Southwest's Promised Changes Are Afoot, But Will They Be Enough?

Southwest Airlines for months has teased Thursday's investor day as a key date in its transformation. But will the plan unveiled Thursday be enough to stave off an aggressive attempt by activist investor Elliott Management?

Southwest Airlines for months has teased Thursday's investor day as a key date in its transformation, in terms of providing more detail on some of the carrier's previously announced changes, like assigned seats and new premium cabins, as well as newly announced initiatives.

But will the plan unveiled Thursday be enough to stave off an aggressive attempt by activist investor Elliott Management to replace most of the Southwest board and CEO Bob Jordan? It remains to be seen.

Southwest provided more detail on the timeline to introduce assigned seating and premium options, and unveiled one new initiative: international airline partnerships, with Icelandair its first.

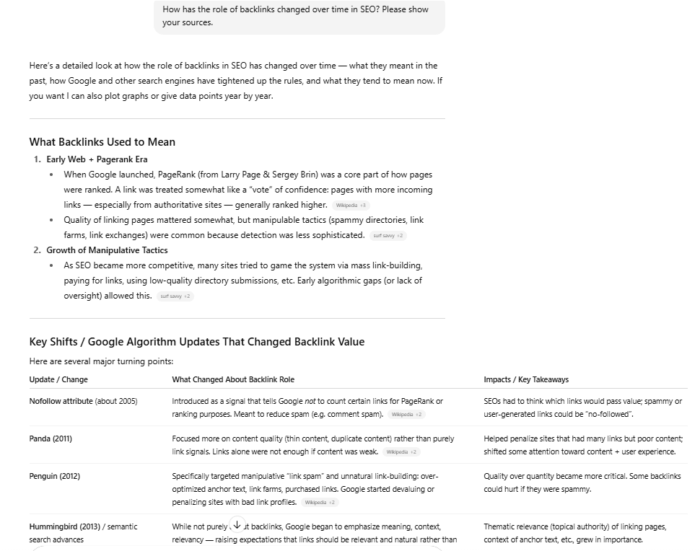

Business Travel Trips Drop

Southwest has more unique business travelers than it did before the pandemic, but they are not taking as many one-day or one-night trips as in the past, according to Southwest COO Andrew Watterson.

The average number of monthly unique business travelers was up 20 percent in January 2024 compared with January 2020, while managed business trips per traveler declined 24 percent for the same period, according to a Southwest presentation.

"Trips per unique business traveler are down," Watterson said. "It's structurally changed given the hybrid business office schedules. … Technology is also playing a role with trips sometimes being replaced by virtual meetings. Although we're taking a bigger slice of a smaller pie called business travel, we still have business travelers occupying less seats [than they] did pre-Covid."

Watterson added this trend is not uniformly distributed through geography or time, but "it does mean we need to backfill those seats with new customers."

As such, the carrier plans to restrict its network to match post-pandemic customer travel patterns, redeploy underperforming capacity to more profitable flying and improve network connectivity and efficiency, among other factors. Southwest plans to reduce Tuesday and Wednesday flying as well as shoulder-season flying, reduce service to some cities, and add redeye flying.

"We've closed cities as you know, and reduced cities," Watterson said, noting Southwest on Wednesday announced further cuts to Atlanta, while also increasing Nashville flights. "Atlanta this summer, and then Oakland, Hawaii and Atlanta again beginning in spring of 2025. We moved our international gateway from Fort Lauderdale to Orlando."

Watterson added that, compared to April 2023, the schedule published for April 2025 shows "about 10 percent of routes were cut, about 10 percent of routes are new, and about 45 percent of routes have had capacity adjusted to an extent greater than 25 percent," he said. "Overall, 65 percent, almost two-thirds of our routes have had consequential action during this period, and that will continue."

Assigned Seats, Premium Cabin Details

Southwest previously announced it would add assigned seating and a premium cabin with extra legroom to attract more customers and increase ancillary revenue opportunities. In the research the carrier conducted over the past year, "looking at lapsed customers, the seating and boarding process is the No. 1 reason they haven't returned to Southwest," EVP of commercial transformation Ryan Green said.

As for reasons why customers chose Southwest over other carriers, schedule and price were the top two, but the carrier's free checked-bag policy was a close third—and Southwest executives made it clear that the carrier would keep the much-valued perk.

Southwest reviewed various bag-fee scenarios, and using one example that most mimics a basic economy fare on another airline with no bags included as part of the base product, "the loss in trips flown from customer defection overwhelms the value of the incremental ancillary revenue from bag fees and results in $300 million less in revenue" per year, Green said.

Change Timeline

As for the availability of the seat assignments and extra legroom options, the carrier first needs certification from the U.S. Federal Aviation Administration on its new cabin layouts. Southwest in a slide showed that no seats on its Boeing 737-8 and 737-800 aircraft would be lost with the cabin changes, with 68 of the 175 seats offering extended legroom. The Boeing 737-7 aircraft would lose two seats and have 48 of 148 seats with extended legroom, while the Boeing 737-700 would lose six seats and offer 40 of 137 seats with extended legroom.

Southwest in a timeline presented Thursday indicated technical changes to more than 60 customer- and employee-facing applications as well as changes to the back office would be required to accommodate the seating assignments and new cabins, as would training for 55,000 frontline employees in advance of its sell and operate dates.

The carrier plans to begin selling assigned seats in the second half of 2025 and to begin flying them in the first half of 2026, according to Green, who added that the increased revenue from these changes would more than offset the losses from the phase-out of current early-boarding products and seat removal from some aircraft.

New Transcontinental Partner

Southwest said it and Icelandair would begin a "bilateral partnership in 2025," which will allow customers to easily connect between the two airlines' networks. The initial gateway city for this partnership will be Baltimore.

"Throughout 2025, we will expand the number of U.S. gateways on our network and are targeting adding at least one additional partner carrier next year," Green said, adding that Southwest's Rapid Rewards loyalty program "will also be integrated, giving members the ability to earn and redeem points for global destinations. We are in discussions with other transatlantic and transpacific carriers and look forward to sharing more details about all of that in the future."

Southwest also announced the addition of former Spirit Airlines and AirTran Holdings CEO Robert Fornaro as a member of the board, effective immediately. He has served as a consultant to Southwest Airlines from 2011 to 2014, and again from 2020 to 2024. The addition comes amid many recent board change announcements for Southwest.

Elliott Management Responds

Though the event was titled "Investor Day," very little was said about Southwest's highest-profile activist investor, Elliott Management, which is calling for a new board and CEO at the airline. Earlier this week, Elliott sent a second letter to Southwest shareholders indicating it would call a special meeting in the coming weeks and possibly as soon as next week. CEO Bob Jordan briefly addressed the issue.

"We do not believe that a proxy fight is in the best interest of the company, and we remain willing to work with Elliott on a cooperative approach," Jordan said. "We have demonstrated that willingness, time and again, through our attempts and engagement, but time and again, Elliott has demonstrated little or no interest in collaborating with Southwest on how to deliver more shareholder value, focusing instead as evidenced by their most recent letter and recent action on tactics and on gamesmanship.

"I hope you can tell that the plan that we presented today is intentional. It's detailed, it's well constructed, it's integrated, and it has been in the works, including execution, for a long period of time. For Elliott to call that plan rushed and haphazard, in my opinion, is inane," Jordan said.

In a statement released on behalf of Elliott partner John Pike and portfolio manager Bobby Xu after the event ended, the management company reiterated its appeal to replace Jordan and to call a special meeting.

"Today's Investor Day will have a familiar ring for many shareholders: Another promise of a better tomorrow from the same people who have created the problems we face today," Elliott said. "The Board continues to evade the most critical question facing Southwest: Why is Mr. Jordan—who has delivered years of unacceptable financial results and, until very recently, was dismissive of the actions announced today—the right leader to execute on these 'transformative' changes? The answer is clear: He is not.

"We came away from extensive engagement with Southwest's leadership—including in-person meetings and more than a dozen phone calls—even more convinced that current leadership is incapable of delivering on Southwest's potential. Today's announcement that adding assigned seating and premium products will take multiple years to implement—when peers have implemented similar changes in much shorter timeframes—is further evidence that Mr. Jordan lacks the vision and capability to execute on these initiatives."

Meanwhile, Jordan took full responsibility for its current plan. "This is my plan, this is my vision for a new Southwest," he said. "We have the right plan, we have the right team, and all of our efforts continue to be focused on transforming Southwest Airlines to create significant long-term value for our shareholders and to be your Southwest even better."

Tekef

Tekef

.jpg&h=630&w=1200&q=100&v=6e07dc5773&c=1)

.jpg&h=630&w=1200&q=100&v=6e07dc5773&c=1)