U.S. payrolls increased by 216,000 in December, much better than expected

Nonfarm payrolls were expected to increase by 170,000 in December, according to a Dow Jones consensus estimate.

The U.S. labor market closed out 2023 in strong shape as the pace of hiring was even more powerful than expected, the Labor Department reported Friday.

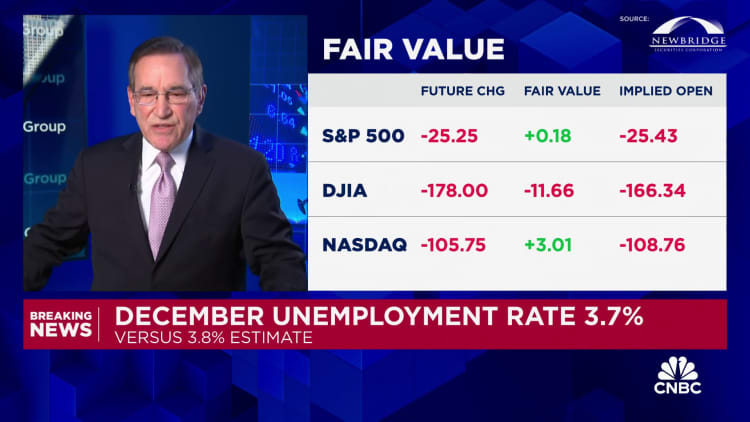

December's jobs report showed employers added 216,000 positions for the month while the unemployment rate held at 3.7%. Payroll growth showed a sizeable gain from November's downwardly revised 173,000. October also was revised lower, to 105,000 from 150,000, indicating a slightly less robust picture for growth in the fourth quarter.

Economists surveyed by Dow Jones had been looking for payrolls to increase 170,000 and the unemployment rate to nudge higher to 3.8%.

A more encompassing unemployment measure that includes discouraged workers and those holding part-time jobs for economic reasons edged higher to 7.1%. That increase in the "real" unemployment rate came as the household survey, used to calculate the unemployment rate, showed a decline in job holders of 683,000.

The labor force participation rate, or the share of the civilian working-age population either employed or looking for a job, slid to 62.5%, down 0.3 percentage point to its lowest since February and down 676,000 on a monthly basis.

The report, along with revisions to previous months' counts, brought 2023 job gains to 2.7 million, or a monthly average of 225,000, down from 4.8 million, or 399,000 a month, in 2022.

Markets reacted negatively to the data, with stock market futures sliding and Treasury yields sharply higher.

The hiring boost came from a gain of 52,000 in government jobs and another 38,000 in health care-related fields such as ambulatory health-care services and hospitals. Leisure and hospitality contributed 40,000 to the total, while social assistance increased by 21,000 and construction added 17,000. Retail trade grew by 17,000 as the industry has been mostly flat since early 2022, the Labor Department said.

On the downside, transportation and warehousing saw a loss of 23,000.

The report showed that inflationary pressures, despite receding elsewhere, are still prevalent in the labor market. Average hourly earnings rose 0.4% on the month and were up 4.1% from a year ago, both higher than the respective estimates for 0.3% and 3.9%. The average workweek edged lower to 34.3 hours.

Fed funds futures markets also reacted, lowering the odds of a March rate cut from the Federal Reserve to about 56%, according to the CME Group.

"Today's report speaks to the bumpy road ahead for the Fed's journey back to 2% inflation," said Andrew Patterson, senior international economist at Vanguard. "The decision of when to first cut policy rates remains one for the second half of the year in our view."

Friday's data adds to the case that the U.S. economy continues to defy expectations for a slowdown, despite an inflation-fighting campaign from the Fed that has produced 11 interest rate hikes since March 2022 totaling 5.25 percentage points, the most aggressive monetary policy tightening in 40 years.

At their December meeting, Fed officials released projections that indicate they could enact three quarter-percentage point interest rate cuts this year. Markets, though, expect the central bank to be more aggressive, with futures traders pricing in up to six cuts.

The belief that the Fed can start cutting is fueled by the view that inflation will continue to recede after peaking at a 41-year high in mid-2022. Inflation is still above the Fed's 2% target but has been making steady progress lower since the increases began.

However, Friday's report could challenge the market narrative of a substantially easier Fed.

"Jobs growth remains as resilient as ever, validating growing skepticism that the economy will be ready for policy rate cuts as early as March," said Seema Shah, chief global strategist at Principal Asset Management. "Indeed, the recent run of labor market data generally points in one direction: strength."

Economic growth has held solid after consecutive negative-growth quarters to start 2022. Gross domestic product is on track to increase at a 2.5% annualized pace in the fourth quarter, according to the Atlanta Fed's GDPNow real-time tracker of economic data.

Consumers have been resilient as well. Holiday spending likely hit a record this year, rising 5% to $222.1 billion, according to projections by Adobe Analytics.

Don't miss these stories from CNBC PRO:

These stocks will be the biggest S&P 500 winners of 2024, according to analystsHere's where to invest $50,000 in the new year, according to the prosCould a bitcoin ETF approval be a sell-the-news event? Here's what to expect if it happensThese stocks will be the biggest Dow winners of 2024, according to analystsOprah's flip on weight loss drugs is a sign of what's to come for the 'Ozempic trade' in 2024

Kass

Kass