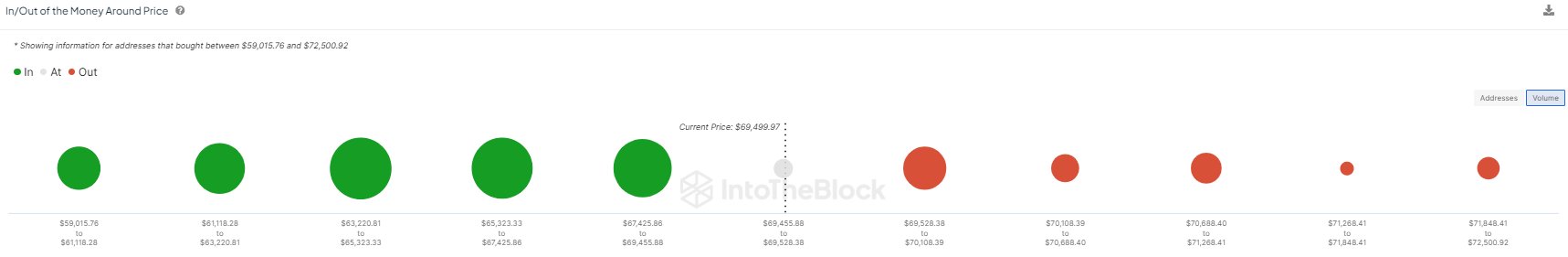

The chart below shows what the cost basis distribution on the Bitcoin network looked like at the time of the analytics firm’s post.

Looks like not many investors bought their coins at the ranges ahead | Source: IntoTheBlock on X

Looks like not many investors bought their coins at the ranges ahead | Source: IntoTheBlock on XIn the graph, the size of the dot corresponds to the addresses that purchased their coins inside the corresponding range. As is apparent, when IntoTheBlock shared the data, the price ranges ahead all had small dots, while those below had big ones.

This suggested that few investors left in the market had their cost basis higher than the spot price. That is, there weren’t many holders in loss left anymore.

Since then, however, BTC has seen some pullback into the first of the big circles. Nonetheless, at the current price, most holders should still be in the green.

To any investor, their cost basis is naturally an important level, and they may be more likely to make a move when a retest of it happens. Investors in loss may look forward to such a retest to exit at their break-even to escape away with their initial investment.

A few investors selling at their break-even isn’t of any consequence to the entire market, but if a large amount of them share their cost basis inside a narrow range, then perhaps a reaction large enough to cause fluctuations in the price can emerge.

This is why the strength of support and resistance price levels is related to the number of investors who have their cost basis in on-chain analysis.

As investors in loss may react to a retest of their cost basis by selling, large red dots can be potential sources of resistance. However, BTC has no significant obstacles left, so the price could be set to travel to higher levels.

As investors in loss react by selling, those in profit can look at the retest of their acquisition level as an opportunity to buy more instead. Thus, green dots can be support centers for the cryptocurrency. As BTC has fallen to one of these green dots, it’s possible the coin can use the cushion to spear ahead at the relatively light red ranges.

Something to keep in mind, however, is that while there may not be many investors desperate to exit at their break-even, there is also a different obstacle BTC could face: profit-taking.

With an extreme majority of investors in profits, many would likely become tempted to harvest some of their gains as the coin surges toward a new ATH. It remains to be seen whether demand would be able to absorb this potential selloff.

BTC Price

Bitcoin had neared the $70,000 level earlier in the day, but the coin has since plunged towards the $67,800 mark.

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com

BigThink

BigThink