2023 recap: A look back at 10 headlines that made waves in S’pore’s tech and business landscape

Amidst a tumultuous economic backdrop, Singapore's tech and business landscape has navigated choppy waters over the past year.

Amidst the backdrop of a global cost-of-living crisis, an expanding war in the Middle East and increasing concerns of a possible recession, Singapore’s tech and business landscape has navigated choppy waters over the past year.

Some suffered, some persevered, while some have even thrived in the face of adversity. Here are some notable headlines that have made waves in the tech and business landscape in 2023:

1) Creative Technology CEO passes away at 67

Image Credit: Creative Technology

Image Credit: Creative TechnologySim Wong Hoo was widely known as the founder, chairman, and CEO of Creative Technology, a Singapore-based company known for its innovative and high-quality audio products.

Unfortunately, he passed away in January at the age of 67, leaving behind a legacy as a successful businessman and innovative thinker.

Sim started his career in 1981 by opening a small computer repair shop in Chinatown with his childhood friend Ng Kai Wa. Back then, the duo’s first project was a multilingual computer with sound and music capabilities, but it was not successful due to a lack of demand and third-party support.

In 1988, Sim established an office in the United States and began selling the standalone Sound Blaster sound card, which quickly gained popularity in the gaming industry and led to the success of Creative Technology.

Four years later in 1992, the company became the first Singaporean company to be listed on the US Nasdaq stock exchange, and by 2000, Sim was named Singapore’s youngest billionaire at the age of 45.

Under Sim’s leadership, Creative Technology grew into a global brand, with a reputation for producing some of the best audio products on the market. One of the company’s most notable products is the Sound Blaster, a line of sound cards that revolutionised personal computer audio and helped establish Creative Technology as a leader in the field.

Today, Creative has global offices in Shanghai, Tokyo, Dublin, and Silicon Valley, and last year, it raked in sales of US$61 million.

2) Honestbee owes S$319.9 million to former staff, vendors, creditors

Image Credit: Honestbee

Image Credit: HonestbeeFounded in 2015 by three Singaporean entrepreneurs — Joel Sng, Isaac Tay, and Jonathan Low — honestbee quickly gained momentum as an e-grocer. The company experienced remarkable success within months of its operation, successfully establishing a presence in eight countries across Asia by the end of 2018.

But as swiftly as it achieved success, its downfall was equally rapid – in 2019, the company faced a financial crisis due to poor capital management by its co-founder and CEO at the time, Joel Sng.

As the company grappled to maintain its stability, Joel was ultimately ousted from his position, with Ong Lay Ann assuming the role of CEO. Although Ong embarked on a series of strategic measures to reorganise the company, these attempts proved futile as the company was ultimately placed under liquidation in July 2020.

In May this year, the failed grocery delivery startup was reported to have had no funds available to settle outstanding debts to former staff, vendors, and other unsecured creditors, amounting to S$319.9 million. BDO, the appointed liquidator for honestbee, was only able to recover S$720 from excess payments related to “electrical supplies.”

The company’s sole secured creditor, Formation Group, has only managed to recover S$700,000 from honestbee’s assets, a far cry from the US$4 million worth of debentures held by the venture capital.

3) Circles.Life executes layoffs amidst allegations of toxic management

Image Credit: Circles.Life via Facebook

Image Credit: Circles.Life via FacebookSingapore’s thriving tech industry, once hailed as a beacon of growth and innovation, has been hit hard by the tech winter.

This downturn in the tech sector has forced several prominent companies, including digital telco Circles.Life, to implement significant layoffs earlier in June.

While the exact number of employees affected by the recent layoffs remains unverified, it is estimated to be around 20 to 30 employees. This comes after an earlier round of layoffs in May, which reportedly impacted at least 50 employees.

Circles.Life, which currently has nearly 1,000 employees according to LinkedIn, saw various departments affected, including Marketing, P&C, Engineering, Product, and the entire B2B Circles X team.

Affected employees were apparently provided with the standard severance package – a two-month notice period and gardening leave – depending on their duration of employment.

According to some of the digital telco’s employees, the most recent layoffs were handled in a similar manner to a previous round of layoffs in 2020. Employees were informed through individual meetings dubbed “quick sync” with their line managers, while some received physical letters or emails on the day itself.

However, the layoffs were not communicated to the wider company.

In response to Vulcan Post’s inquiries about the layoff, a spokesperson from Circles.Life refuted the claims, dismissed the remarks from the affected employees as “untrue”. However, the ex-employees showed their “agreement of separation and release” from the company to Vulcan Post, contradicting the spokesperson’s statement.

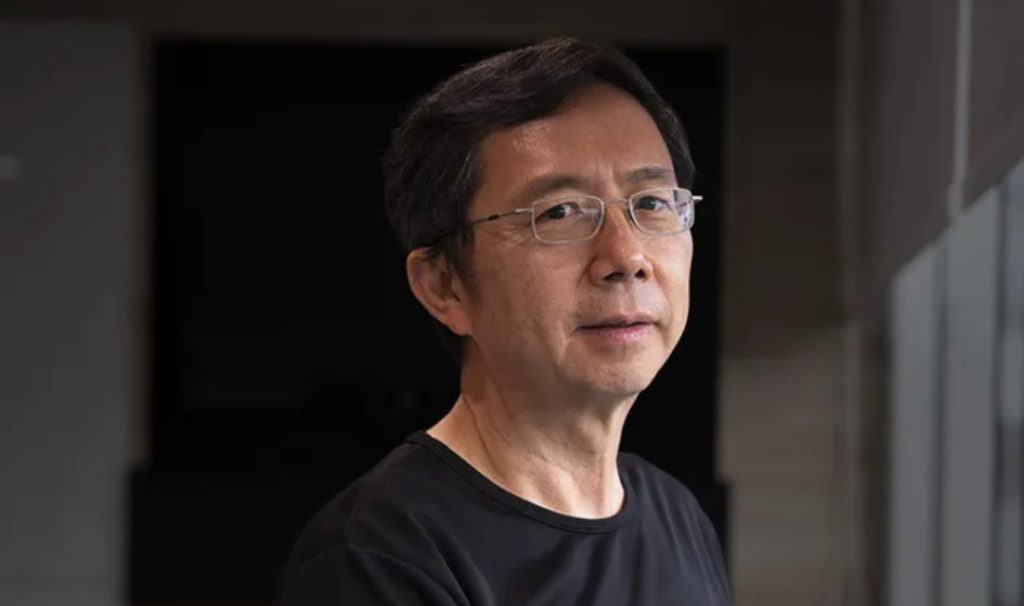

4) 3AC senior executives get nine-year ban from MAS

Image Credit: T. Schneider / Shutterstock

Image Credit: T. Schneider / ShutterstockIn June 2022, Singapore-based cryptocurrency hedge fund Three Arrows Capital failed to pay its debts, so it had to undergo liquidation.

Later in January 2023, the founders of Three Arrows Capital resurfaced, seeking US$25 million to fund its new venture called GTX.

Three months ago, Three Arrows Capital returned to the hot seat again as the Monetary Authority of Singapore (MAS) imposed nine-year prohibition orders (POs) against its former senior executives Zhu Su and Kyle Livingston Davies, for multiple violations of the Securities and Futures Act 2001 (SFA) and Securities and Futures (Licensing and Conduct of Business) Regulations (SFR).

The POs, which came into effect on September 13, 2023, bar Zhu and Davies from engaging in any regulated activity and prohibit them from participating in the management, directorship, or substantial shareholding of any capital market services firm governed by the SFA.

The stern action by MAS comes as a result of a series of regulatory breaches committed by Three Arrows Capital and its top management.

After reprimanding the firm back in June 2022 for several infractions, including providing false information to MAS, further inquiries by MAS revealed additional violations of the SFA and SFR committed by Three Arrows Capital between August 2020 and January 2022.

5) Grab co-founder Tan Hooi Ling to step down from operating roles by end-2023

Image Credit: Grab

Image Credit: GrabOn May 25, Southeast Asian ride-hailing and delivery giant Grab announced that co-founder Tan Hoo Ling has informed its board of directors of her intention to step down from her operating roles at Grab, including her directorship, by the end of this year. Moving forward, Tan would be transitioning into an advisory role with Grab.

Tan co-founded Grab with Anthony Tan, Group CEO, in 2012 and worked at other companies in the US before rejoining Grab in April 2015. The company was also known as MyTeksi back then, starting out as a mobile app that connected passengers with licensed taxis in Malaysia.

MyTeksi soon expanded to other countries in the region as GrabTaxi, including Singapore, Thailand, and the Philippines, where the taxi market was highly fragmented and unregulated. Tan played a crucial role in establishing the company’s operations in these countries, leveraging her consulting background to navigate complex regulatory and logistical challenges.

The company later rebranded to Grab in 2016 to reflect its expansion beyond just ride-hailing to a super app platform that also offers food delivery, digital payments, and other services.

Up until January 2022, Tan led various operations and technology teams as the company’s Chief Operating Officer (COO). Currently, she leads its technology organisation, and is mentoring the next-generation of technology leaders. Tan has also served as a member of Grab’s Board of Directors since its public listing in December 2021.

6) Grab’s potential acquisition of foodpanda

Image Credit: Tzido / depositphotos

Image Credit: Tzido / depositphotosIn September, Delivery Hero, the German-based parent of food delivery service foodpanda, reportedly confirmed preliminary talks to offload its Asian operations to a prospective buyer.

The final price of the acquisition might reach over €1 billion (about S$1.5 billion), and would include foodpanda’s branches in Singapore, Cambodia, Malaysia, Myanmar, Philippines, Thailand, and Laos.

Singapore-headquartered Grab has been floated as a potential buyer of foodpanda’s operations in Southeast Asia. The company, however, has yet to confirm the reports and no official statement has been released.

The purchase of foodpanda would position Grab aa a virtual monopolist in Southeast Asian food deliveries, where it already commands 50 per cent of the market (or more), challenged only by foodpanda, which holds around 30 to 40 per cent, depending on the country.

Prior to reports of the potential buyout, Grab announced its acquisition of Singapore’s third-largest taxi operator Trans-cab back in July.

The purchase, which will also strengthen Grab’s position in the ride-hailing industry, was estimated to be around S$100 million and includes Trans-cab’s fleet of more than 2,500 taxis and private-hire vehicles, maintenance workshop, and fuel pump operations.

7) Flash Coffee winds up Singapore business

Image Credit: Christopher Lim via Google reviews

Image Credit: Christopher Lim via Google reviewsJust two months ago, homegrown coffee chain Flash Coffee shuttered all its 11 outlets in Singapore. According to media reports, the founder and CEO of the company, David Brunier, alongside director Sebastian Hannecker, filed for a voluntary winding-up due to its liabilities on October 11.

Flash Coffee’s Singapore business owes over S$14 million to over 150 creditors, including employees who are owed up to two months’ salaries and CPF contributions.

At its peak, the company was opening up to three new outlets per week and managed close to 250 stores and 1,400 employees across various markets in Asia. The coffee chain also successfully closed a US$50 million Series B funding round in May following a round of layoffs last November.

However, the company has actually struggled to fundraise for some time, with its latest US$50 million funding round representing an accumulated series of capital injections since the start of 2022.

While it has achieved breakeven profitability across several markets during the COVID-19 lockdowns, the company saw this reverse after the lockdown restrictions were lifted.

Meanwhile, the coffee chain’s business in Thailand was acquired by venture capitalist (VC) Turn Capital for an undisclosed sum last month. The VC firm plans to expand the coffee firm’s presence across the country by opening more than 100 new stores in the next two years, bringing the total number of outlets in the country to over 200.

8) Musk’s takeover of Twitter and rebrand to X

Image Credit: Twitter/ Getty

Image Credit: Twitter/ GettyIn April of 2022, Elon Musk made his first bid to take Twitter over for US$44 billion, which valued the company roughly 38 per cent above its stock price at the time. About 10 days later, Twitter accepted the offer.

In the following months, a lengthy legal battle ensued as Musk sought to put the deal on hold until July, when he ultimately withdrew his offer. However, by October 2022, the billionaire finally closed the deal to buy the social media service.

On his first day, Musk begun clearing house, firing Twitters CEO, CFO, general counsel and head of Legal, Trust, and Safety. By January 2023, the company was left with just 2,300 employees, a far cry from the 7,400 people the company had employed prior to his takeover.

Alongside the layoffs, Musk has also made a series of changes to Twitter’s platform, including the introduction of new features for its paid subscription users (otherwise known as Twitter Blue users) such as Tweet limits of up to 25,000 characters.

In July, Musk rebranded the social media app to “X”, replacing the app’s iconic blue bird logo with a new logo, which features a white X against a black background.

With the rebranding, Musk aims to create a “super app” that can compete with the likes of WeChat, extending its functions beyond a mere social media app.

9) WeWork files for bankruptcy

Image Credit: The New Yorker

Image Credit: The New YorkerGlobal coworking company WeWork filed for a Chapter 11 bankruptcy in New Jersey federal court on November 7 as the company grappled with hefty losses and a massive debt pile. In an initial filing, the company reported debts of US$18.65 billion against total assets of US$15.06 billion.

The SoftBank Group-backed company, which once valued at US$47 billion, has been in turmoil since its plans to go public in 2019 imploded following investors’ scepticism over its business model of taking long-term leases and renting them for the short term and worries over its hefty losses.

While WeWork finally managed to go public in 2021 at a much-reduced valuation, it has continued to lose money despite its major backer sinking tens of billions to support the company. Four months earlier, the company announced in its second quarter earnings release that it had “substantial debt” about its ability to continue its operations over the next year.

The company has also seen the departure of numerous top executives this year, including CEO Sandeep Mathrani.

However, WeWork assured that it’s “business as usual” in Singapore as the bankruptcy filing is limited to WeWork’s locations in the United States and Canada.

WeWork first entered into the Singapore market through their acquisition of homegrown coworking company Spacemob in 2017. The company currently operates 14 locations across Singapore, serving clients ranging from government agencies to MNCs and start-ups.

10) Richard Teng replaces CZ as Binance CEO

Image Credit: ADGM

Image Credit: ADGMWhile Binance remains the biggest player in the crypto industry worldwide, like most crypto companies, it hasn’t had a particularly good year following the deflation of the crypto bubble and collapse of one of its main competitors, FTX, in November last year.

In addition to the bear market, the crypto company has also found itself embroiled in a legal saga with US authorities, with the US Securities and Exchange Commission (SEC) — the federal agency tasked with protecting investors and maintaining the integrity of the securities market — filing a lawsuit against Binance and its CEO Changpeng Zhao (CZ), as well as several other entities within the platform’s corporate conglomerate.

The legal saga came to an end earlier in November as the company has reportedly agreed to pay a massive US$4.3 billion settlement fine. Its CEO had also stepped down and is expected to pay an additional criminal fine of US$150 million.

CZ’s replacement is Richard Teng, a Singaporean who joined the company in 2021 as the CEO of its Singapore business before moving up to become the global Head of Regional Markets.

Richard first started his career at the Monetary Authority of Singapore, and after a successful 13-year stint, during which he ascended to the role of Director of Corporate Finance, he transferred to the Singapore Exchange as Chief Regulatory Officer between 2007 and 2015.

After leaving Singapore and immediately before joining Binance six years later, he served as the CEO of the Abu Dhabi Global Market financial centre, which, during his tenure, began attracting crypto companies seeking to operate out of the UAE.

ANEXT Bank, a Singapore-based digital bank regulated by MAS, empowers startups with easy and accessible financing to fuel their business growth and expansion.

Featured Image Credit: Ivan The – Running Man/ Creative Technology/ Roslan Rahman via AFP/ X/ Alamy/ Doc.Investx

Also Read: Tech layoffs to digibanks: 10 headlining events in S’pore’s tech and business scene for 2022

FrankLin

FrankLin