Wells Fargo seeks to catch faster-growing rivals by boosting engagement with rich clients

CEO Charlie Scharf has highlighted wealth management as one source of growth for the company, along with credit cards and investment banking.

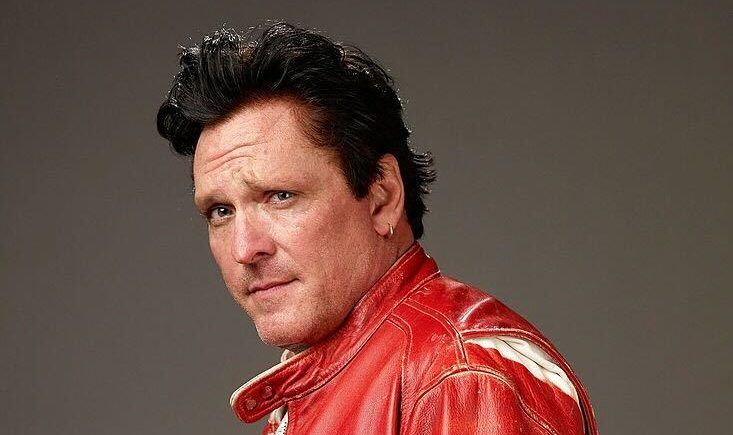

Pedestrians pass a Wells Fargo bank branch in New York, U.S., on Thursday, Jan. 13, 2022.

Victor J. Blue | Bloomberg | Getty Images

Wells Fargo is unveiling a new platform to boost digital engagement with its 2.6 million wealth management clients, CNBC has learned.

The service, called LifeSync, lets users create and track progress on financial goals, ingest content tied to their plans, and contact their advisors, according to Michael Liersch, head of advice and planning at the bank's wealth division. It will be delivered through a mobile app update in late March, he said.

"These are the things that will really enhance the client-advisor experience, and they're not available on the mobile app today," Liersch said. "This is a really big platform enhancement for clients and advisors to collaborate around their goals and connect what clients want to accomplish with what our advisors are doing."

Banks are jockeying to provide their customers with personalized experiences via digital channels, and this tool should enable Wells Fargo to boost satisfaction and loyalty. CEO Charlie Scharf has highlighted wealth management as one source of growth for the company, along with credit cards and investment banking, amid his efforts to overhaul the bank and appease regulators.

Wells Fargo is a major player in American wealth management, with $1.9 trillion in client assets and 12,027 financial advisors as of December.

But its client assets haven't grown since the end of 2019, when they also stood at $1.9 trillion. Under Scharf's streamlining efforts, Wells Fargo sold its asset management business and dropped international wealth clients in 2021.

The trajectory of the asset figure "primarily is a reflection of the volatility seen over the last few years," according to a bank spokesperson.

During that stretch, its competitors — sometimes referred to as wirehouses — grew by leaps and bounds, thanks to acquisitions, organic growth and new technology. Morgan Stanley saw client assets surge from $2.7 trillion to $4.2 trillion. Bank of America saw balances in its wealth division climb from about $3 trillion to $3.4 trillion.

With its new offering, Wells Fargo hopes to turn the tide. The bank may eventually opt to offer a financial planning tool to its broader banking population, said Liersch. That would follow the move that Bank of America made in 2019, when it unveiled a digital planning tool called Life Plan.

"We wanted to solve for that more complex experience first, and then develop the client-directed capability which is absolutely in our consideration set," Liersch said.

UsenB

UsenB

![Are You Still Optimizing for Rankings? AI Search May Not Care. [Webinar] via @sejournal, @hethr_campbell](https://www.searchenginejournal.com/wp-content/uploads/2025/06/1-1-307.png)