Shopee swaps quantity for quality as it exits another country, dominates live selling in SEA

As Shopee's parent company Sea is hoping to reach profitability this year, “less” may really mean “more” in the end.

Disclaimer: Opinions expressed below belong solely to the author.

Two news stories in the recent week have caught my eye, subtly showing how Shopee is adjusting to the new, more challenging, market circumstances in pursuit of profitability (or at least, financial self-sustainability).

While they may sound relatively minor in isolation, the shift they provide hints about is fundamentally important to the entire company and suggest a departure from earlier growth strategy.

Polexit

Last week, quite overnight, news broke that Shopee would ditch its last outpost in Europe, Poland, on January 13. According to reports, the abrupt decision took both merchants and customers by surprise, given the significant investment the platform has made in the country.

It wasn’t the first withdrawal from a European market — as it earlier ditched France and Spain — but the difference is that it has never gave much attention to either market, likely only testing the waters. It did launch localised websites in French and Spanish, but beyond that, it didn’t run significant campaigns or recruit local staff and suppliers like it did in Poland.

In its announcement, the company mentioned “macroeconomic uncertainties” in the region and will focus on Asia and Latin America instead. It seems, however, to be just a case of cutting losses amid global, not regional, pessimism.

This is in addition to the fact that when it launched its service in the country, domestic competition in Poland is far stronger than whatever it has thus far faced in less developed markets.

In other words, Sea took on a much bigger challenge at a considerably less favourable time.

The company was definitely dedicated to growing the platform in Eastern Europe, as it built up its local office and recruited hundreds of suppliers — likely with the ultimate goal of not only serving Poland, but using the country as an outpost for European expansion.

A screencap of one of Shopee’s local TV commercial featuring a local musician / Image Credit: Shopee via YouTube

A screencap of one of Shopee’s local TV commercial featuring a local musician / Image Credit: Shopee via YouTubeShopee spent millions running ad campaigns across all possible platforms. It employed a number of local celebrities and ran TV and radio ads day and night for many months, but it must have now become clear it is incapable of translating it into enough growth to justify the expense.

Sea has managed to cut its losses in half by the third quarter of 2022, but it still meant losing half a billion dollars per quarter — a sum untenable in the current economic reality, as it can’t hope to raise more funding after its market capitalisation collapsed together with most of the global tech

So despite huge outlays and etching itself in the minds of Polish customers with its annoyingly catching advertising tunes, it decided that it has to extract more from the markets it is already doing well in rather than seek success in new ones.

Leader in live selling

One of the examples of how it is trying to accomplish it, is its relative success as a platform for live selling in Southeast Asia, as it came first in Ninja Van’s study of the market published a few days ago.

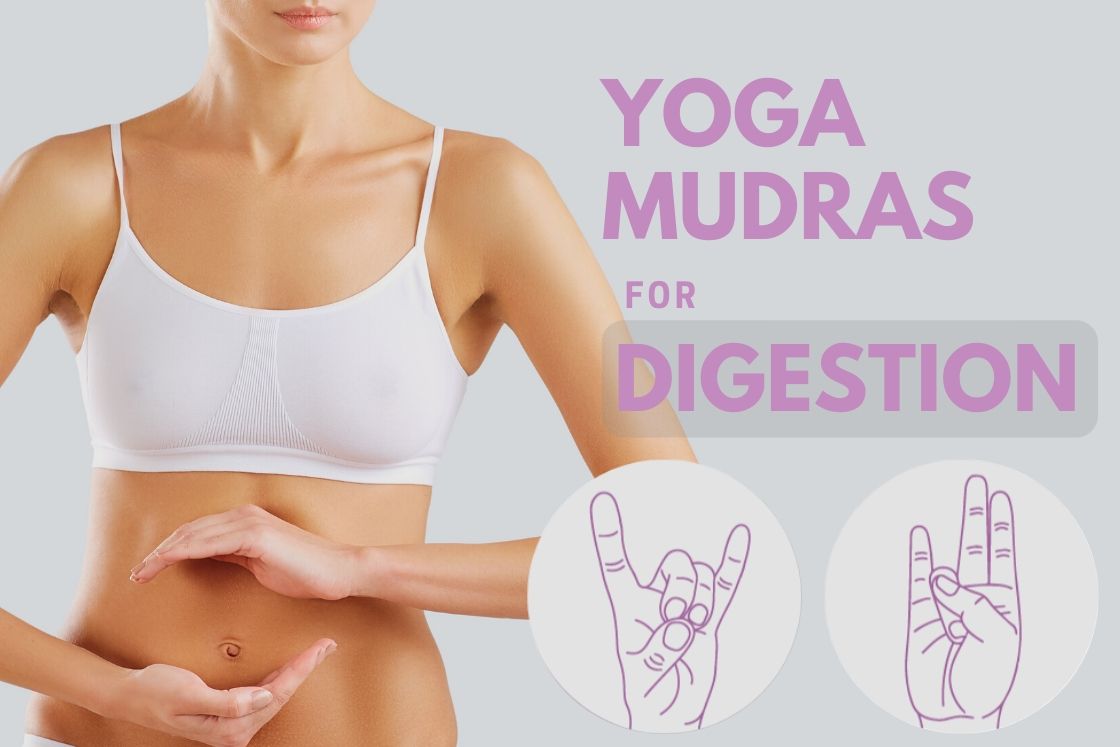

Image Credit: Ninja Van

Image Credit: Ninja VanOut of 1,186 live selling merchants polled, 27 per cent reported using Shopee, followed by Facebook and TikTok, with Lazada coming in a fairly distant fourth.

I think this is quite an accomplishment given that social media platforms are designed with video delivery in mind and are frequently the main medium of interaction with fans and followers.

Excluding Thailand, where it’s been beaten by large margins by Facebook and TikTok, it is the platform of choice for up to one-third of merchants (e.g. in Singapore or Vietnam).

Image Credit: Ninja Van

Image Credit: Ninja VanThis is what I mean by qualitative growth — extracting more value from the customers the business already has, in markets it is well-recognised in.

Rather than trying to reach more people, it now needs to make its current ones a habitual, repeated buyers, as it would permit a decrease in marketing expenses on user acquisition.

Once someone grows used to using one solution, you no longer have to advertise to them as heavily as before and their lifetime value increases.

And as Sea is hoping to reach profitability this year, “less” may really mean “more” in the end.

Featured Image Credit: stLegat / depositphotos

Lynk

Lynk