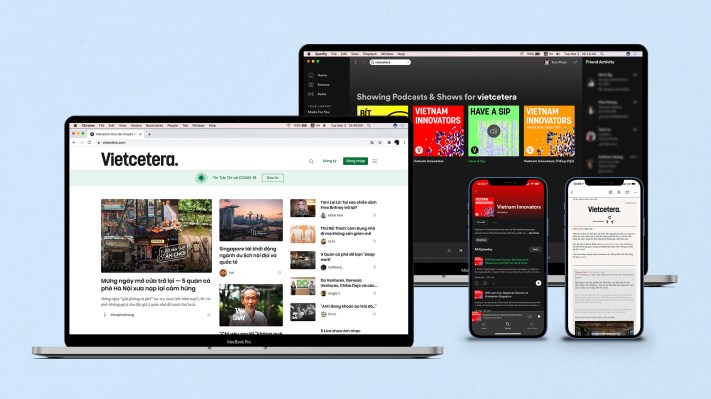

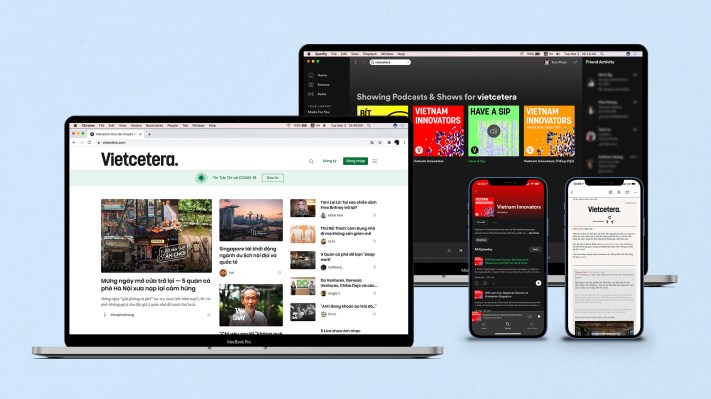

North Base Media leads $2.7M pre-Series A funding in digital media startup Vietcetera

Ho Chi Minh City-based Vietcetera, a digital medial network originally created for millennials and Gen-Z, will broaden its target demographic after getting $2.7 million in pre-Series A funding. The capital was raised over two rounds this year, led by...

Ho Chi Minh City-based Vietcetera, a digital medial network originally created for millennials and Gen-Z, will broaden its target demographic after getting $2.7 million in pre-Series A funding. The capital was raised over two rounds this year, led by media-focused venture firm North Base Media.

Other investors included Go-Ventures, Gojek’s corporate venture arm; East Ventures; Summit Media; Genesia Ventures; Hustle Fund; and Z Venture Capital, the corporate venture arm of Z Holdings, which is owned by SoftBank Group and Naver Corporation.

Vietcetera was founded in 2016 by Hao Tran and Guy Truong and now claims an audience of 20 million users per month. Its advertisers include AIA Life Insurance, Google, Facebook, Nestlé, MasterCard, Vingroup and Tiki. Tran told TechCrunch that Vietcetera will also monetize by “prioritizing original content licensing and development.”

The network was originally created for millennials and Gen-Z audiences who wanted “content going beyond showbiz, sensational news and entertainment.” To serve more groups of readers, Vietcetera will launch new content or vertical brands in 2022 focused on women’s content, real estate and personal finance.

North Base Media was founded in 2013 by Marcus Brauchli, former lead editor of the Wall Street Journal and Washington Post, and Media Development Loan Fund chief executive officer Saša Vučinič to back digital media startups in markets where mobile internet penetration is growing. Its other portfolio companies include The News Lens, Atlas Obscura, Rappler and Majarra.

Vietcetera’s new funding will be used on content, including new shows and podcasts, mobile app development, franchise and content licensing, and potential acquisitions.

Koichiko

Koichiko