The Risk Management Trends That Will Help Your Business Stay Afloat

Risk management is the silent hero when it comes to managing a business. It keeps employees aware of potential risks and allows information security, risk and IT teams to nip issues in the bud before they become larger issues....

Risk management is the silent hero when it comes to managing a business. It keeps employees aware of potential risks and allows information security, risk and IT teams to nip issues in the bud before they become larger issues.

However, many businesses put minimal resources into risk management. This means that countless businesses are on the brink of facing financial, cybersecurity or reputational damages without even realizing it.

To combat these threats, businesses can begin a risk management protocol to stay on top of risks and resolve them when need be. By having such a system in place money, resources, and the company’s positive image can all be preserved.

Yet any business that wants to start incorporating risk management processes may not be sure where to start. Many supervisors may be wondering what others have been doing, and which practices should be mimicked.

Read on to see which risk management trends are the most useful and can be copied by most businesses with ease.

1. Keeping an Up-to-Date Risk Register

A risk register is a comprehensive document created during a risk assessment – typically the company’s very first risk assessment. This register collects information on every potential risk that can hurt a business, both big and small. Identifying information such as the type of risk it is, the likelihood of it actually happening, and an identification number or code are just some of the information that should be included in a risk register.

Having the risk register be as up-to-date as possible allows a company to work with accurate information to help make decisions. As such, a business will know-how resources and manpower should be allocated to address risks that still haven’t been resolved, while also recognizing which risks can be addressed at a later date.

By having such information be as accurate as possible, businesses won’t waste time or money handling risks that may not be as high a priority, or that may have already been resolved by another team member.

It’s crucial for a business to conduct regular risk assessments to keep registers up-to-date. These assessments can be done manually, or with the help of risk management software. Either way, these registers should be easily accessible to every relevant person and department, to avoid any interruptions in communication. Ideally, these registers would also be detailed enough that future newcomers to the team as well as departments who

2. Investing in Risk Management Software

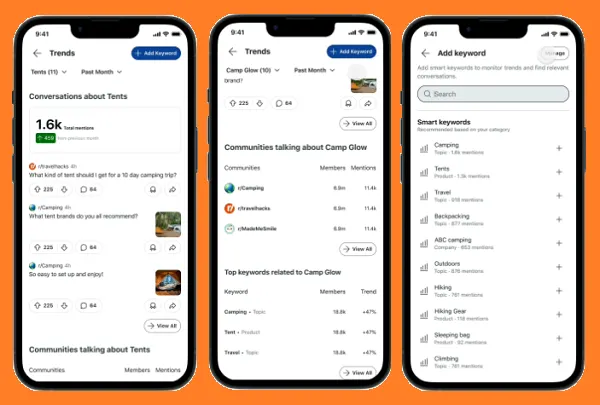

Risk management software is a crucial investment when it comes to staying on top of risks and automating the risk management process. By having a program do the heavy lifting of conducting risk assessments, generating registers, and providing concise reports for team members, fewer mistakes will be made during the risk management process, and a business will save money and manpower in the long run.

In addition to the perks of having the risk management process automated, most risk management programs often come with additional features. These features can include auditing software as well as risk monitoring programs. These two common add-ons found within most risk management programs make it all the easier for a business to keep track of its inner workings.

By having a one-stop shop for all your business’s risk management needs, your team will be able to store information, share information and refer back to it all in one place. One department can carry out risk assessments, while another can use the risk register generated to help make decisions. Still, other departments can utilize the auditing software to keep track of the business’s financials, as well as ensure that the company is on the up-and-up when it comes to reporting taxes and income.

On top of this, buying risk management software would also be a one-time purchase. Most risk management programs are built to last a business for years. Since most software are programmed to last, they can keep businesses from sinking too much money into the risk management process in the long term.

3. Keeping Departments Abreast of Developments

A single person or department can’t manage every risk alone; to do so is asking for disaster. Mistakes can be made if too much is piled onto one person’s or team’s plate, and when it comes to mistakes with risk management, such blunders can have ripple effects throughout the whole company.

With this in mind, it’s important that risk management is a shared burden that most team members take a piece of. One way to spread the labor is by making other departments aware of risks that affect their line of work specifically. For example, the IT department should be aware of all cybersecurity threats, while the accounting department should be aware of every potential financial risk.

By dividing up the labor, a business increases the accuracy of the risk management process by having multiple departments handling the same information. In the same vein, mistakes will be reduced, as everyone will be responsible for the same risk register and will be utilizing the same programs.

Another way a business can keep its employees in the know is by having departments keep each other informed. When one department carries out a new risk assessment, other departments should be made aware that the register has been updated with the latest information. Departments should also update the register as risks are resolved, keeping their co-workers informed in the process.

All in all, the risk management process is a necessity for companies big and small. Not only can it help a business stay on top of any potential risks and handle them when necessary, it can also keep departments informed of the latest goings-on within a company. However, risk management doesn’t need to be an arduous task. Companies can indeed have risk assessment and management teams to handle everything manually, however, there are a number of risk management software and programs that can be used to speed up the process and reduce human error. The first step for many businesses is simply deciding to begin the process.

Aliver

Aliver