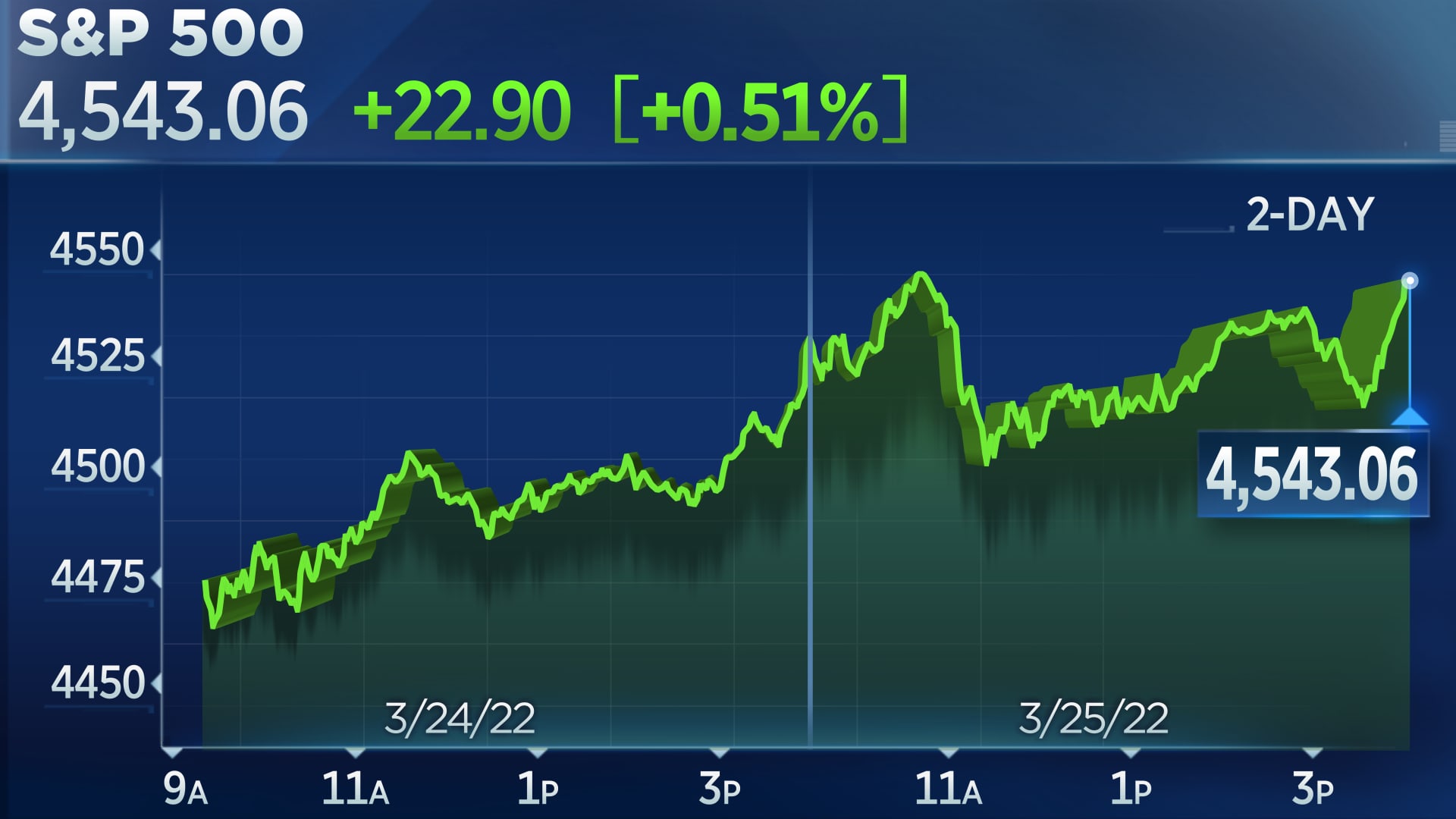

S&P 500 rises Friday, posts second winning week in a row

The S&P 500 rose Friday, notching its second consecutive week of gains.

The S&P 500 rose Friday to close out a winning week even as investors weighed interest rate hikes and war in Ukraine.

The Dow Jones Industrial Average rose 153.3 points, or 0.4%, to 34,861.24. The S&P 500 added 0.5% to close at 4,543.06. The Nasdaq Composite dipped about 0.2% to 14,169.30.

All three major averages notched second consecutive winning weeks. The Dow ticked up 0.3%. The S&P 500 gained 1.8%, and the Nasdaq rallied nearly 2% week to date.

The S&P 500 is now up about 3.9% higher in March, more than erasing its losses since Russia invaded Ukraine late last month.

The rebound has come even as the war in Ukraine continues and interest rates shoot higher, with the Federal Reserve is set to hike rates several more times this year.

"Equities are rallying despite a hawkish Fed and stagflation concerns, as many believe there is no alternative to stocks," said Mark Haefele, chief investment officer at UBS Global Wealth Management.

The benchmark 10-year rate on Friday touched a fresh multi-year high of 2.5% as investors priced in a more aggressive rate hike cycle.

Financial stocks rose Friday as the 10-year yield jumped. Bank of America and Wells Fargo rose 1.5% and 2.4%, respectively

On the downside, technology stocks eased, weighing on the Nasdaq. Zoom fell 3.2% and DocuSign lost 3.9%, among the Nasdaq's worst decliners Friday.

Fed Chair Jerome Powell on Monday vowed to be tough on inflation. The remarks came after the Fed raised interest rates for the first time since 2018 last week, with hikes coming at each of the six remaining policy meetings this year.

Powell on Monday noted rate hikes could go from the traditional quarter-percentage-point moves to more aggressive half-point increases if necessary.

The central bank chief's comments led Wall Street to raise rate hike expectations, with firms from Goldman Sachs to Bank of America penciling in half-point hikes in future Fed meetings this year.

Stock picks and investing trends from CNBC Pro:

Meanwhile, investors looked to promising signs the economy can run strong even as the interest rates have climbed amid expectations for a more aggressive Fed.

First-time jobless claims last week reached the lowest tally since 1969, the Labor Department reported Thursday — the latest sign of a resilient labor market. Economists expect the March jobs report next week to show similar strength.

"The 10-year yield is rising at the same time that the belief in growth is not collapsing. It's permeating the market and lifting stocks a bit because that was the immediate concern of the impacts of the war in Ukraine," Yung-Yu Ma, BMO Wealth Management's chief investment strategist, said.

Traders kept an eye on Europe as the Ukraine-Russia war continues. The European Union on Friday struck a gas deal with the U.S. in an effort to reduce its dependency on Russian energy.

—CNBC's Christopher Hayes contributed to this report.

Hollif

Hollif