Singapore could abolish all taxes and still pay each family $1,500 per year. Here’s the math

Since 2016, Singaporeans have recieved more in grants and schemes than we've paid in income tax, so what would happen if we all stopped paying tax?

Disclaimer: Opinions expressed below belong solely to the author. Data sourced from the Singapore Department of Statistics.

Much is being said about how rich Singapore is as a country but I often come across people who say they don’t see or feel it in their lives.

Singapore’s tax system, while attractive compared to the rest of the world, is still quite complex, and there seems to be a sense that Singaporeans are asked to pay extra everywhere they turn. There’s income tax, GST, property taxes, COE, vehicle taxes, etc., all add to the cost of living.

So, how much are you getting for all the money paid into the system? Quite a lot, it turns out.

Taxes begone

In recent years the government has become so generous that, on average, each Singaporean receives more money than they pay into the budget in all taxes.

Yes, all of your income taxes, the higher GST, water conservancy, property and so on, are less than you receive back.

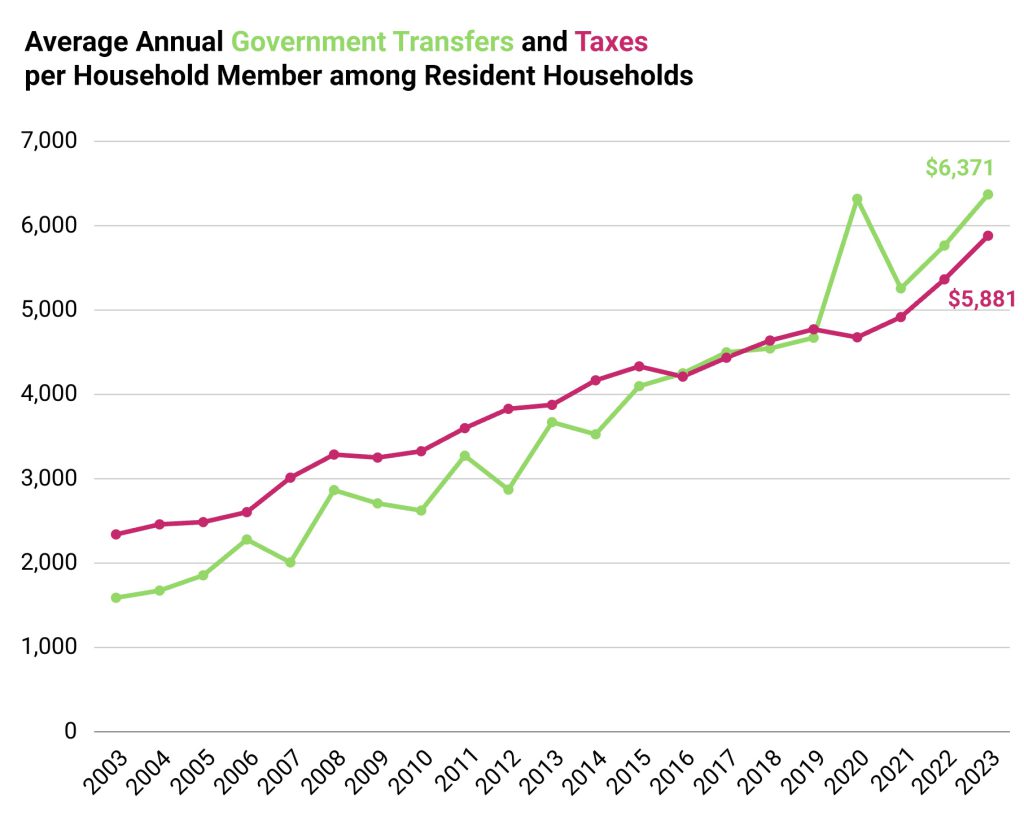

Source: Singapore Department of Statistics

Source: Singapore Department of StatisticsIt wasn’t always this way. Prior to 2016, Singaporeans paid a bit more than they received before both lines converged and, ultimately, diverged in opposite directions following the pandemic.

These changes can be linked to the increase in Net Investment Returns Contribution (NIRC), the returns contribution from investment of the reserves, as well as Covid and post-Covid, inflation-related aid programs, whose role is to reduce the impact of the global inflation crisis that followed.

The side effect is that today the government could theoretically abolish all taxes (affecting individuals, not the corporate tax, of course) and would still pay a net ca. $500 to each Singaporean every year.

Yes, that would mean zero PIT, zero GST, zero property, vehicle, alcohol, tobacco, or water taxes, and still $1,500 cash per average 3 pax household.

Wouldn’t that be nice? So, why isn’t it?

Pay up

Of course, given that you wouldn’t pay into the system, you would receive much less in numerous public services. Forget about healthcare or education subsidies, CPF top-ups, Workfare Income Supplement, Baby Bonuses and so on.

The list is so long, in fact, that it takes two pages in the official government document listing all programs qualifying as government transfers. You can check this list in last year’s Key Household Income Trends report here, at the very end of the document.

The other thing to remember is that all of these numbers are averages. This means that a small group of wealthy residents is paying a lot more in taxes, supporting the rest of the country.

If taxes were abolished, then this burden would have to be evenly distributed amongst everyone, leaving a large majority of the society with much higher bills to pay.

How large?

Around 80 per cent, because that’s how many people live in HDB apartments.

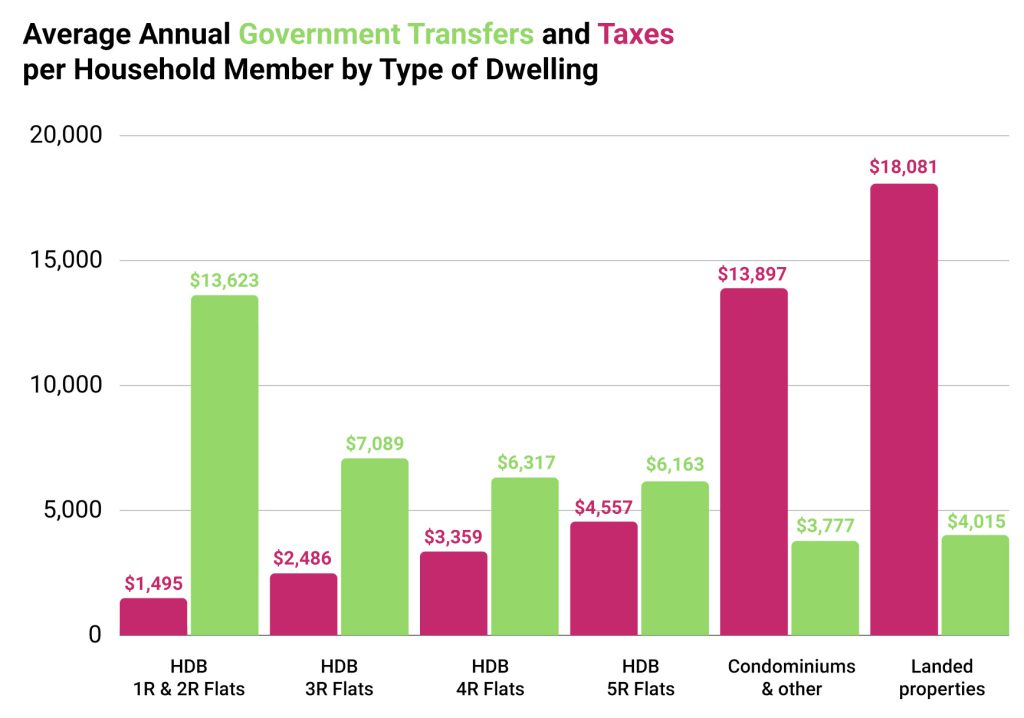

Source: Singapore Department of Statistics

Source: Singapore Department of StatisticsAs it turns out, even those enjoying the most spacious, 5-room HDB apartments are, on average, net recipients of government support, to the tune of $1,500 per person, each year.

It’s those wealthy enough to afford private properties who, unsurprisingly, fall into the top tax brackets and consume the most, together paying between $10,000 and $14,000 more for each household member than they receive back.

If taxes were gone, they would stand to gain the most, at the expense of everybody else.

Taking grants for granted

Not enough time seems to be spent on communicating these numbers to broader audiences. We all know that the rich pay more in taxes—but how much more? And what does this buy for the rest of society?

This often appears murky, lost in the dozens of government support programs designed for various demographics. But it’s there.

Subsidies, grants, vouchers, and transfers have become an entitlement that isn’t questioned. But the money has to come from somewhere.

Besides taxation, there’s of course, the NIRC—returns from reserves invested for profit by GIC, MAS, and Temasek, which contributes to over 20 percent of the national budget. Taking from the rich and giving to the poor would not be enough. That’s why the government had to find some money of its own, and thankfully so.

There’s a limit on taxing the rich, after all.

At 24 percent the top income tax rate may seem relatively low compared to many developed countries, but there are always tax havens competing for the same people. Squeeze them too much and they will leave with all of their money, never to pay taxes here again.

This is why taxes are here to stay: to create a common pool of funds, redirected to the majority of the population, a share of the success of those at the top, in the private and public sectors alike.

Featured image: ixuskmitl / depositphotos

Aliver

Aliver