This Scam Is Targeting Home Closing Costs

You’re about to buy a home for the first time after years of work, sacrifice, and saving. Your state requires you to wire your closing cost, so you decide to just wire it online to the title company to...

You’re about to buy a home for the first time after years of work, sacrifice, and saving. Your state requires you to wire your closing cost, so you decide to just wire it online to the title company to save time. But you’re a savvy homebuyer and call the company before wiring the money to do your due diligence and make sure they’re legit. All good, wire away. But no—you may have just sent $100,000 of your money to scammers.

If this sounds too far-fetched and hypothetical, you’ll be surprised to learn this recently happened to a family in Ohio. But what did they do wrong? Here are the lessons you can learn so scammers don’t ruin your American dream.

How do scammers steal your home’s closing cost fee?

As with any scam that promises high reward, the time and attention to detail spent to trick you is more sophisticated. If you don’t know what you’re looking for, you might not see it. This is a type of scam the FBI calls Business Email Compromise (BEC).

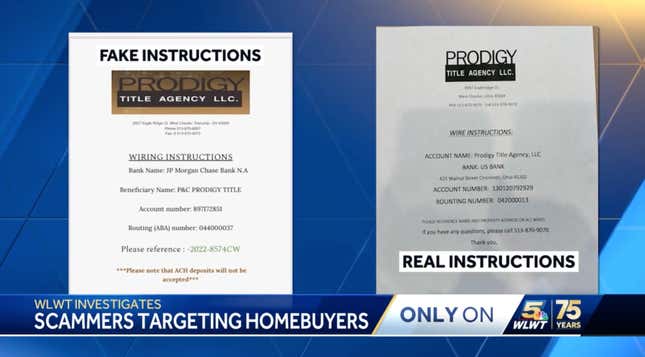

Scammers hack a company or individual by spoofing an email account or website (think official-looking emails or slightly different but recognizable email domains of employers), sending spear-phishing emails (that trick you into revealing sensitive information to access company accounts, calendars, data, etc.), or using malware (malicious software) to gain access to a company’s or individual’s sensitive information.

Once hackers know who, when, and for how much someone is buying a home, they wait for the perfect moment—when the victim is ready to pay the closing costs—to send them a curated email with instructions on how to send the payment. Scammers prefer you wire the money online because there is no protection if something goes wrong.

According to Money.com, this scam picked up speed during the pandemic when stay-at-home restrictions allowed for more people to wire their payments online. And the practice, which used to be the norm to do in person, is still mainly done online today post-pandemic.

How to avoid being scammed when wiring money

Since scammers will know your amount, dates, name, addresses, and other information, you’ll have to look elsewhere for discrepancies. One giveaway can be the sender’s email. Look at the host domain to see if it matches the official email. Instead of clicking on the link on the email or calling the number on the email, cross reference it on Google or call the company directly to make sure it’s correct. Never trust wire instructions, links, or phone numbers in an email.

However, the safest method to make sure you don’t get scammed is to do it in person. You can ask to pay via cashier’s check instead of wiring your funds or ask your bank to do a wire transfer in person with the title company. While it might feel inconvenient to do something in person that you can do online, it will not feel nearly as inconvenient as having to report wiring fraud.

What to do if you are a victim of a wiring fraud?

How fast you act does make a difference, so always make sure you get a confirmation that the title company received the payment. If you catch the scam within 24 hours, you have a higher chance of getting your money back (although Money.com says only 29% of victims see their funds fully recovered and in 40% of cases, 10% of the fund or less is recovered).

The FBI recommends you do the following:

Contact your financial institution immediately and request that they contact the financial institution where the transfer was sent (they should also recall the wire transfer immediately).Next, contact your local FBI field office to report the crime.Also file a complaint with the FBI’s Internet Crime Complaint Center (IC3).

Astrong

Astrong