Pinterest Reaches New Record High for Users in Q3

A solid performance update from Pinterest in Q3.

Pinterest has shared its latest performance update, posting a solid increase in revenue, and reaching a new record high in usage.

Which has the platform well-placed for the holiday shopping surge.

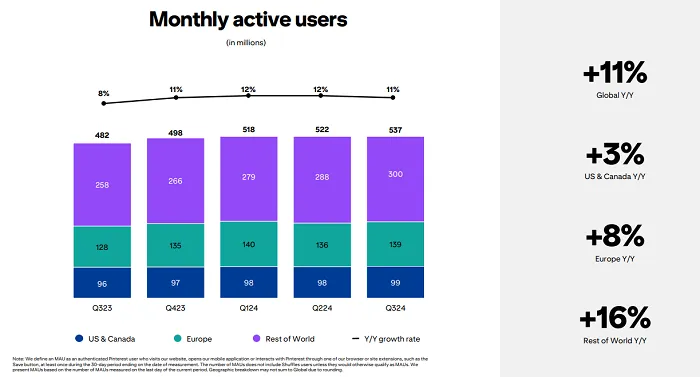

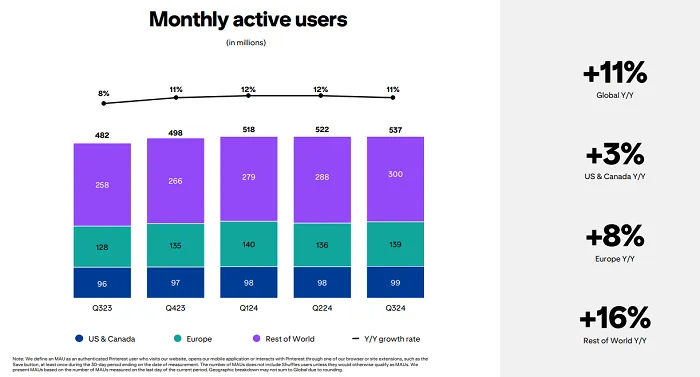

First off, on active users, Pinterest added 15 million more users in Q3, taking it to 537 million MAU.

Which is a significant rise in its growth momentum versus Q2, where it only added 4 million more actives.

I mean, that’s all relative, as 4 million is still a significant number of people who are regularly coming to the app. But in social media growth terms, 4 million is minor, but 15 million is a far more positive result for the app.

Reaching a new usage high is also significant in terms of Pinterest’s broader growth story, because the platform did came off the rails there for a little bit.

Back in 2020, amid the COVID lockdowns, which forced everyone to shop from home, Pinterest saw a big rise in usage, and the assumption from many market analysts had been that this would spark a sustained shift in broader shopping trends. But once physical stores re-opened, most people went back to their regular shopping habits, and Pinterest usage dropped in response.

It took a little while to recover, but Pinterest has now well surpassed those COVID highs, and is on the way building a more solidified foundation for ongoing success.

The only concern here is that Pinterest’s growth remains relatively stagnant in the U.S. and EU, which are its key revenue markets.

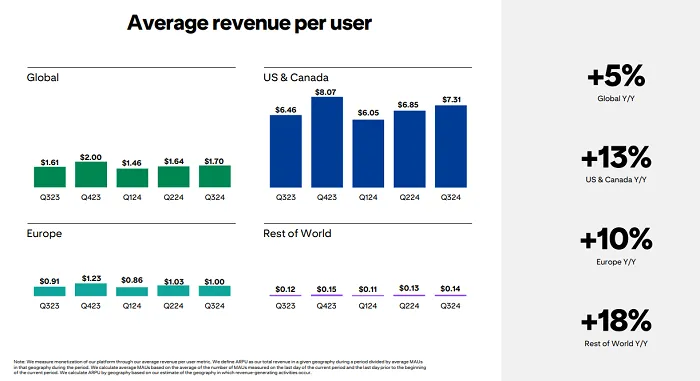

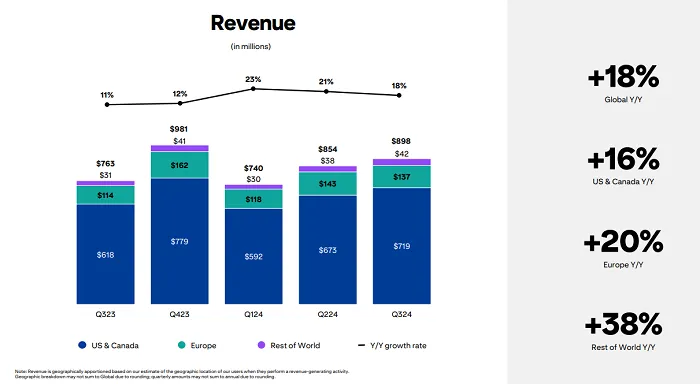

As you can see in these charts, Pinterest is generating significantly more revenue from users in these two regions, so that fact that it’s not growing its audience reach here could impact its ad potential. It’s still growing its ad business in other markets, which will offer future value. But right now, it’s not gaining in any significant way in the regions that matter most in this respect.

Most social apps have reached, or are reaching saturation point in Western markets, so it’s not an unexpected result, as such. It just puts more pressure on the company to come up with alternative ad options to capitalize on their opportunities, which also runs the risk of annoying users if they go too far. As such, the safer bet is expanding on ad potential in other regions, but as you can see in the above charts, building an ad business is not easy, with Pinterest’s EU ARPU numbers still lagging well behind the U.S.

In terms of overall revenue, Pinterest brought in $898 million for the quarter, representing 18% growth year-over-year.

That’s a good result, and again, with Q4 sales incoming, going on last year’s performance, Pinterest is in for a big finish to 2024. Its focus on facilitating more shopping options, and improving its digital matching and try on options is holding significant appeal to a growing number of users, and as it continues to focus on building its tools, that does look like making it a more valuable destination for more shoppers.

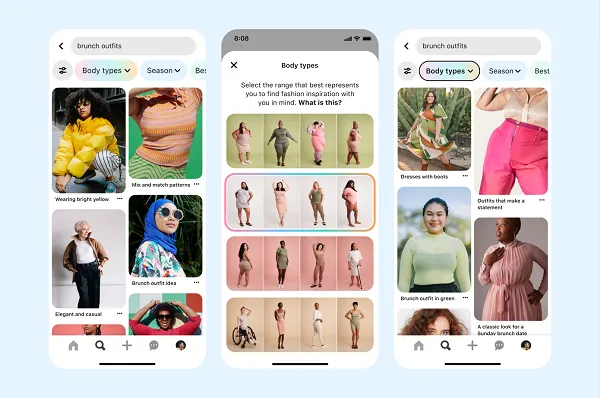

And those options are improving. This year, Pinterest has continued to expand its AI-powered “Body Type Filters”, which make it easier for Pinners to find matches that more accurately represent their body type.

It’s also added more AI elements into its ad creation process, to help marketers tap into key usage trends, and improve the presentation of their content.

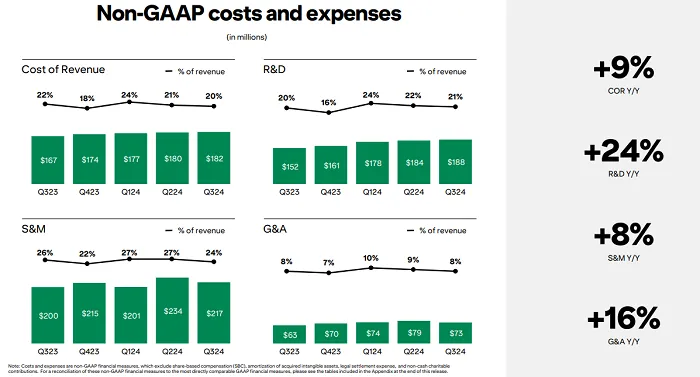

Which are important improvements, but they also come at a price.

As you can see in these charts, Pinterest’s research and development costs have increased by almost 25% this year, and it’s expecting them to continue to increase heading into the end of the year.

Which makes sense. Other platforms are spending billions on AI development, and while Pinterest doesn’t have the same level of resources in this respect, it does need to move with the times, and provide more options to maximize the shopping experience in the app.

Because that’s Pinterest’s key appeal. Aside from giving users the opportunity to save items, then get recommendations relative to your chosen style, a key benefit of Pinterest for brands is that it offers a more comprehensive product display and experience than they can within their own online stores. The better Pinterest can do this, the better placed it will be to remain a key shopping destination, driving more activity and engagement.

Overall, the indicators for Pinterest are good, with improving results, and steadily increasing engagement. Maximizing its ad opportunities in non-U.S. markets will help to boost its market appeal, but in terms of user experience, Pinterest is clearly on the right track, and has remained true to its goals, rather than latching onto the latest social media trends.

Konoly

Konoly

![Benefits of Hiring a Fractional CMO – Manny Torres – [VIDEO]](https://www.digitalmarketer.com/wp-content/uploads/2022/04/YOUTUBETHUMB_FracCMO_1.jpg)

![LinkedIn Company Pages: The Ultimate Guide [+ 10 Best Practices]](https://blog.hubspot.com/hubfs/linkedin-company-pages.jpeg#keepProtocol)

![How to Write a Great Email Signature [+ Professional Examples]](https://blog.hubspot.com/hubfs/email-signatures-1.jpg#keepProtocol)