6 Advantages of Hyperbolic Discounting

You may not know what hyperbolic discounting is, but it has vast ramifications on society as a whole. Additionally, a lot of people do not use the power of hyperbolic discounting in conversion optimization. What Is Hyperbolic Discounting? Put...

You may not know what hyperbolic discounting is, but it has vast ramifications on society as a whole. Additionally, a lot of people do not use the power of hyperbolic discounting in conversion optimization.

What Is Hyperbolic Discounting?

Put simply, hyperbolic discounting happens when people would rather receive $5 right now than $10 later. That’s it. People value the immediacy of time over the higher value of money.

Expressed another way, hyperbolic discounting is a person’s desire for an immediate reward rather than a higher-value, delayed reward.

You may be confused why someone would not choose the delayed reward if it means a greater benefit.

Here’s the thing: hyperbolic discounting is a cognitive bias, meaning that it is an ingrained mental snafu that defies logic and common sense. When hyperbolic discounting is framed differently, it has incredible power.

The power of hyperbolic discounting adjusts based on the time involved. If you have to wait to receive both rewards you become more likely to want the reward with the greatest benefit.

For example, if you had to choose between $50 now or $100 in 6 months, you’re most likely going to take the $50 today. However, if you are offered $50 in nine years or $100 in a year, you are more likely to choose the $100.

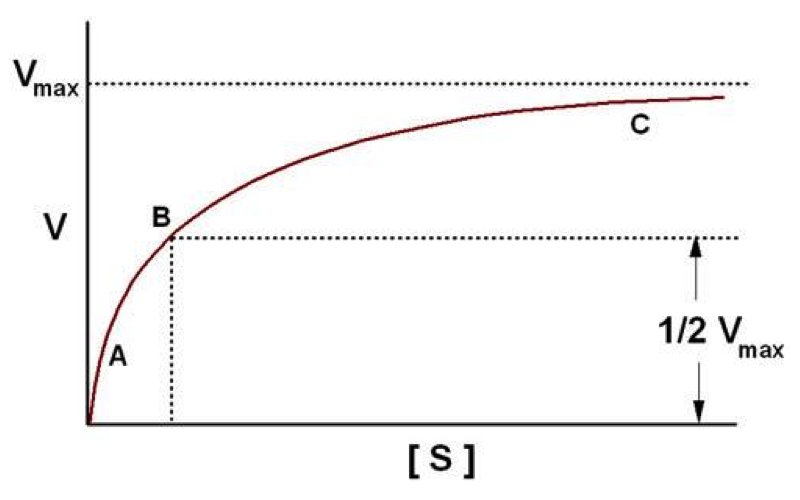

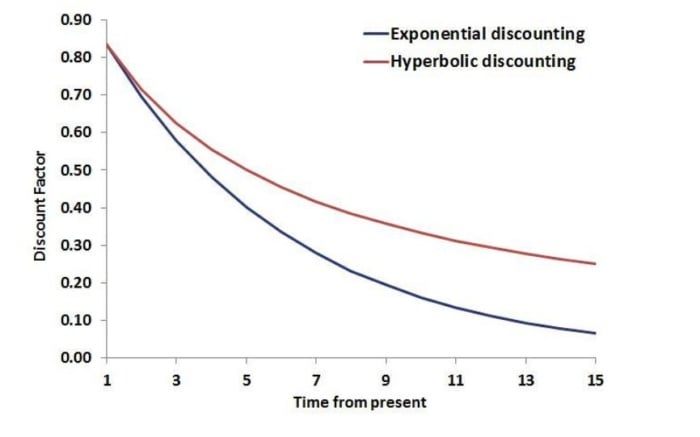

The pattern follows a hyperbola. Once a certain amount of time has passed, people begin to choose the option with the greater value again. For example, most will opt to take $100 in ten years over $50 in nine years.

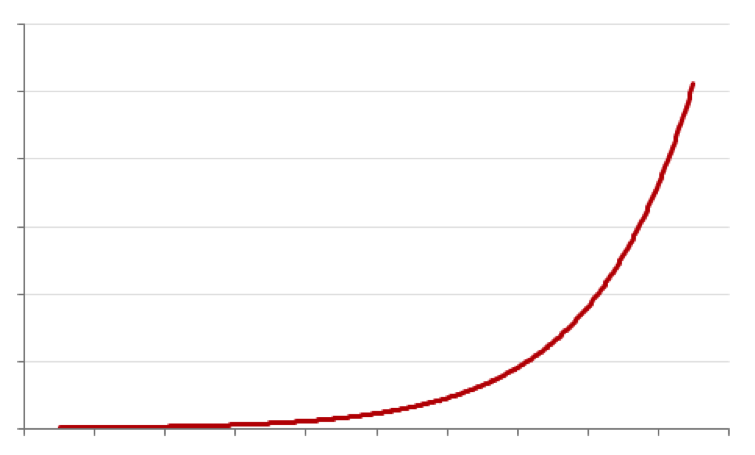

That’s where the hyperbola part of hyperbolic discounting comes in. A hyperbolic curve displays the effect of hyperbolic discounting, in contrast to an exponential curve.

This is an exponential curve:

This is a hyperbolic curve:

Hyperbolically, the discount factor diminishes based on the amount of time that elapses.

How Hyperbolic Discounting Works in the Brain

Hyperbolic discounting isn’t some nifty gimmick that sometimes works and sometimes doesn’t. Our brains are programmed to be drawn to the tug of hyperbolic discounting.

Although we can’t avoid the feelings that pop up as a result of hyperbolic discounting, we can combat it by recognizing when it’s happening and understanding how to proceed.

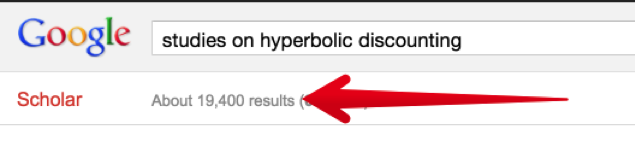

A spate of scholarly studies have confirmed the validity of hyperbolic discounting.

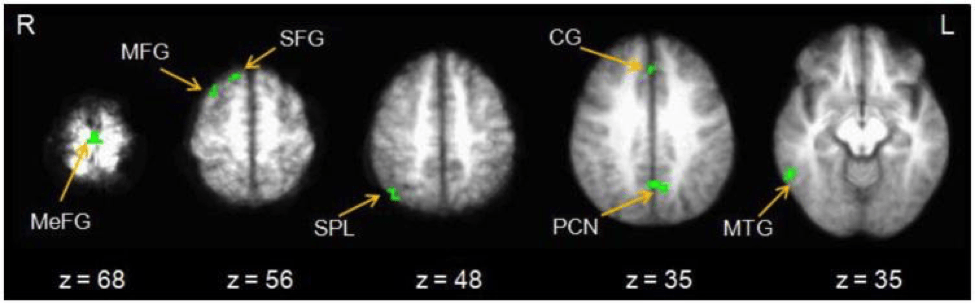

Research published in the Journal of Neuroscience discovered the brain makes discounting judgments reflexively and automatically.

We aren’t thinking through whether we want more now or less later. We inherently want to get the benefit as quickly as possible. This desire for immediate reward diminishes as time goes on.

Hyperbolic Discounting Origins

Some scientists explain hyperbolic discounting through an evolutionary approach. If your ancestors found food, they would kill it and eat it right away. They wouldn’t let the scrawny antelope pass to possibly get a fatter one later. They would get the scrawny one now. One little antelope meal now is better than two fat ones in a month. By that time, the hunter-gatherer would die.

Imagine a dehydrated person traveling through the desert. Ahead, they see a small glass of water. If they deny the sip of water and keep going just a little longer, they will receive one hundred water bottles. What do they do?

According to hyperbolic discounting theory, they’d choose to sustain life by having a little bit of water now rather than a lot of water later.

The Power of Now in Hyperbolic Discounting

Copywriters, psychologists, and moms understand the hyperbolic discounting phenomenon all too well. We want what we want, and we want it now.

In the famous marshmallow experiment, Stanford psychologists led a child into a room and offered the child a single marshmallow. The treat was sitting there on a table right in front of them. If the child could wait fifteen minutes without eating the marshmallow, they would receive a second marshmallow.

Although most children were able to keep their appetite in check, the study highlighted an issue known as delayed gratification.

Delayed gratification is the behavioral opposite of hyperbolic discounting. Delayed gratification means “making a choice which limits the ability of getting something now, for the pleasure of being able to have something bigger or better later.”

It’s a concept that goes against hyperbolic discounting and the ingrained ideals of culture — the whole “we want it now” idea.

Our brains are wired for now. Neuroscientists have discovered that our brains light up like a Fourth of July night when we get stimulated by the power of something right now.

What Are The Effects of Hyperbolic Discounting?

Apart from sales gimmicks and advertisements, hyperbolic discounting can have devastating effects elsewhere in life.

For example, each year, hundreds of thousands of people receive coronary-artery bypass graft surgery. The surgery saves their lives. However, it only saves their lives for the long term if they apply the correct lifestyle changes.

Recommended changes include no smoking, more activity, a healthier diet, and faithfully taking medications. Tragically, however, “Ninety percent of those patients decide to forego survival and comfort in favor of the short-term pleasures of unhealthy foods and laziness” (source).

Let’s examine another massive example of hyperbolic discounting. It’s not as morbid, but it’s equally devastating: credit cards.

Credit cards push hyperbolic discounting to the max. A credit card user can have something of value now, or they can wait until they can afford the item, thereby saving them the money they would be paying in massive interest rates.

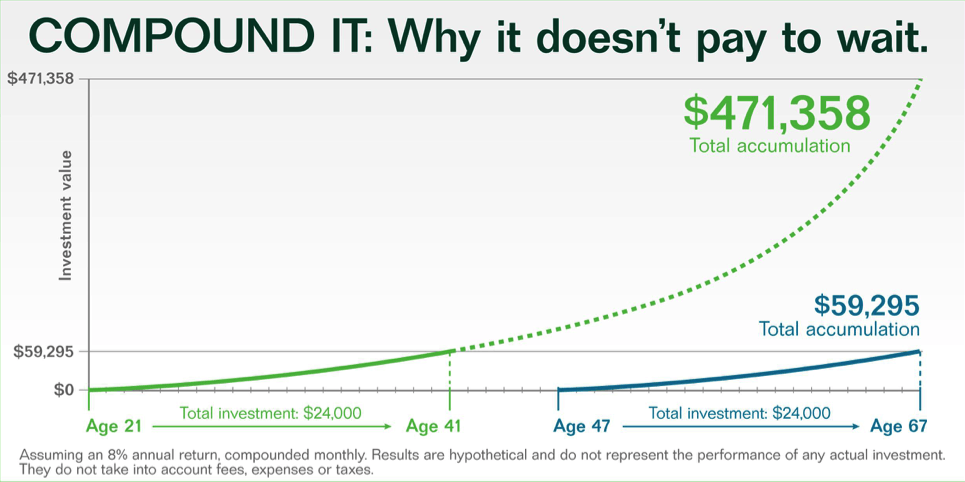

Here’s another example. Many people save for retirement because there’s no immediate reward for saving for the future.

If you could go out to eat at a nice restaurant for $200 tonight, why put that money in some retirement fund to enjoy when your 72?!

Waiting to invest in retirement has its own hyperbolic curve, and it’s not very pretty.

Hyperbolic discounting is dreadfully powerful. It’s hard for people to deny themselves now in order to enjoy a reward later. I would never advise any marketer to exploit the hyperbolic discounting principle in harmful ways.

I’ve used the above examples to show the incredible power of hyperbolic discounting, but I also want to use them as a warning. On a macroeconomic scale, hyperbolic discounting can have devastating results.

On a smaller scale — conversion optimization, ecommerce, etc. — the results are innocuous, beneficial, and appropriate.

Put Hyperbolic Discounting to Work

Are you ready to leverage the power of hyperbolic discounting? Here’s how it’s done:

1. Raise Your Price. Wait For The Reward.

Hyperbolic discounting gives you license to raise your price as long as you delay payment.

When you offer to postpone payment for your goods or services, the items’ price becomes less relevant to the buyer.

This is because as soon as they realize they don’t have to pay right away, the customer doesn’t think about paying. Instead, the power of hyperbolic discounting and the reward of getting the product immediately dominates your customers’ thinking.

Instead of thinking, “Wow! That’s expensive!” the buyer is thinking “Wow! I can have it now!” Based on the hyperbolic discounting principle, the wow-I-can-have-it-now thought is going to win out.

As soon as the price consideration is removed, the buyer is ready to make their purchase, even if it costs them a lot of money (someday). You’re ready to profit.

2. Buy Now. Pay Later.

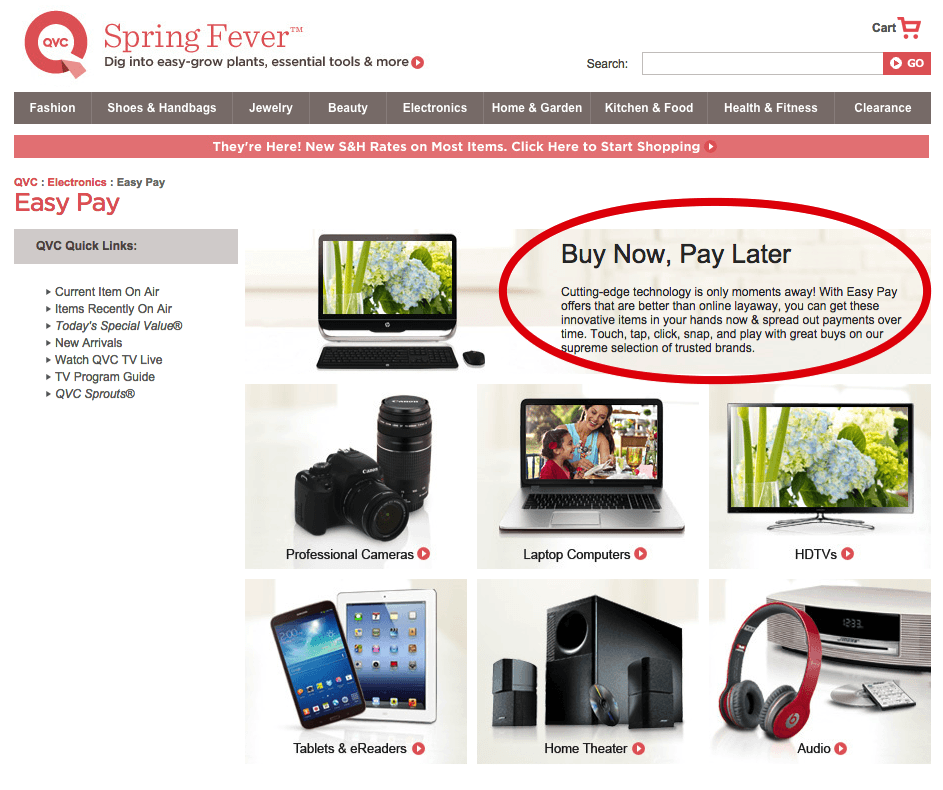

This is one of the most common forms of hyperbolic discounting in marketing. You may know it better as the “Buy now! Pay later!” technique.

QVC.com uses this approach. Their website is packed with hyperbolic discounting. If you want to exercise your delayed gratification muscles, go check them out.

PayPal’s infamous PayPal Credit (previously “Bill Me Later”) was also built on the whole psychological principle of hyperbolic discounting.

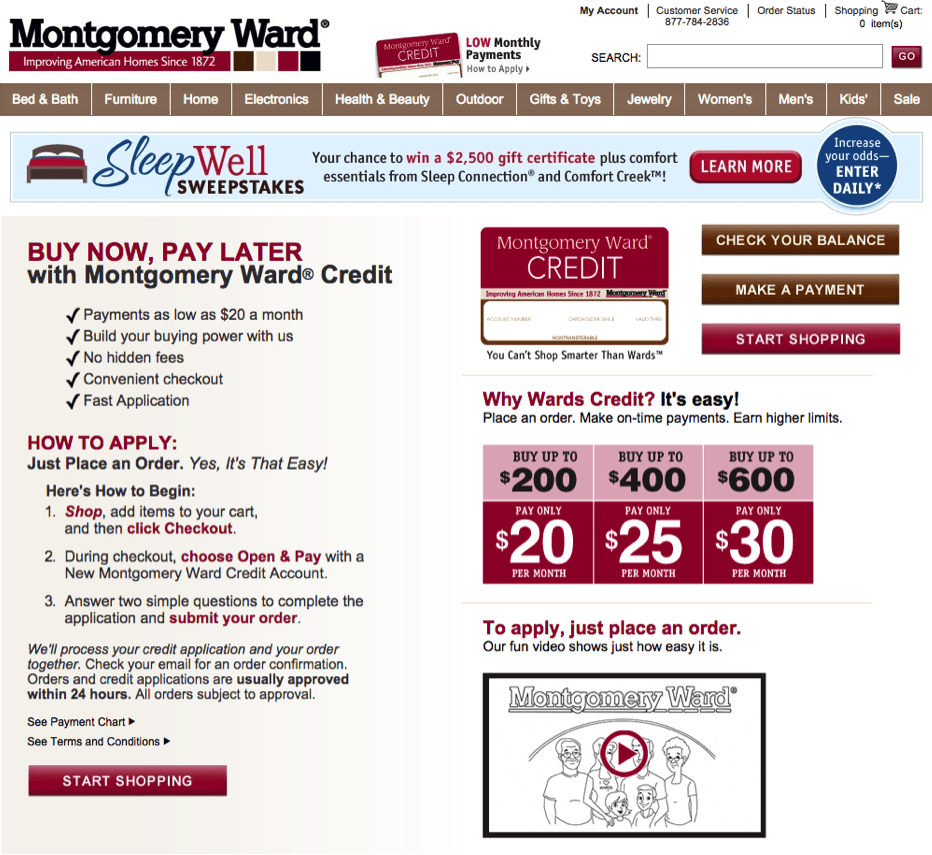

Montgomery Ward does it, too.

Lurking behind the principle of hyperbolic discounting is the fact that you’re applying for a credit card. Remember what I told you about credit cards? They are built on the power of hyperbolic discounting.

You don’t have to offer credit cards in order to use the hyperbolic discounting technique. You can simply delay payment, allowing the user to make a purchase and wait to pay. It’s risky for you, but it could improve sales.

3. Give an Immediate Gift.

With hyperbolic discounting, timing is everything. That’s why some people refer to it as temporal discounting.

The time element is the most important factor for buyers. Rather than wait for any length of time for a reward, they prefer benefits that are available immediately.

In many cases, a simple and inexpensive gift will suffice. Sometimes, users will convert based on the promise of an immediate result, even if the full product is not available until later.

EA Access gives gamers the ability to join a program where the big results aren’t available until later. Gamers are likely to convert, however, because they get immediate access to the parts of the game.

4. Charge a Higher pPrice for a Shorter Term.

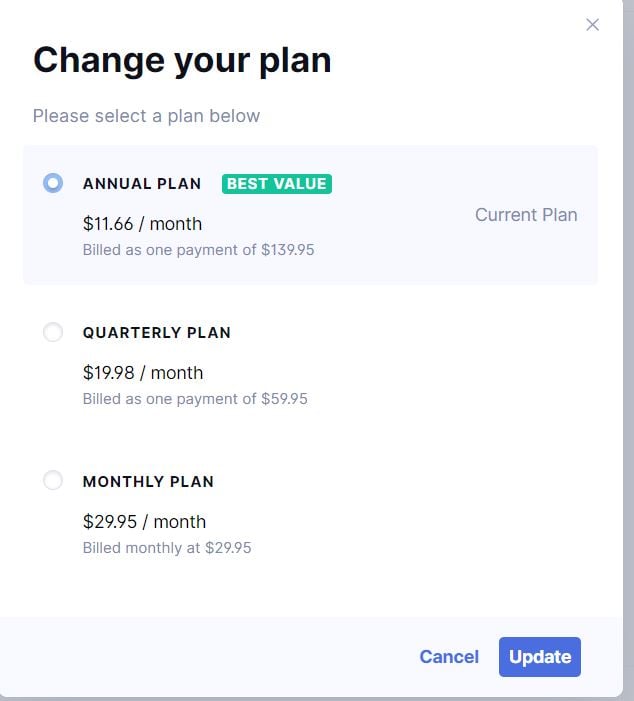

Have you ever noticed that some websites offer payment plans that don’t make financial sense?

Here’s the type of thing they offer:

Buy 1 month: $9.99Buy 1 year: $39.99Most people can do the math. They know that there are twelve months in a year. If one year costs $39.99, then one month at the yearly rate is only $3.33. Why would anyone pay $9.99 for one month?

Hyperbolic discounting, that’s why. The user wants to pay less now. They don’t want to pay more, even if it results in a discount over the long term. They consider the issue from a hyperbolic discounting perspective, not a true value perspective.

Here’s an example:

Grammarly uses this on their pricing page. Users can pay $29.95 each month, or $11.66 per month. Obviously, you would choose to pay the $11.66.

However, you have to keep the framing effect in mind. How the price is framed heavily influences how the price is perceived. Thus, when presented with a lump sum payment of $139.95, users are tentative. They would rather save money now than save money over the long term.

As a conversion optimizer, you can use this technique to your advantage. Users get to choose their payment method. You’re getting more value per order from the short-term pricing option because buyers are heavily influenced by hyperbolic discounting.

5. Pay For Referrals Right Away.

Online affiliate programs are very popular, but not very strategic. Here’s how they work:

If customers refer friends, then they get money when the friends sign up. Here’s a screengrab from Payoneer:

This is a nice feature, but who wants to wait for their friends to sign up? Even though the payout could be big, the delay is insufferable. Remember, people want the reward now.

A more strategic approach of hyperbolic discounting is to pay people for the referral, rather than making them wait for their friends to actually sign up.

If you offer, say, ten cents for every referred friend, then you can give the referring friend $10 to refer 100 friends. This approach could get you a lot more potential leads.

If you stick with the old pay-when-they-sign-up model, you may have to pay $10 for only a single referral. With the pay-now model, you can compel the referring friend to make 100 times as many referrals.

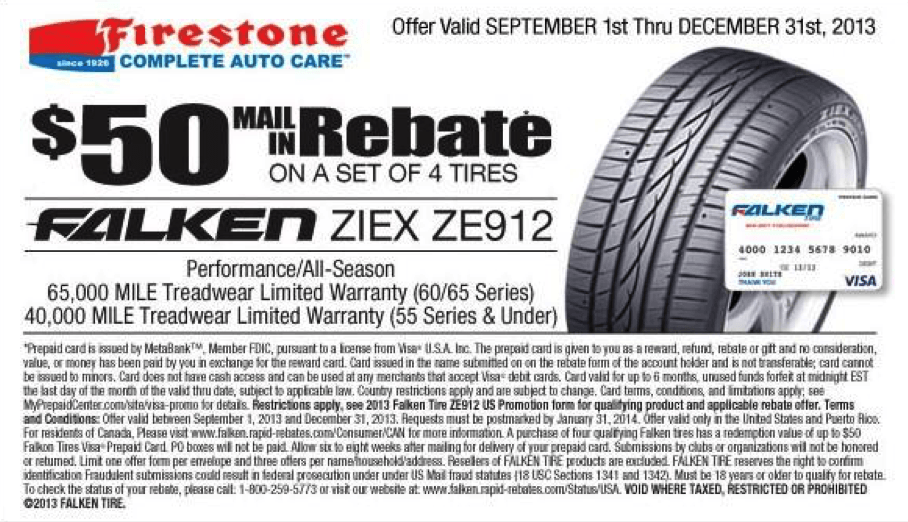

6. Offer Mail-in Rebates

Why do some retailers offer mail-in rebates? The idea is that if you cut a coupon, scan your receipt, and mail them or upload them to a website, you might get a check in the mail in 20-40 weeks.

Who even has time for that? Do retailers really think that they’re doing you a favor? Of course not. They’re using hyperbolic discounting.

Mail in rebates work for only a select few customers: the disciplined ones who never lose anything and save their receipts. In other words, not many people.

People are likely to buy the product now, thinking that they might get a discount in the future. More likely than not, that mail in rebate form will languish in a stack of papers until it expires. The retailer doesn’t have to pay anything.

Conclusion

If you want better conversion rates and smart marketing power, then this article was written with you in mind.

Are you ready to harness the power of hyperbolic discounting in your marketing strategies? Let’s talk!

About the Author: Jeremy Smith is a conversion consultant and trainer, helping businesses like Dow Chemical, American Express, Panera Bread, and Wendy’s improve conversions and strategically grow their testing culture and digital presence. Jeremy’s experience as the CMO and CEO of technology firms has given him a powerful understanding of human behavior and profit-boosting techniques. Follow him on Twitter.

AbJimroe

AbJimroe