Unlocking Success: A Deep Dive into PayPal’s Marketing Strategy

Ever wondered what fuels the digital payments revolution? How does a company like PayPal keep millions of users not just clicking but eagerly paying? And what are the secret ingredients of PayPal’s digital marketing strategy that makes the competition...

Ever wondered what fuels the digital payments revolution? How does a company like PayPal keep millions of users not just clicking but eagerly paying? And what are the secret ingredients of PayPal’s digital marketing strategy that makes the competition break a sweat? If these questions have ever crossed your mind, you’re in for an intriguing ride.

A few brands have managed to achieve the same level of recognition and trust as PayPal in the world of digital commerce. A titan in the online payment industry, PayPal is the 6th largest fintech company in the world. The brand has consistently adapted, innovated, and led from the front, maintaining its position as the go-to choice for 431 million users worldwide.

However, what truly sets PayPal apart is not just the intricacies of its marketing strategy but the systematic and strategic decisions that have underpinned its remarkable success.

Join us as we embark on this exciting expedition into the world of PayPal’s strategic marketing.

Understanding PayPal’s Target Audience

The key to any successful marketing strategy lies in truly comprehending who you’re speaking to. For PayPal, this understanding isn’t just surface-level; it’s intricate, detailed, and rooted in data-driven insights. Let’s take a look:

Individuals

The modern consumer seeks convenience, and PayPal answers this call immaculately. Catering primarily to individuals who transact online – be it for shopping, freelancing, or international purchases – PayPal ensures a smooth experience. These individuals, ranging from millennials making their first online purchase to the elderly securing their favorite book, all find solace in the brand’s simplicity. Moreover, PayPal regularly adds features designed to improve each user’s experience through monitoring transaction activities.

Businesses

The corporate world isn’t untouched by PayPal’s allure. Businesses, both large and small, lean on PayPal for B2B transactions. Recognizing the unique needs of this segment, PayPal offers specialized tools to streamline invoicing, facilitate easy international payments, and manage corporate expenses. In addition, the brand has consistently shown adaptability, introducing features that address emerging business challenges in the digital world.

Merchants

Arguably one of the most crucial segments for PayPal, merchants form the backbone of its ecosystem. From eCommerce giants to local stores venturing online, merchants require a reliable payment gateway. And PayPal, with its emphasis on secure and swift transactions, stands out as an ideal choice. The brand doesn’t stop at just being a transaction medium; it goes a step further. Merchants have access to a suite of analytics tools, helping them gain insights into sales patterns, customer behaviors, and more, allowing them to refine their strategies for increased profitability.

PayPal’s Unique Value Proposition

The world of online payments is perhaps more crowded than ever. This situation makes standing out a challenge. Yet, PayPal has not only managed to stand out but also to lead, and much of this is credited to its distinct value propositions. These propositions cater to the very needs and aspirations of its varied user base.

Convenience

PayPal understands deeply that time is of the essence in today’s fast-paced world. That is why the brand ensures a smooth and effortless process. Setting up a PayPal account is quick, allowing users to transact within minutes. With one-click transactions and integrations across numerous eCommerce platforms, users can check out swiftly without repeatedly entering payment details. Furthermore, with the ability to link multiple bank accounts and cards, users enjoy a seamless financial experience, making PayPal the preferred choice for many.

Security

Security features are perhaps the most crucial thing when it comes to finance and fintech brands, especially in fintech advertising. It’s one of the most important features to promote as a brand. When it comes to financial transactions, trust is crucial, and PayPal has based its whole business model on this idea. Utilizing state-of-the-art encryption technologies, the platform ensures that user data is shielded from potential threats. But beyond the tech, it’s the brand’s Buyer Protection initiative that truly wins hearts. Offering users peace of mind, this feature ensures that they are covered if they don’t receive an item, or it’s significantly different from its description. By prioritizing user safety, PayPal fosters an environment of trust and reliability.

Affordability

Although premium services are typically associated with a premium cost, PayPal breaks this convention. Its competitive pricing structure ensures transparency without hidden charges. Regular users, especially merchants, benefit from discounts on transaction fees, making large-scale operations more viable. By striking the right balance between quality service and affordability, PayPal ensures it remains accessible to all – from individual consumers to large businesses.

Additional Features

PayPal’s main purpose is to process payments, but it has continuously added a number of functions that go beyond that. Offerings such as PayPal Credit, which provides users with a line of credit, and “Pay in 4” a buy-now-pay-later solution, showcase the brand’s commitment to financial flexibility.

Additionally, its capability to handle international currency conversions effortlessly means that global transactions are as easy as local ones. These added features cement PayPal’s position as more than just a payment solution; it’s a comprehensive financial tool.

By carefully weaving these value propositions into its brand narrative, PayPal ensures that its users always find more than one reason to choose it over competitors. But having a strong value proposition is only half the battle.

PayPal’s Multi-Channel Marketing Approach

Even the most compelling value proposition requires an equally compelling medium to reach its intended audience. Over the years, PayPal has masterfully wielded a multi-channel marketing approach to ensure its message not only reaches its target audience but also resonates deeply. However, in the complex world of tech marketing, where the audience can be both local and global, the need for expertise becomes essential. Thus, as a finance brand, collaborating with tech marketing agencies offers a strategic advantage that can’t be overstated.

These agencies bring a wealth of experience and industry knowledge to the table, enabling brands like PayPal to navigate the intricacies of local and global markets. They possess the insights to understand cultural nuances, economic trends, and regional preferences, allowing for a tailored and effective marketing strategy. Just like PayPal’s.

Online Advertising

You’re probably a little tired of hearing this, but having a strong online presence is genuinely crucial. PayPal not only recognizes this fact but has also established a solid foundation in the digital world through the implementation of various strategies. Naturally, the ongoing sustainability of these efforts is equally important.

Through strategic PPC campaigns, display ads, and retargeting efforts, PayPal ensures that it remains top of mind for potential users. By targeting keywords related to online transactions, eCommerce, and financial services, the brand effectively captures the attention of those seeking reliable payment solutions. Moreover, its sophisticated use of analytics allows it to fine-tune campaigns in real-time, optimizing for maximum ROI.

If you’re a finance brand venturing into the digital marketing landscape, you and I are both aware that you need to establish a strong online foundation that maximizes your digital ad ROI. While strategic PPC campaigns, display ads, and retargeting efforts are your tools of choice, the secret to unlocking their full potential lies in partnering with finance marketing agencies. They empower you to navigate the dynamic digital landscape and achieve the highest returns on your advertising investments, ultimately ensuring that your brand shines bright in the digital world.

Social Media Marketing

Social media platforms are much more than just networking sites; PayPal knows how to take advantage of their potential. With a strong presence on platforms like Instagram, LinkedIn, and Twitter, the brand crafts engaging narratives. Whether it’s sharing success stories, announcing new features, or fostering community engagement, PayPal’s social media strategy is both dynamic and human-centric, resulting in authentic connections with its audience.

PayPal demonstrates its leadership in this sector by effectively engaging its nearly 700K Instagram followers. It entertains with engaging stories, like the DIY example below, while also providing valuable information about its key features.

Naturally, the brand posts more than just humorous posts and updates on social media. By tackling important topics like fraud and security, which are crucial in the digital and financial areas, they also educate their audience.

Email Marketing

Personalized, time, and relevant – that’s how PayPal’s email campaigns can be described. Through meticulously segmented lists, the brand ensures that its users receive content tailored to their needs. Transactional emails, newsletters, and promotional offers are not just seen as communication tools, but as opportunities to add value. And with high open and click-through rates, it’s evident that PayPal’s email marketing hits the right notes.

Content Marketing

The following principles guide PayPal’s content marketing initiatives: educate, inform, and engage. PayPal positioned itself as a thought leader in the online payment space with a rich repository of blogs, videos, webinars, and infographics.

Whether it’s guiding merchants in optimizing sales or helping individuals understand financial nuances, its content is always steeped in value. And by prioritizing SEO, the brand ensures that this content is easily discoverable, further enhancing its reach and impact.

Partnerships

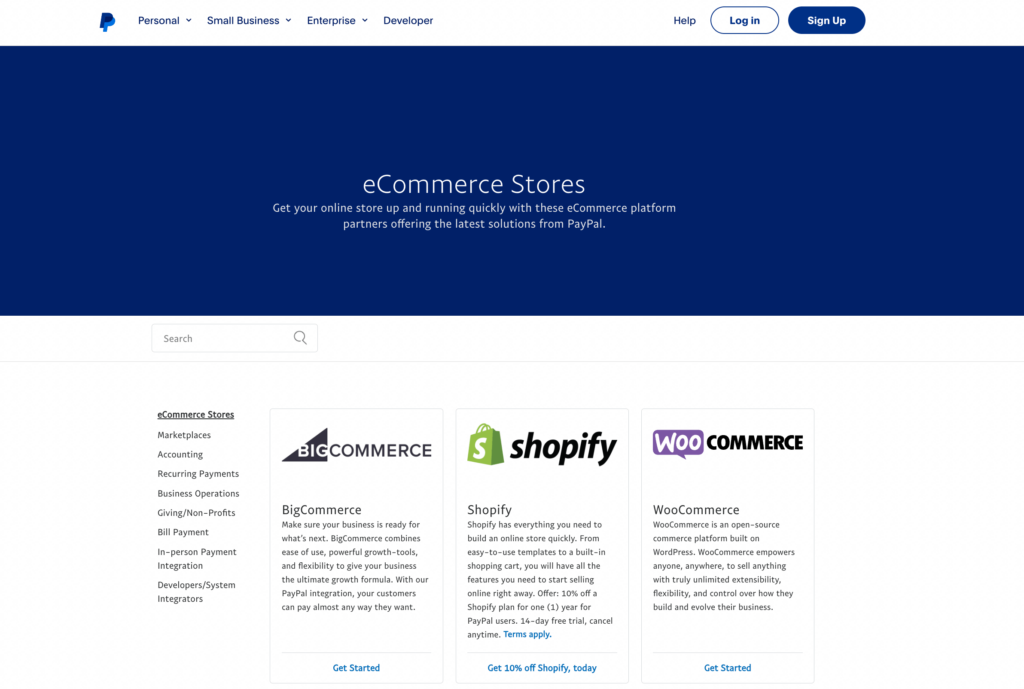

Strategic collaborations have been a cornerstone of PayPal’s marketing strategy. By forging alliances with eCommerce giants, tech platforms, and financial institutions, PayPal amplifies its reach exponentially. These partnerships, often marked by co-branded campaigns or special offers, result in a win-win situation. PayPal benefits from increased visibility and usage, while its partners can offer their users a tried-and-tested payment solution, enhancing their service quality.

PayPal creates a compelling and powerful marketing symphony by carefully combining different channels together. But as we’ve seen, the brand’s success isn’t just about reaching out; it’s about reaching out right.

Specific Examples of PayPal’s Marketing Strategies

Throughout its journey, PayPal has launched a plethora of marketing campaigns, each designed to resonate with its target audience and further its brand narrative.

Here, we’ll spotlight a few such campaigns that encapsulate the essence of PayPal’s marketing genius.

1. “New Money” Super Bowl Campaign

In 2016, PayPal made a splash with its debut Super Bowl commercial titled “New Money.” This campaign was a bold proclamation of the shift from traditional to digital money, showcasing PayPal as the forerunner of this revolution. The advertisement, with its dynamic visuals and compelling taglines, effectively communicated the brand’s vision of a more inclusive financial future, resonating deeply with a global audience.

2. “Money Pools” Launch

To introduce its “Money Pools” feature, which allows users to connect money from friends and family for joint expenses, PayPal used a mix of influencer partnerships and social media marketing. Collaborating with influencers from diverse domains, the brand showcased real life scenarios where “Money Pool” could be beneficial. This relatable, user-centric approach amplified the feature’s value proposition, driving both awareness and adoption.

3. Make it One to Remember Campaign

This advertising campaign shows us how easy it is to make payments with PayPal. In this utterly charming campaign video, a loving father creates the perfect setting and decor for his daughter, who’s trying to learn and perform the ever-famous Nutcracker Ballet. When the dad sees his daughter’s passion, he decides to order the necessary items to create a homemade theater ambiance to accompany her. He even learns the choreography too! This is a holiday gift for his daughter, made easier than ever with a seamless shopping and checkout process experience provided by PayPal.

PayPal’s Focus on User Experience

In the era of customer-centric businesses, user experience has transitioned from being just a buzzword to a fundamental pillar of brand success. And for a digital-first brand like PayPal, the importance of UX is magnified.

Intuitive Interface Design

From the moment a user lands on the PayPal website or opens the mobile app, they’re greeted with an interface that prioritizes simplicity and clarity. Large icons, clear calls-to-action, and a minimalistic design ensure that even first-time users can navigate with ease. This intentional design ensures that common tasks, like sending money or checking transaction history, are straightforward and hassle-free.

Responsive Customer Support

Even the best of platforms can occasionally face issues. What differentiates great brands from the rest is how they handle such instances. PayPal’s customer support is renowned for its efficiency and responsiveness. Whether it’s through live chats, phone calls, or email support, users always find a helping hand ready to assist them. Moreover, the extensive FAQ section addresses a majority of common queries, ensuring that users can find quick solutions.

Personalized User Journeys

Drawing from its vast data resources, PayPal offers personalized experiences for its users. Tailored product recommendations, customized notifications, and user-specific promotions ensure that every interaction feels unique and relevant. This level of personalization not only enhances user satisfaction but also drives increased transaction frequencies.

Seamless Integrations

PayPal understands the diverse needs of its audience. Thus PayPal makes sure that its services work seamlessly with a variety of platforms. Be it eCommerce websites, subscription platforms, or even charity donation portals, the PayPal button is ubiquitous. This seamless integration ensures that users can utilize PayPal’s services without disruptions, irrespective of the platform they’re on.

Continuous Feedback Loop

User feedback is a goldmine of insights, and PayPal is adept at tapping into this resource. Through periodic surveys, user testing sessions, and feedback forms, the brand continually gathers user opinions. This feedback is then channeled into refining and enhancing the platform, ensuring that the user experience is always evolving and improving.

PayPal’s Investment in Innovation

Complacency is a luxury no brand can afford, especially in the fintech sector. PayPal’s enduring success can be attributed, in large part, to its consistent drive for innovation. This commitment not only keeps the brand ahead of the curve but also reinforces its position as an industry leader.

Pioneering New Payment Methods

From its inception, PayPal has been at the forefront of redefining how we perceive online payments. Over the years, the brand has introduced numerous payment methods tailored to changing consumer habits. Features like “One Touch” for quicker checkouts and “Pay in 4” a not to the rising popularity of buy-now-pay-later schemes, showcase PayPal’s knack for anticipating and addressing evolving market needs.

Embracing Emerging Technologies

Blockchain, artificial intelligence, and machine learning – these aren’t just tech words for PayPal; they form the backbone of its innovation strategy. By actively researching and integrating these technologies, PayPal ensures enhanced security, faster transaction times, and more personalized user experiences. Their recent foray into cryptocurrency is a testament to the brand’s vision of shaping the future of digital payments.

Acquisitions and Collaborations

Over the years, PayPal has strategically acquired several companies that align with its vision and bring novel technologies to its portfolio. Be it the acquisition of Braintree, which brought Venmo under its wing, or the purchase of Honey, a shopping and rewards platform – such moves underscore PayPal’s intent to offer an ever-expanding suite of financial solutions. Collaborations, too, play a crucial role. By teaming up with tech innovators and industry leaders, PayPal taps into synergies that drive mutual growth.

PayPal vs. Stripe: The Differences Between the Two Online Payment Giant

Of the ten biggest fintech companies worldwide, seven are based in the United States and two in China. The Irish payment processing platform Stripe was the highest-valued fintech unicorn at the end of 2022, despite the dominance of both countries. Stripe is considered a competitor to PayPal because both companies offer online payment processing services. They often target the same customer base as well: businesses and eCommerce websites looking for reliable payment solutions. While they share this common ground, they also compete in various aspects of the payment processing industry.

Target Audience

We’ve already examined PayPal’s target audience above. As we’ve mentioned, PayPal‘s target audience includes users of all ages and income levels. Stripe, on the other hand, has primarily targeted developers and businesses that require more flexible and customizable payment solutions. It’s known for its developer-friendly approach.

Integration and APIs

PayPal provides APIs for developers to integrate its payment system into various platforms and websites. It offers PayPal Payments Standard, PayPal Payments Pro, and various other APIs to cater to different business needs. When we look at Stripe, however, we can see that it is well-regarded for its developer-centric APIs and extensive documentation. It’s designed to be highly customizable and is favored by tech-savvy businesses that want more control over their payment processing.

Payment Flow

PayPal often redirects users to its website for payment processing which can sometimes lead to a less seamless checkout experience. It does offer options like PayPal Express Checkout for a more streamlined experience. The difference between PayPal and Stripe is that Stripe allows for in-app or on-site processing, providing a smoother user experience without the need for users to leave the website or app during the payment process.

International Reach

PayPal has a global presence and supports transactions in multiple currencies, making it suitable for businesses with an international customer base. In fact, PayPal is available in more than 200 countries and support 25 currencies, its services being particularly popular in the U.S., The UK, and Australia. When we look at PayPal’s major competitors like Stripe, we can see that as opposed to PayPal, Stripe is only available in 46 countries as of today. Either way, both are an excellent choice for businesses looking to expand globally.

Fees and Pricing

PayPal’s pricing structure includes transaction fees, chargeback fees, and currency conversion fees. These fees can vary depending on the country and type of transaction. Stripe’s pricing is typically more straightforward, with transparent transaction fees. It also offers customizable pricing for large enterprises.

User Experience

PayPal offers a familiar and trusted brand, making it an attractive option for businesses that want to instill confidence in their customers. However, the checkout experience may vary depending on the integration method used. When evaluating Stripe though, we see that Stripe’s focus on providing a seamless and customizable payment experience can be appealing to businesses looking for a more branded and integrated checkout process.

Additional Services

Stripe primarily focuses on payment processing but has added features like Stripe Radar for fraud prevention and Stripe Connect for marketplace solutions. As opposed to Stripe, PayPal offers additional services like PayPal Credit, which allows customers to pay over time, and PayPal Working Capital, a lending service for businesses.

Not only Stripe, but PayPal has a lot of other competitors. If you’re curious about what these competitors are up to, you can discover intriguing insights into Wise’s marketing strategy.

How Other Businesses Can Learn from PayPal’s Marketing Strategy

PayPal’s meteoric rise and sustained market leadership serve as a masterclass in strategic marketing. However, the lessons it offers aren’t exclusive to fintech giants or established brands. Businesses, ranging from budding startups to seasoned enterprises, can gain invaluable insights from PayPal’s playbook.

a. Understand and Cater to Your Audience

PayPal’s success in identifying and serving the unique needs of individuals, merchants, and businesses is a testament to the power of audience understanding. Businesses should invest time in market research, user surveys, and feedback loops to deeply comprehend their audience’s pain points, aspirations, and behaviors. Crafting solutions and campaigns that align with these insights ensures greater resonance and success.

b. Differentiation is Key

In a crowded market, standing out is imperative. PayPal’s emphasis on its unique value propositions, such as security and convenience, has set it apart from competitors. Businesses must identify what makes them distinct and ensure that this differentiation is communicated clearly and consistently across all marketing channels.

c. Embrace a Multi-Channel Approach

PayPal’s adeptness at weaving a consistent narrative across diverse platforms underlines the importance of a holistic marketing strategy. Businesses should look beyond siloed campaigns and strive for an integrated approach, ensuring that the brand message is harmonized, whether it’s an email, a social media post, or a billboard advertisement.

d. Prioritize User Experience

A stellar product or service, if paired with a subpar user experience, can deter potential customers. Taking a cue from PayPal’s relentless focus on UX, businesses should evaluate and optimize every touchpoint in the user journey. This not only bolsters customer satisfaction but also aids in retention and referrals.

e. Innovation is Continuous

Just as PayPal continuously innovates its offerings and technologies, businesses should foster a culture that celebrates experimentation and forward-thinking. Regularly revisiting and refreshing products, services, and marketing strategies can keep a brand relevant and ahead of the curve.

f. Build Authentic Connections

PayPal’s campaigns, often rooted in real stories and genuine emotions, highlight the importance of authenticity. Businesses should strive to build genuine connections with their audience, prioritizing transparency, empathy, and value addition. Remember that beyond transactions, it’s the relationships that sustain a brand.

Learning from PayPal: A Blueprint for Success

As we’ve traversed the intricate tapestry of PayPal’s marketing strategy, certain themes recur the power of understanding one’s audience, the need for continual innovation, and the imperative of creating authentic, user-centric experiences. But beyond these specific tactics and strategies lies a more profound truth: At the heart of PayPal’s success is its constant commitment to its users.

Businesses in today’s digital age are presented with a paradox. On one hand, there are more tools, platforms, and channels than ever before to reach potential customers. On the other, consumers are more discerning, with a plethora of choices at their fingertips.

In such a landscape, merely catching a user’s eye isn’t enough; brands need to build trust, offer undeniable value, and foster genuine connections.

FrankLin

FrankLin