Sanctions on Russian oil are having the 'intended effect,' IEA says

Bans and price caps targeting Russian oil are having the "intended effect" despite surprisingly resilient exports in recent months, according to the International Energy Agency.

Russia announced that it would cut oil production by 500,000 barrels per day in March after the West slapped price caps on Russian oil and oil products.

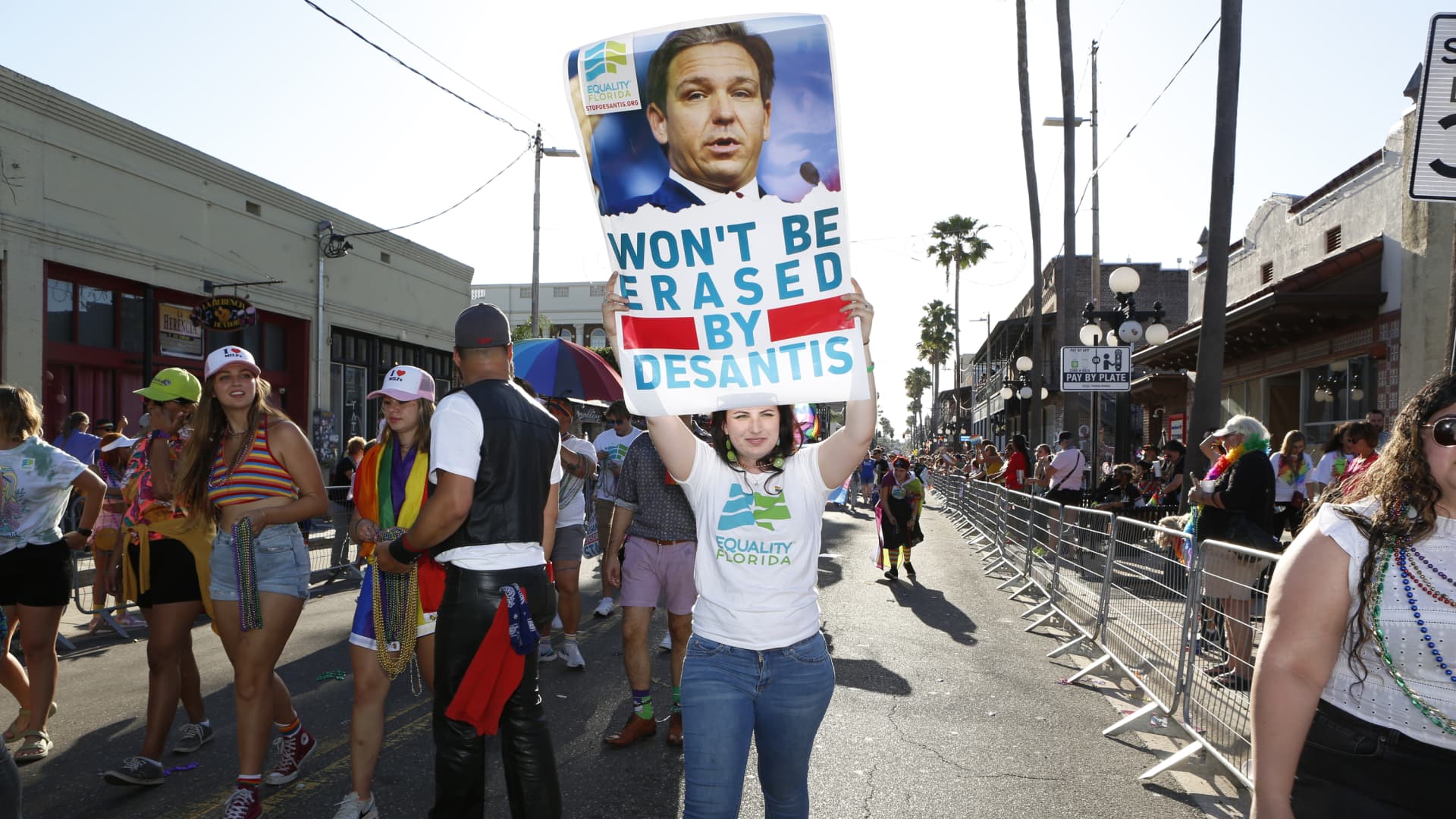

Picture Alliance | Picture Alliance | Getty Images

Bans and price caps targeting Russian oil are having the "intended effect" despite surprisingly resilient production and exports in recent months, according to Toril Bosoni from the International Energy Agency.

The European Union's embargo on Russian oil products came into effect on Feb. 5, building on the $60 oil price cap implemented by the G-7 (Group of Seven) major economies on Dec. 5.

Bosoni, who's head of the oil industry and markets division at the IEA, told CNBC on Wednesday that Russian oil production and exports had held up "much better than expected" in recent months. This is because Moscow has been able to reroute much of the crude that previously went to Europe to new markets in Asia.

China, India and Turkey in particular ramped up purchases to partially offset the 400,000-barrel-per-day fall in Russian crude exports to Europe in January, according to the IEA's oil market report published Wednesday. Some Russian oil is also still making its way to Europe through the Druzhba pipeline and Bulgaria, both of which are exempt from EU embargo.

As such, Russian net oil output fell by only 160,000 barrels a day from pre-war levels in January, with 8.2 million barrels of oil shipped to markets worldwide, the IEA said. The agency added that G-7 price caps may also be helping to bolster Russian exports to some extent, as Moscow is forced to sell its Urals oil at a lower price to those countries complying with the caps, which potentially makes it more attractive than other sources of crude.

Despite Russia's substantial export volumes, Bosoni argued that this did not mean the sanctions had failed.

"The price cap was put in place to allow for Russian oil to continue to flow to market, but at the same time reducing Russian revenues. Even though Russian production is coming to market, we're seeing that the revenues that Russia receives from its oil and gas have really come down," Bosoni said.

"For instance in January, export revenues for Russia were about $13 billion, that's down 36% from a year ago," she said. "Russian fiscal receipts from the oil industry is down 48% in the year, so in that sense we can say that the price cap is having its intended effect."

She also highlighted the growing discrepancy between Russian Urals crude prices and international benchmark Brent crude. The former averaged $49.48 per barrel in January, according to the Russian Finance Ministry, while Brent was trading above $85 a barrel on Thursday.

Importantly, Russia's 2023 budget is based on a Urals price average of $70.10/bbl, so plunging fiscal revenues from oil operations year-on-year are leaving a substantial hole in public finances.

Bosoni also noted that the indications are that Moscow may not be able to reallocate the trade of oil products in the same way as it has crude exports, which is why the IEA expects exports and production to fall further in the coming months.

"We're seeing now some reallocation of trade of the products but we haven't seen the same shift as we saw for crude, which is why we're expecting Russian exports to fall and production to fall," she said.

Production cut

Russia announced last week that it would cut production by 500,000 barrels a day in March in response to the latest round of Western bans, amounting to around 5% of its latest crude output.

However, Bosoni said this was in line with the IEA's expectations.

"This is included in our balances that still see the markets relatively well supplied through the first half of the year, so we're not too concerned about this decline, we think there's enough supply to meet demand for the coming months," she said.

"The question will be when summer comes around, refinery activity picks up to meet summer driving and China rebound really takes off, this is when we can see the market tighten really through the rest of the year."

In its report, the IEA suggested the production cut may be less about retaliation and more an attempt by Moscow to shore up pricing by curbing output rather than continuing to sell at a large discount to countries complying with the G-7 price caps.

Global oil demand

Global oil demand growth is expected to pick up in 2023 after a sharp slowdown in the second half of 2022, with China accounting for a substantial portion of the projected increase.

The IEA said a pronounced uptick in air traffic in recent weeks highlighted the central role of jet fuel deliveries in 2023 growth. Oil deliveries are expected to surge by 1.1 million barrels a day to hit 7.2 million barrels a day over the course of 2023, with total demand hitting a record 101.9 million barrels a day.

The effects of the West's latest oil embargo and price cap will be a key factor in meeting that demand growth, the IEA report noted.

"So will Beijing's stance on domestic refinery activity and product exports amid its reopening. New refineries in Africa and the Middle East as well as China are expected to step in to cater for the growth in refined product demand," it said.

"If the price cap on products is half as successful as the crude cap, product markets may well weather the storm – but more crude supplies would be required to prevent renewed stock draws later in the year."

ShanonG

ShanonG