6 Social Advertising Tips For Financial Brands via @sejournal, @atuljindal01

Perfect your social advertising campaigns for a far-reaching and powerful marketing impact. The post 6 Social Advertising Tips For Financial Brands appeared first on Search Engine Journal.

More than 50% of offline investors first collect information online before making an investment decision.

And according to research from RRD, more than half of consumers have discovered a new brand, product, or service in the past year via both word of mouth and social media.

These statistics show how social media can be a literal goldmine for financial services brands looking to attract customers and foster sustainable growth.

But only if they manage to use it well.

Financial services marketing is often restricted in its capacity, partly due to traditional advertising approaches, but mainly due to the strict regulatory compliances it has to adhere to.

Social media advertising helps finance brands stay on top of their prospects’ minds and win customers while staying within their regulatory bounds.

In this article, you will find six tips to perfect your social advertising campaigns for a far-reaching and powerful marketing impact.

Financial Services Marketing – A Challenge Of Its Own

Marketing financial services is not as easy as marketing a makeup product or an apparel brand.

These conventional products have an inherent charm and appeal that most financial products lack. The products that financial brands hope to sell are inherently dull – that is why convincing people to buy them can be a challenge.

Another reason financial services marketing is trickier than other industries is that the finance industry is jargon-heavy.

Finance professionals use highly technical terms, and their processes are also filled with industry jargon.

It can be challenging for marketers and advertisers to break the jargon into a language that a typical social media user with an attention span smaller than that of a goldfish can understand. No offense to social media users. We are all in the same boat!

Moreover, many regulatory and compliance formalities restrain the financial services marketing industry.

You cannot take even a step in a particular direction without looking back at your legal advisor to see if they are giving a green or a red signal. These restrictions stifle advertisers’ creativity and hold them back from competing on a playing field that is similar to that of other brands.

Additionally, people buy value. They invest in things that they believe will add value to their lives.

This is why it is easier to convince people to buy a waterproof watch – all they have to do is take a shower wearing the watch to know it’s worth their money.

Most financial services are unlike the waterproof watch.

They generate results in the long run, or sometimes, they don’t generate any tangible results at all.

This presents another challenge for financial advertisers to convince their customers to buy their products.

Financial marketing incumbents’ reluctance to marketing automation appears to be yet another challenge for marketers and advertisers. They can only do so much with legacy strategies and traditional marketing methods.

And finally, a large part of ecommerce, regardless of the industry, rests on trust – something the finance industry lost after the 2008 recession.

It’s been many years since that happened, but customers are still skeptical about trusting financial services.

This presents another hurdle in the way of financial services marketers as they go forth toward building their audience’s trust and getting their buying cycle turning.

Now that you know of all the hurdles in financial services marketing, let’s move forward and discuss some tips to get your advertising game going despite all these challenges.

Social Advertising Tips For Finance Brands

Fintech companies have disrupted the marketing and advertising scene for financial services brands.

It’s about time all finance brands gear up, adjust to the changes in the marketing arena, and devise strategies to help them deliver campaigns according to the modern customers’ changing demands.

Here are some practical tips to help you create a disruptive advertising strategy to bag some remarkable wins (and prospects) for your finance brand:

1. Engage Influencers

Influencer marketing was not taken seriously by many people when it was young. However, it has become a multi-billion dollar industry now, already reshaping how brands interact with their customers.

Financial services brands are often skeptical of influencer marketing since they believe most of their target audience comprises the older generation.

However, Gen Z accounts for over 40% of global consumers. And, interestingly, 34% of Gen Z are learning personal finance through TikTok and YouTube.

Screenshot from YouTube by Editorial Staff, November 2022

Screenshot from YouTube by Editorial Staff, November 2022

The best way to tap into this audience pool is through social media, mainly through influencer marketing.

Influencer marketing is especially crucial for finance brands dealing with tech-savvy and younger audiences because that’s who most influencers reach and… well, influence.

Always choose an influencer who understands the finance industry.

As stated above, the finance industry is heavy with technical processes and jargon. You should partner with an influencer who can help break down these terms for the general audience.

Make sure the influencers’ target audience aligns with your ideal customer persona, and don’t just create one-off campaigns. Remember, you need to build trust.

Financial services saw a 14% increase in trust factor in 2020, which is the highest figure the industry has seen in years.

Customers are just starting to trust financial institutions, and you want to reinforce this trust by hand-picking the right influencers and then sticking with them for long-running campaigns.

2. Perform In-Depth Audience Research

42% of financial service marketers state that reaching the right audience is one of their primary concerns.

The success of your advertising campaign relies on how accurate your audience persona is.

Your audience data will guide all the decisions you make down the road. Therefore, you must ensure your customer profile is built on precise and accurate data.

Even social media ad campaigns require you to insert your customers’ age, gender, and geographic information so your ads can be served to the right people.

Say your target audience is a 25-year-old freelance worker living in New Jersey. But your audience research is messed up, and you choose a 40-year-old corporate employee in New York as your chosen audience. In this case, even Facebook ads won’t do your brand much good.

Therefore, start by identifying your target audience’s age, gender, location, and other similar demographic information. You can tap into your social media handles and find out much of this information from there.

Also, try to learn about their interests and struggles, so you can craft messages that resonate with them.

You can do this by asking your customer directly through surveys.

Or, you can see who your competitors are targeting and how, and figure out key data points from there.

3. Choose Your Platform Wisely

If your target audience hangs out at Burger King, would you consider it appropriate to market at Pizza Hut? Of course not.

The same is true for social media advertising.

See, social advertising comes at a cost. So, you have to ensure your ad goes to the right people so your efforts can generate tangible value for your finance brand.

And for that, you have to find and pick a social platform where your target customers hang out the most.

If your target audience is a married millennial female, you may want to head to Pinterest. If, however, you want to reach Gen Z, you might be better off sticking to Snapchat, TikTok, and Instagram.

Apart from finding out which platform your target audience uses, it also determines the kind of content they consume on the platform. Are they using TikTok for how-to videos? Or are they using Instagram to discover brands?

Create the kind of content you know your audience consumes.

4. Perform Tests To Optimize Ad Performance

Have you ever cooked dinner for important guests? If you have, you know how important it is to taste-test the food before you serve it. The same is true for your ads.

Your ads have a fundamental goal: to create the right impact once it goes out to the audience.

To make sure they do that, you have to test them before launching.

The financial services sector makes up over 14% of online advertising spending. This shows how much financial brands spend on ads. You have to make sure every penny is worth it by testing your ads.

Ad testing involves creating different variants of the same ad and testing to see which one performs better. It gives you insights into which of your ad concepts are working and what needs to go.

For example, your ad graphic might be good, but the copy may not be too appealing to the audience. So, before running this ad on a larger scale, you would want to adjust the copy so it can make the right impact when it goes out to a bigger audience.

Make at least three variations of one ad, so you have enough data to guide your decisions. For granular insights, stick to changing just one element of the ad. If you alter more than one element, you may be confused when attributing the results to elements.

For example, if your ad variant generated a good number of clicks, but you had changed the headline copy and the background graphic, you wouldn’t know what led to the increase in click-through rate (CTR) – the change in copy or the graphic.

So, change just one element in each test.

Once your ads have run for a while, analyze the results of each ad variant and let these results guide your ad creative decisions.

5. Always Stick To Your Brand

Trust is a crucial factor in all industries. But it is ever so important in the finance industry.

61% of people are unlikely to use a finance brand that’s new to them.

You need to build your brand and then stick to it to make sure people can recognize your business from its branding elements.

Think of PayPal. Would you recognize PayPal from its trademark colors? Most likely, the answer is yes.

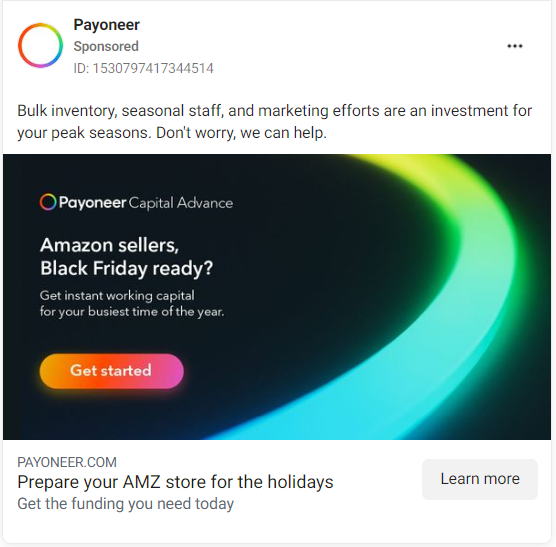

Have you seen how Payoneer sticks to its trademark color palette?

Screenshot from Facebook Ad Library by Editorial Staff, November 2022

Screenshot from Facebook Ad Library by Editorial Staff, November 2022

People trust brands, not businesses. Therefore, stick to your brand when creating and running social media ad campaigns. No one will recognize you if your ad creatives don’t align with your regular branding.

And it’s not just about recognition. Consistent representation of a brand can increase revenue by 33%. This shows how branding can also impact your bottom line.

So, identify your brand’s tone, color, and personality and stay consistent when creating your social media ads so you can stand out in a crowded atmosphere where customer attention is a limited resource.

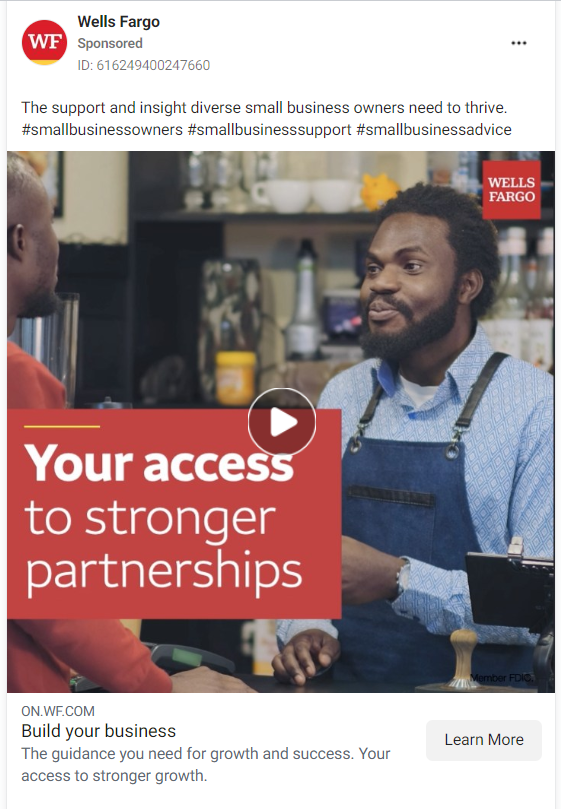

6. Prioritize Quality Visual Content

We have said it a couple of times already, but it won’t hurt to repeat it: Attention on social media is scarce.

People consume bite-sized content.

Screenshot from Facebook Ad Library by Editorial Staff, November 2022

Screenshot from Facebook Ad Library by Editorial Staff, November 2022

And no one has the time to go through boring blocks of text.

Processing visual content is faster and easier for our brains. So, when creating ads on social media, prioritize high-quality visual content.

Also, simply including visuals isn’t enough.

In some cases, your social media ad may only have 10 seconds to make the right impact. Therefore, create visuals that are appealing, easy to remember, and deliver your message quickly.

Screenshot from Facebook Ad Library by Editorial Staff, November 2022

Screenshot from Facebook Ad Library by Editorial Staff, November 2022

Conclusion

Social media ads are indispensable for financial brands looking to grow in the current marketing ecosystem.

Despite the obstacles in the way of financial services marketing, you will have to develop strategies that can take your brand to the right people, deliver the right message, and generate value for your brand.

The strategies discussed here can help you get started with contemporary advertising strategies and help you stay competitive in a fast-paced financial marketing environment.

However, before you implement all the strategies we discussed here, make a note of this: always practice transparency.

Trust is already a scarce commodity in financial services marketing, and you can’t afford to lose more of it.

Therefore, keep your offerings as transparent as possible, educate the audience, and speak to them in a language they understand through a medium they value.

More resources:

SEO For Financial Services Brands: Key Trends & Opportunities In Search 7 Content Marketing Tips For Financial Services Brands Content Marketing: The Ultimate Beginner’s Guide to What WorksFeatured Image: MK photograp55/Shutterstock

KickT

KickT