Unpacking NerdWallet’s SEO: 10 Things I Discovered

Their S-1 shows over 70% of traffic is unpaid. For a business that transforms knowledge-seeking into profit, that’s a perfect strategy. But it’s also imperfect. As a public company, NerdWallet must openly admit when its SEO fails. Worse still,...

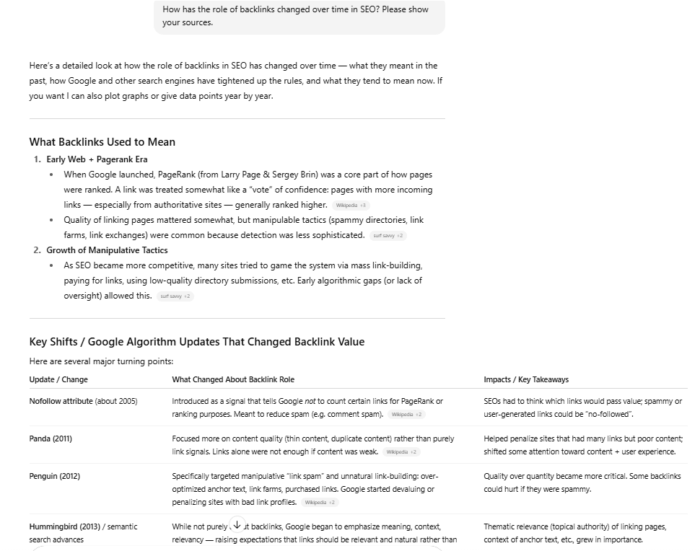

Nobody needs SEO like NerdWallet. Their S-1 shows over 70% of traffic is unpaid. For a business that transforms knowledge-seeking into profit, that’s a perfect strategy. But it’s also imperfect. As a public company, NerdWallet must openly admit when its SEO fails. Worse still, dips in organic traffic can trigger falling stock prices and potential job losses. Lower organic can trigger falling stock prices, which can lead to job losses. And when Google tweaks its algorithms, it sends ripples through NerdWallet’s entire ecosystem—from employees to stockholders. Can you name another company with more skin in the SEO game? NerdWallet’s journey offers a masterclass in SEO strategy and adaptation. Their SEO success story is impressive, to say the least, but they’re walking a tightrope where missteps aren’t an option. This is precisely why there will always be much to learn from NerdWallet. Here are some things I learned from spending too much time in Numberland with NerdWallet. According to our data, NerdWallet lost an estimated 6M in organic traffic in three months. That’s a 23.6% loss in a very short period. This loss was caused by “unexpected headwinds”, as their CEO put it in the 2024 Q2 financial report. And it looks like the loss in traffic resulted in a significant loss in revenue and stock value. Here’s what the traffic looked like before the start of Q3 2024. And this is how the stock value chart looked when they told everyone how the traffic looked. Interestingly, it happened around the same time as the recent March core update. The update was said to “fix” what you see on Google’s search results by 40% by literally punishing sites that tried to take advantage of Google. Was it the update that hit NerdWallet so badly? Julien Brault speculates it might have been because of Google’s new rich result type. As Search Engine Round Table reports, Starting June 2024, Google may show credit cards right inside the SERPs. This means less traffic for everyone who wants to rank for “best credit cards”, including NerdWallet. But the traffic slump started before that. By June 1st, it was actually all over. I think there were multiple reasons for this slump in traffic. One of them was search demand seasonality for some of their “fattest” keywords. Here’s an example. This explains why their yearly traffic dips around the same time. But notice how they bounce back stronger after each drop. Other reasons: I will go deeper into the cause of the loss in a bit. If NerdWallet lost all that traffic, someone else must have gained it, right? I was curious, who deserved that traffic more than NerdWallet? I found three types of winners: I checked keywords where NerdWallet lost at least 5k visits each or dropped by tens of ranking positions. I found three types of winners. Type 1 winners. Competing sites with similar business models or at least similar sources of revenue (e.g., Bankrate, Forbes). Examples: “high yield savings account” and “best online bank”. This is business as usual. NerdWallet loses a lot of traffic from small ranking drops because a competitor got more links or tweaked their content. The outlook is still good for NerdWallet — they can do the same to compete back. This change might even benefit the average Google user if the new top-ranking content offers more value. Type 2 winners. More topically specialized sites. NerdWallet doesn’t just write about credit cards. They also write about topics unrelated to their core business model. Examples: “rv rental” and “do you need a passport to go to puerto rico”. These specialized sites can easily find relevant calls to action or readers. NerdWallet, in contrast, might struggle to connect their offerings. I think we’ll likely see more of this shift in search results. Google talks about giving a chance to “small, independent sites”, which will likely be narrowly specialized sites. For NerdWallet, writing about topics like “rv rental” might be a poor bet for organic traffic in this climate. Readers might still find and trust this content through other channels, given the strong brand in finance. However, the outlook for ranking recovery or future competition in these areas looks poor. Whether this benefits consumers is debatable. Personally, I might prefer NerdWallet’s partner offers for travel over someone’s niche travel stories about trips I’d never take. Type 3 winners. Big brands offering the products that NerdWallet writes about; mostly financial providers. And that includes their partners like Chase or Wells Fargo. I’ve seen many such cases. Together with type 2, these keywords fell in rankings the most. I also looked at some of the ranking history charts and I think I know which “headwinds” rocked the boat. For instance, look at the chart below — nice, steady drifting, and then it hits. It could be argued that it’s fair for, say, Chase to outrank NerdWallet for branded queries. But what if the outranking content is a comparison of the bank’s credit card and the content that loses is a market-wide comparison of credit cards? Which is better for the consumer? So, since NerdWallet can’t really afford to be in this situation for too long, what measures did they take to get the traffic back up? I checked the top 20 pages that lost over 50k in traffic between the end of February and June. Every single one had been updated, with most undergoing major revisions or complete overhauls. In 8 out of 20 cases, it worked. Beyond typical tactics like tweaking titles and expanding topic coverage, they employed two notable strategies that likely helped regain some lost traffic. The first key tactic was strengthening their E-E-A-T signals. Specifically, they added explanations about their content creation process and why readers should trust their expertise. In the graph below, you can see the moment of the big update (dark green circle) and the lift in traffic that came after. Second tactic. When tweaking content failed, they relocated pages to a new directory. This move appears to give the content a “fresh start” while retaining the link equity from its original location. I wondered: if NerdWallet is losing rankings to the products and services they review, does this mean they’re actually losing traffic to their own partners? I checked a sample of 9 partners offering credit cards. There are over 144K keywords where NerdWallet ranks in the top 10, and at least one of those partners ranks as well, often outranking the fintech company. It looks like a smart way to diversify traffic sources for the partners. From NerdWallet’s perspective, if deliberate, it could be an intriguing partnership proposition: “Partner with us because we can outrank you, but you won’t lose if we do.” However, this puts significant pressure on NerdWallet, especially since some of these keywords are branded. They must maintain top-tier SEO performance while hoping Google doesn’t decide they’re “too good at SEO”. There’s also the risk that Google might shorten the path from search to product, favoring product creators over reviewers. NerdWallet has already lost some traffic to their partners this way. If you look at the shift in the share of voice, it’s clear that NerdWallet lost some of it to the banks. In the past, it was the other way around. You might think that’s bad, but it’s actually quite normal. It’s the Pareto principle in action. NerdWallet’s competitors show similar or even more extreme traffic distributions. Even at Ahrefs, we observe the same pattern. Among NerdWallet’s top 1.2% of traffic-driving content, a surprising frontrunner emerges: a blog post about making money outperforms all other pages, including their financial product comparisons. It generates more traffic than the nifty cost of living calculator with all of its static pages indexed. NerdWallet practically doesn’t need to touch that blog post. They’ve done one content overhaul and two major changes since 2021. It just sits there and keeps the door open for searchers. That’s an epic win and and ideal case of the value of SEO - free, passive, consistent traffic. Could this be the GOAT blog post? There are more blog posts on that list; about 65% of all pages. The rest of the traffic comes from online tools such as the auto loan calculator and product reviews, like the best credit cards. And almost a quarter of them were created this year. This happens even to the pros. It may sound counterintuitive, but these pages will always be the last thing they should worry about. Focusing on improving their biggest traffic generators — if there’s still room for growth — will likely yield better overall results. Power law distribution works in SEO, too. Here’s an interesting idea for content localization — buy the content that already works well. In 2020, NerdWallet acquired Know Your Money. Along with the company, they acquired an established domain on the UK market with all of its backlinks, traffic-generating content, and last but not least, a counterpart of their credit card comparison tool. And it worked. On the chart you can see the moment where domain became nerdwallet.com/uk and a rise in traffic that followed. The traffic is now 40X in PPC money. Three years after the acquisition they pruned half the pages, and traffic went up. While counterintuitive, deleting poorly performing pages or “sacrificing” them to give another page a link equity boost often works. Every year, 1.6k to 3k pages fall from the top 100. I asked AI to write a little script that checks if the final URL was different from the original to catch all types of redirects. I found that from the 2343 pages they lost between 10 Jun and 13 July 2023, around 75% were redirects — another case of content pruning. With this type of pruning (redirects), sometimes you can see results shortly after. For example, in 2023, the results came immediately (1). The next time they had the same number of pages as before the cut, their traffic was up by 4 million (2). If you’re doing SEO for a site like NerdWallet, you need to know your redirects inside and out. That’s how they split 14k blog posts with 7M traffic into different topic clusters. One of the AIs drew me this fantastic visualization of how they split it. Redirects at NerdWallet deserves its own article. If you’re not familiar with programmatic SEO, it is a method of automatically generating large volumes of content at scale. Diminishing returns is a common phenomenon in content marketing. It’s when the incremental benefits of creating and publishing new content decrease over time despite the same or increased effort and resources being invested. Here’s how diminishing returns in programmatic SEO look on a chart. Page count (blue line) goes dramatically up with no effect on the traffic (orange line). Programmatic SEO is a smart tactic but also flawed by design. It treats keywords with the same structure in the same way. But in reality, each keyword will have a different difficulty. And with that typically comes someone’s effort in content and links that you’d need to beat. We observed this with one of our attempts at templated content. It worked for low-difficulty keywords (see chart below), but for other keywords, we needed to develop unique content. Keywords you’d be trying to target this way may even have different intent. For instance, “phoenix vs new york” has the cost of living as the primary intent, while a general city comparison is last. NerdWallet ranks #1. Conversely, “portland vs austin” is dominated by city comparison pages, and the cost of living is last. NerdWallet ranks #7 with the same programmatic tactic that gave it the top spot before. Over 100 authors link to NerdWallet from at least 30 different domains each. The top contributor links to NerdWallet from an impressive 303 unique domains. Surprised? I was. If you have these kinds of numbers on your site, it probably means that someone is working very hard at scraping your content. But if you’re using a PR agency to syndicate your content — like NerdWallet — you can check which content goes where and whether the canonical tag is in place. Competitors, partners making bolder moves, and Google which sometimes happens to help them… although the period examined in this article may not seem too bright for the company, NerdWallet earned over $150 million in Q2 2024. In the entire 2023, they made $599.4 million. All with the help of SEO. Got questions or comments? Ping me on LinkedIn.

Source: Google.

Source: Google. Image via seroundtable.com

Image via seroundtable.com

The blue line marks the traffic to the old page, and the orange line is the new page created with a redirect.

The blue line marks the traffic to the old page, and the orange line is the new page created with a redirect.

The bigger the chart area, the higher the share of voice.

The bigger the chart area, the higher the share of voice.

The number of keywords in the top 10 goes down with each keyword difficulty bucket.

The number of keywords in the top 10 goes down with each keyword difficulty bucket.

Final thoughts

Tekef

Tekef

.jpg&h=630&w=1200&q=100&v=6e07dc5773&c=1)