S’pore to charge GST on imported goods in 2023 – will this level playing field for local bizs?

Singapore is implementing GST for imported goods in 2023. What will the updated policy mean for businesses?

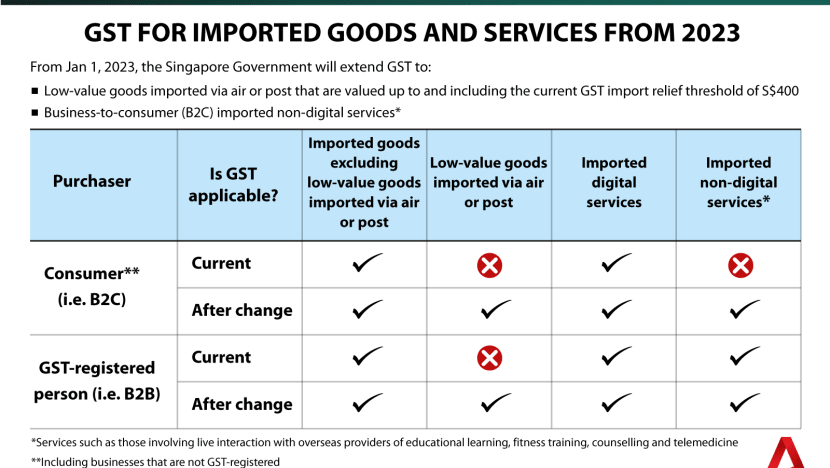

Starting from January 1st, 2023, imported goods with a value below S$400 will have Goods and Services Tax (GST) applied to them. These goods are currently not subject to GST to facilitate clearance at the border.

Suppliers of these goods will have to register under the Extended Overseas Vendor Registration Regime to charge GST, and pay the GST revenues to the Inland Revenue Authority of Singapore (IRAS).

Originally called the Overseas Vendor Registration Regime, the policy was intended to levy some GST charges on suppliers of business-to-consumer (B2C) digital services. Under the Extended OVR Regime, all remote services and low-value goods (LVGs) will be taxed GST. This includes some redistributors, redeliverers, and electronic marketplace operators.

Why GST on imported goods?

Increased scope of GST / Image Credit: Channel News Asia

Increased scope of GST / Image Credit: Channel News AsiaIRAS cited the need to protect local businesses by ensuring a level playing field between foreign exporters and local businesses among the reasons to impose the GST. This increased scope for the Extended OVR comes as the e-commerce scene is booming, with Singapore consumers also shopping from overseas providers.

The increase in GST is expected to taper consumers’ spending when prices increase due to the implemented tax, but the government has defended the tax adjustments as necessary.

Finance Minister Lawrence Wong stated during his Budget debate round-up speech this year that an increase in taxes is necessary to counteract future increases in fiscal spending, of which healthcare for elder citizens is a prominent contributor.

Is there a problem-solution mismatch?

But will the GST increase on imported goods really “level the playing field” with local suppliers?

Taxes are expected to cut consumption, and levying a tax on foreign goods where none was before should achieve this. At least theoretically, foreign producers of LVGs will see their prices in Singapore rise and consumption fall.

As these prices rise, consumers will turn to substitutes, namely local producers.

Local producers who already pay GST, will see more revenue as a result, and do better than they currently are. But this is theoretical. The reality could be different. We should also consider the implications of the GST implementation in general.

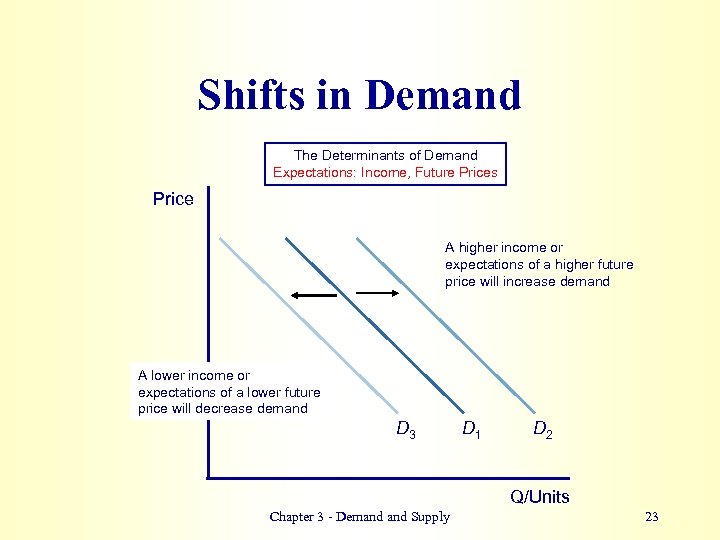

How demand reacts to expectations of future prices and changes in income / Image Credit: present5

How demand reacts to expectations of future prices and changes in income / Image Credit: present5Alongside the increased scope of GST for imported goods, the rate of local GST is also set to increase to eight per cent in 2023 and nine per cent in 2024.

One of the factors that affect demand is consumer expectations of future prices. Given that consumers know that GST will increase in general, they expect higher prices in the future. Therefore, in the run-up to the GST hike, consumption could actually increase.

During this time, the GST remains at seven per cent, and consumers continue to shop at the comparatively “lower” price. This means that anyone who wants to import foreign LVGs still does not have to pay GST on these LVGs, while continuing to pay GST on local products. So for the rest of this year, local producers may not see the benefits of the GST hike yet.

Of course, expected future prices are not the only factor that affects demand. The incomes of consumers are also a factor. If consumers have less disposable income, they will not spend as much, and demand will fall. While sales of essential items will not see a drastic fall, other consumer goods may not be as fortunate.

Given the pandemic’s effect on the global economy over the past few years, it is reasonable to suggest that a tax hike now would not be in anyone’s best interest.

Countercyclical fiscal policy during a recession would mean reducing taxes while increasing expenditure in order to increase disposable income and lower prices so that the economy can recover.

Instead, the GST hike would raise prices and slow the economy’s recovery. Consumers would have less to spend, while goods get pricier. When considered in conjunction with inflation, the price increases would most likely mean slower business driven by low consumption.

So who wins?

So if local producers are not necessarily benefitting in the short term, are they at least benefitting in the long term?

Unfortunately, this is not guaranteed either. When the tax hikes go into effect, taxes will be applied to both local and foreign products, with no distinction between them. Consumers will simply pick the better product of the two. Whether local producers benefit or not from this competition will therefore depend on the quality of the products and the efficiency of the company.

However, one can justify that precisely because consumers pick the better products, the tax may actually benefit local producers, only if the producers play their cards well.

Singapore is well known for its education system and for the quality of research. This research is the key to its success. Peter Thiel, the co-founder of Paypal, argued in his book “Zero to one” that “unless (companies) invest in the difficult task of creating new things, they will fail in the future no matter how big their profits remain today”. This, I argue, is the singular goal that Singaporean companies should be focusing on, and where the government is directing efforts towards.

Policies should not be considered in isolation. The government is increasing taxes, but at the same time, offering incentives for research and upskilling.

The increased taxes may seem to hurt businesses, but we should understand that not all businesses need to be concerned. Businesses, after all, aim to differentiate themselves from each other, and this is done through product development. While easier said than done, it is nevertheless what businesses must do to survive.

Image Credit: Pexels

Image Credit: PexelsFor businesses that fail to innovate and create new products, to fail now and fail small is better than for them to simply coast along and eventually become too big to fail. At the end of the day, Singaporean businesses should remember this – a nation’s economic strength is not determined by what it can consume, but what it can produce.

The increase in GST will ensure a “fairer” playing field for businesses through an expansion of scope. But businesses are ultimately the ones that must do the heavy lifting by innovating so that Singapore can remain competitive internationally.

It is of paramount importance that as consumers, we do not become so obsessed with consumption that we forget the value of production.

That being said, more can and should be done: Local SMEs will not survive if there is no demand for their products. So for local companies to survive, it is essential that consumers have money to spend on their products. The market may exist to discipline producers, but it must do so through the means of consumers. At present, a unified policy that addresses the concerns of both suppliers and consumers does not exist.

The GST increase’s effect is yet to be seen, but the government’s intention is clear. Local SMEs and startups must innovate and Singaporeans must upskill – only the best survive in a marketplace that is no different from a battlefield.

Kass

Kass