S’pore vs SEA: A look at the regional crypto landscape and the different regulations in place

Crypto has become a popular investment, but government regulations have been less than keen on its adoption. Why is this so?

Cryptocurrencies have exploded over the past few years, from being a niche investment to being a mainstream category for investment. As a result, governments have started to take notice.

Policies vary widely between jurisdictions, but in Southeast Asia (SEA), the general policy has been one of suspicion. Myanmar, for instance, has banned all digital currencies of all forms since last year. While Myanmar’s actions may seem excessive, their view of cryptocurrencies seems to be the norm in the region.

Even governments seen as friendlier to cryptocurrencies in the region have also introduced regulations on cryptocurrencies and cryptocurrency trading, and those that have not are currently considering some form of regulation.

For Singapore, it has introduced its own set of crypto regulations, such as banning cryptocurrency-related advertisements in public areas.

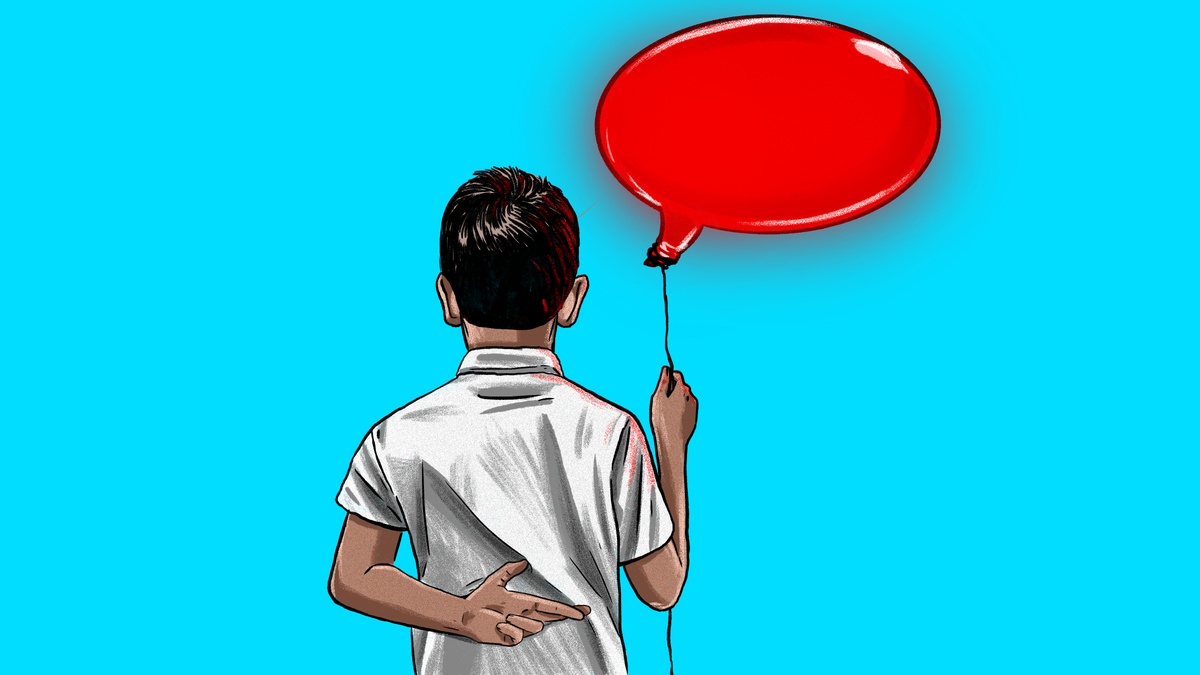

However, this indicates a mismatch between public sentiment and public policy. While governments are cautioning against cryptocurrencies, the public is hyping it up and holding cryptocurrency up as the future.

So what are the concerns of governments, and why have they adopted their stances against cryptocurrencies?

Potential for fraud and misuse

Image Credit: Time

Image Credit: TimeGiven the anonymity of cryptocurrencies, it makes sense for governments to be cautious with cryptocurrencies. The potential for cryptocurrencies to be used for illicit transactions means that law enforcement agencies now have to consider and adapt to the possibility of cryptocurrencies being used for money laundering, fraud, and other financial crimes.

In fact, cryptocurrencies have already seen their fair share of scandals, with a crypto influencer having been in the spotlight recently for shilling bad coins.

As such, several countries in SEA have instituted regulations for cryptocurrencies, pertaining to their potential use in financial crime and other illicit activities. The Philippines has issued guidelines for virtual currency exchanges, and mandated that these institutions must work with the country’s Anti-Money Laundering Council. Singapore has also followed suit, announcing regulations to prevent money laundering and terrorism financing.

SEA’s reputation for the drug trade also likely does cryptocurrencies a disfavour, as do the presence of insurgencies and political unrest, and it should come as no surprise that Myanmar and Laos have some of the harshest rules in place against cryptocurrencies. Myanmar has banned all digital currencies, and Laos has only issued licences for two brokerages.

To be clear, cryptocurrencies are not only used for illegal activities — businesses and consumers use them for other reasons that are above board as well. Businesses are already beginning to accept cryptocurrencies as a form of payment, and some businesses only accept crypto as a payment method.

However, as mentioned above, governments have not shown the same enthusiasm. In fact, they have advised caution for consumers when dealing with cryptocurrencies. Let’s examine why.

Macroeconomic policymaking

Image Credit: CoinDesk

Image Credit: CoinDeskThe values of cryptocurrencies can experience huge fluctuations in short periods of time. This volatility means that there is potential for massive wealth, but also the possibility for dramatic crashes.

Southeast Asian governments are well aware that building an economy from these volatile investments is likely a bad idea. The Asian Financial Crisis provides a strong reminder that economies must be built on solid foundations to be sustainable.

The possibility of an economic bubble and subsequent crash that results in great economic hardship is a likely reason why governments have been hesitant to fully embrace cryptocurrency. Even countries like Singapore, which is considered one of the friendlier countries towards crypto, have their own reservations.

Ravi Menon, head of the Monetary Authority of Singapore (MAS) has previously declared that the central bank “frowns on cryptocurrencies, or tokens as an investment asset for retail investors”.

That being said, MAS has acknowledged that cryptocurrencies and blockchain technology do have its benefits, and Singapore is also currently looking at rolling out a digital Singapore dollar.

Separately, the MAS has made a statement that whether or not businesses accept bitcoins as payment is a commercial decision and that it will not intervene. The government has also indicated that it will not interfere with innovation, and allow blockchain technology to develop in Singapore.

Indonesia has taken a similar stance, with the Commodity Futures Trading Regulatory Agency Bappebti setting requirements for future exchanges and clearing houses that deal with cryptocurrency assets. These requirements include security systems, risk assessment processes, and other capital requirements.

In essence, these countries have decided that cryptocurrencies are risky investments, with potentially destabilising effects that could impact the wider economy. That being said, the technology and investment in itself is not inherently destabilising.

Therefore, while caution is needed, a blanket ban is not necessary. What is needed is for precautions to be made against malinvestments and economic bubbles.

Other ASEAN nations have not been as friendly. Thailand’s Securities Exchange Commission has declared cryptocurrencies as too volatile, and possibly detrimental to financial security.

While investors, consumers, and citizens can still trade digital assets for investment as usual, and digital assets can be used as payments between merchants and customers, Digital Asset Operators are banned from facilitating the use of crypto as a means of payment.

Vietnam has also banned the use of cryptocurrencies as a form of payment, and while there are no other regulations as of yet, the State Bank of Vietnam has been ordered by the government to study cryptocurrency, and consider adopting regulations for its use.

Vietnam’s stance is certainly curious — it has been investing heavily, and with significant success, in its digital infrastructure. Why then, would it pump the brakes when it comes to cryptocurrencies?

Monetary stability and currency demand

Image Credit: Perpetual Wealth Management via Medium

Image Credit: Perpetual Wealth Management via MediumWe should understand that SEA is a region of countries highly jealous of their own sovereignty. As such, governments are often suspicious of anything that could threaten their own power.

Economic security and nationalism for these countries, therefore, often means control of their own currencies, and the currencies circulating within their own borders — whether this means fiat currencies from other countries or in this case, cryptocurrencies.

The advent and acceptance of cryptocurrencies would significantly threaten countries with already weak currencies — namely Vietnam, Cambodia, and Myanmar. All of these countries have been struggling with weak currencies, which have constantly depreciated against foreign currencies.

These economies are also significantly dollarised, meaning that there is widespread internal use of the US dollar instead of their own domestic currencies.

Rising demand for cryptocurrencies in these countries could be disastrous — demand for their own local currencies is already low, and if cryptocurrencies become mainstream in these countries, it could mean even lower demand for local currencies.

If this hypothetical scenario comes to pass, these countries would lose all ability to control their own monetary policy, so it should come as no surprise that these countries have all expressed some form of opposition to cryptocurrency adoption.

While Cambodia and Vietnam have not outrightly banned its use, there are significant de-dollarisation efforts underway in all countries.

Cambodia’s Securities and Exchange Commission released a statement that unlicensed operations related to cryptocurrencies are illegal, and provided no information on how to apply for such a licence, while the National Bank of Cambodia started its own digital currency last year.

The government hopes that such a move will increase financial inclusion and wean the country off the US dollar.

So have these measures worked? To some extent, yes. The Cambodian Riel and Vietnamese Dong have been relatively stable over the past few years, but the Myanmar Kyat is an exception. It has continuously experienced depreciation, and the civil unrest seems to have driven more citizens to invest in crypto.

Lessons to be learned

Image Credit: Finance Magnates

Image Credit: Finance MagnatesThe crypto policies may vary widely between countries, but its motivations are surprisingly constant — governments in SEA are motivated above all by needs for national security, and economic security forms an important component of this.

It’s not just economic security — there are also concerns about political and social security at stake, and it should therefore come as no surprise that governments have been interested in adapting the technology to suit their own needs while rejecting wholesale adoption.

Blockchain technology and cryptocurrencies have the potential for massive disruption for economic development, but they also come with significant risks for investors; and by extension, the countries where these investors are based in.

Whether or not these policies succeed in preventing the worst excesses made possible by cryptocurrencies remains to be seen. But if history is anything to go by, the future is promising.

Southeast Asian governments in general have generally understood that one cannot swim against the currents forever. Instead, it is much better to adapt to circumstances as they arise, and make the best of what happens.

Singapore is likely the one most likely to succeed in this, having turned the city-state into a hub for technological innovation and cryptocurrency. However, only time will tell if SEA has taken the right approaches, and to what extent are these approaches either enlightened or ignorant.

Featured Image Credit: Forkast

MikeTyes

MikeTyes