Tesla shares up after Elon Musk says he is set for victory in $56 billion pay vote

Elon Musk said Tesla shareholders are set to approve his $56 billion pay package and a resolution to move the electric car maker's incorporation to Texas.

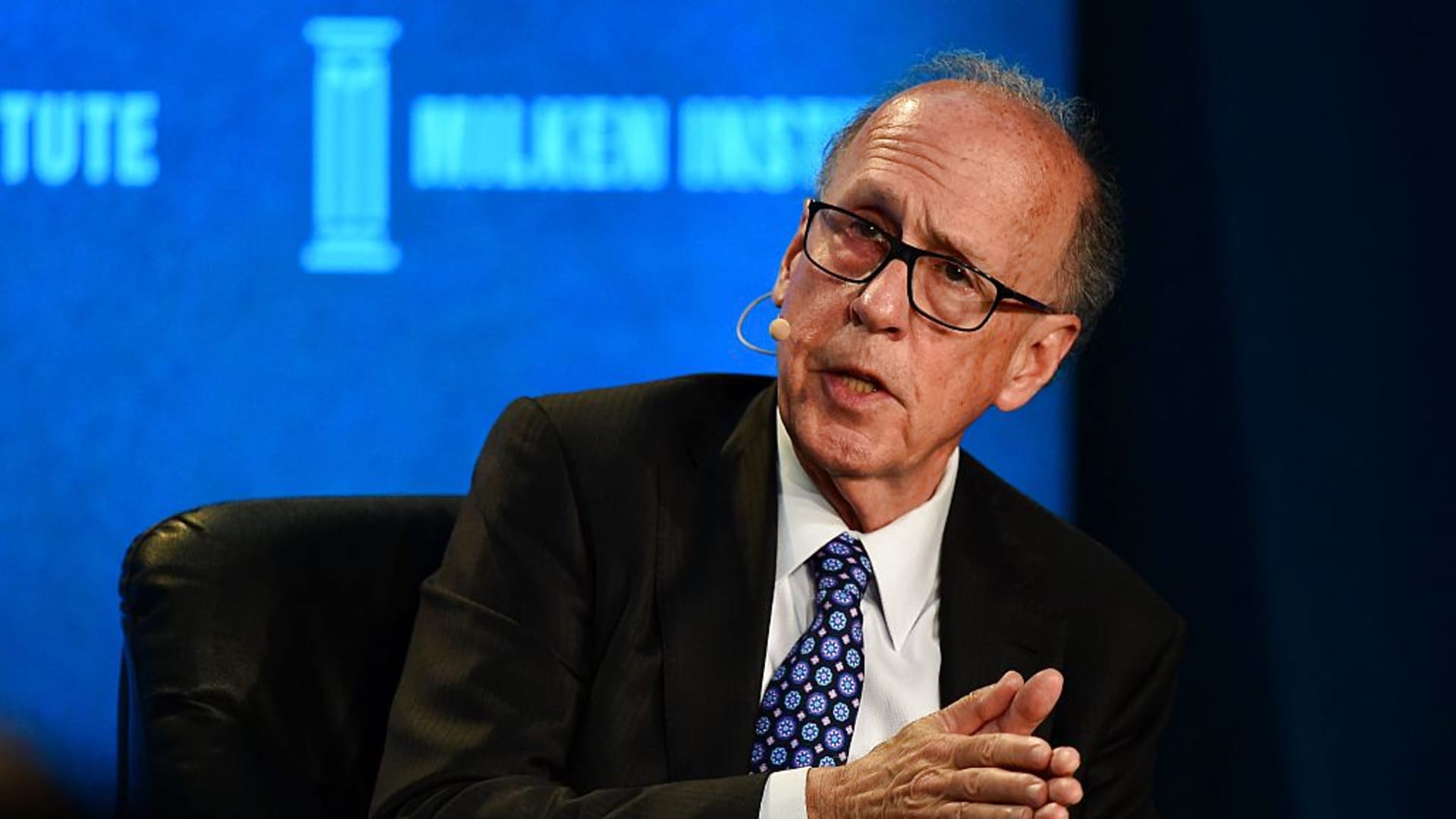

Elon Musk, co-founder of Tesla and SpaceX and owner of X Holdings Corp., speaks at the Milken Institute's Global Conference at the Beverly Hilton Hotel,on May 6, 2024 in Beverly Hills, California.

Apu Gomes | Getty Images

Shares of Tesla popped higher after Elon Musk said shareholders are set to approve his controversial $56 billion pay package and a resolution to move the electric car maker's incorporation to Texas.

The company's stock was up about 3% as of 10:45 a.m. ET.

Tesla shareholders have been voting on two resolutions and can have their say up to the company's annual meeting on Thursday. Most Tesla shareholders had to submit their votes by the end of the day on Wednesday. Others attending the shareholder meeting are eligible to vote in person or online on Thursday.

The first measure under consideration is whether to green light a $56 billion pay package that shareholders originally approved in 2018, before being voided by a Delaware judge in January.

The second resolution is whether Tesla should transfer its state of incorporation from Delaware to Texas. That proposal was put forward after Musk asked his followers on social media platform X earlier this year whether Tesla should carry out such a move — to a resounding yes.

Musk now said that both of these resolutions are currently passing by "wide margins," without disclosing specifics or his sourcing.

It's likely that even a majority vote for ratification of Musk's pay plan will be challenged in court, and require judicial review, according to Yale law professor Sarath Sanga.

CNBC has reached out to Tesla for comment.

The initial pay package had aggressive targets for Tesla's financial performance and market value — and, while the company has turned into one of the world's largest electric auto makers, a lot has changed since 2018.

Tesla is facing slowing growth and increased competition, especially from Chinese players. In that time, Musk also bought Twitter, now called X, and has ramped up focus on other projects, including in his brain computer interface firm Neuralink and artificial intelligence company xAI.

Critics of the pay deal argue that Musk is distracted by his other endeavors, and that the package, the largest in U.S. corporate history, is excessive. More recently, they say that Tesla's financial performance has not been up to scratch.

Some notable shareholders have said they planned to vote against the deal, and top proxy advisors Institutional Shareholder Services and Glass Lewis also recommended this step. The California State Teachers' Retirement System, a massive pension fund, likewise objected to the package, claiming the sum was too high. Norway's sovereign wealth fund has similarly come out in opposition.

Shareholders in favor of the compensation argue that Musk is integral to Tesla's future success and that the billionaire will take his efforts elsewhere if he is not reimbursed adequately. They claim that the pay package has incentivized Musk.

Billionaire investor and longtime Tesla shareholder Ron Baron said he is voting in favor of the pay package, suggesting that Musk is key to the EV maker's future.

"At Baron Capital, our answer is clear, loud, and unequivocal: Tesla is better with Elon. Tesla is Elon," he said this month.

Some major investors, such as Vanguard and BlackRock, have meanwhile not said how they will cast their votes.

Aliver

Aliver