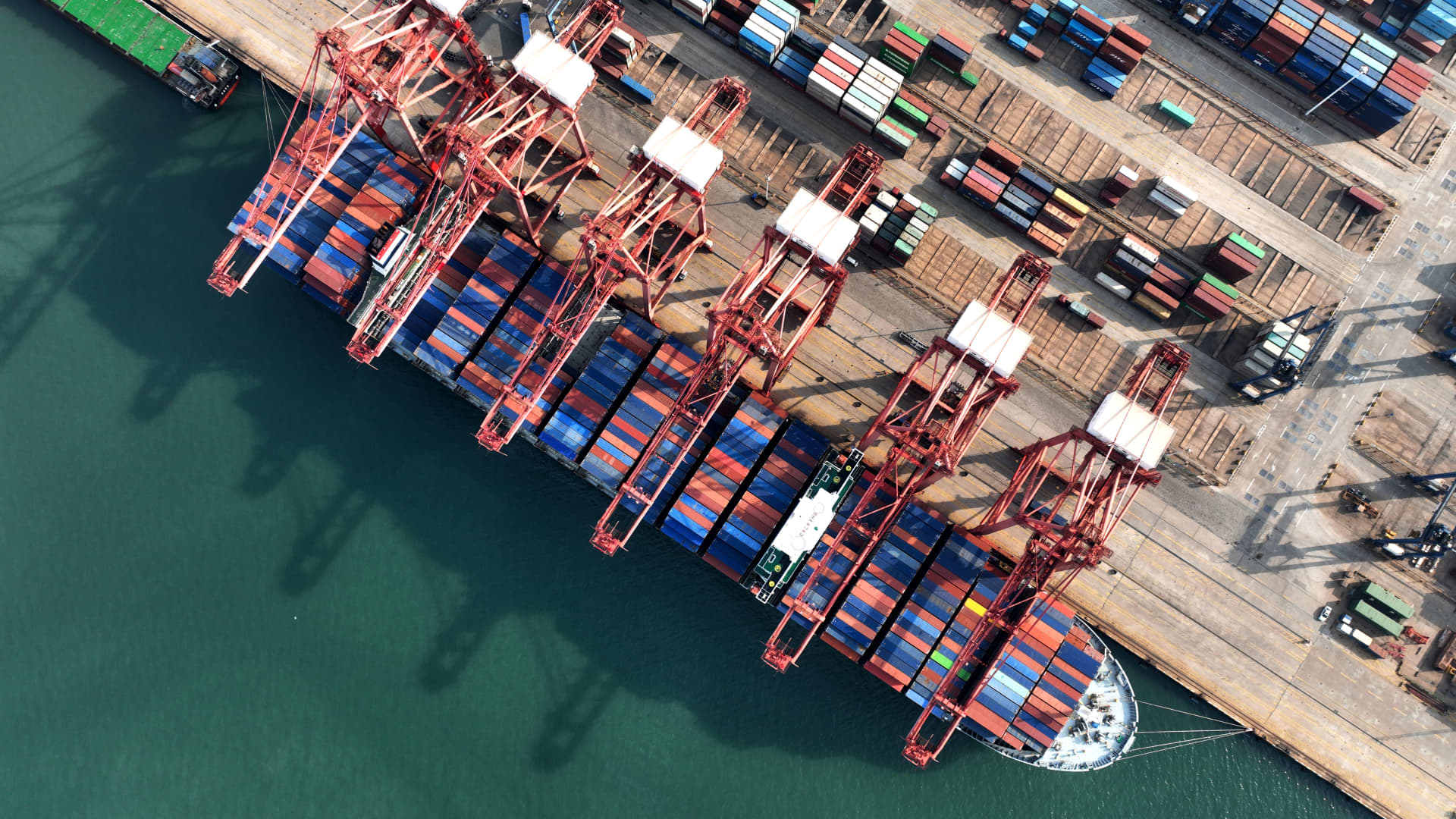

Trade tensions seen hanging over U.S. firms' caution over China

Foreign multinationals in the U.S and Europe are getting more cautious about their capital investments in China due to geopolitical concerns, said consultancy.

U.S. and European multinational firms are getting more cautious about their capital investments in China due to geopolitical concerns, according to a risk consultancy.

Richard Martin, managing director of IMA Asia, said the ongoing U.S. trade tensions with China is the main reason for the investment caution shown by American companies.

"Without a doubt, it is geopolitical risk because U.S. firms were becoming more cautious from the Trump administration on with the trade war," he told CNBC's "Squawk Box Asia" on Friday.

The White House under President Joe Biden is currently reviewing the penalties imposed under former President Donald Trump. Trump levied a raft of tariffs on Chinese goods in a long-running retaliatory trade war with Beijing in an effort to bolster U.S.-made goods.

As for European firms, Martin noted, its Russia's invasion of Ukraine that has led to concerns over Beijing.

"So at the board level, you sit there and you say, 'We just lost our shirt in Russia. We had to close down our operations and sell out.' Is there any chance that might happen in China? And of course, the answer to that is, yes, there is," Martin said.

"So everyone is scrambling with their China operations, [asking] how do we mitigate the risks?"

Even at 3% or 4% growth, China will add more dollar value in the next five years than the United States. You can't walk away from that.

Russia's unprovoked invasion of Ukraine in February a year ago prompted a growing list of companies to shun doing business with Moscow, as firms scrambled to cut ties as foreign governments ratchet up punitive economic sanctions.

European energy majors such as BP, Shell and Equinor all announced plans to bring an end to joint ventures in Russia.

China growth

Martin further highlighted foreign companies need to work out how they want to mitigate their risks in China.

"Yes, some companies will diversify. But they don't want to diversify away from the biggest growth market in the world," he said. "Even at 3% or 4% growth, China will add more dollar value in the next five years than the United States. You can't walk away from that."

Read more about China from CNBC Pro

China's economy grew by just 3% in 2022, official figures revealed in January. This is the second-slowest growth rate since 1976 and well below the government's target of around 5.5%.

Still, the reopening of the Chinese economy after the shift away from the zero-Covid policy will help lift growth in the second quarter, said Martin.

"The Covid wave hit them in January. So their workers went off sick in the first week of January. And with Chinese New Year coming at the end of the month, they just didn't come back," he said.

"So we're going to see a giant hole in the first quarter. Second quarter, they get their services sector back and China's GDP will lift and that's a plus for everything."

Konoly

Konoly