A Guide to Identifying and Avoiding Top Crypto Scams

The surge in popularity of Bitcoin and other cryptocurrencies has a dark underbelly. It is spurring the growth of a vast cybercrime industry rife with numerous scams. Cunning wrongdoers are preying on unsuspecting Internet users, hoping to trick them...

The surge in popularity of Bitcoin and other cryptocurrencies has a dark underbelly. It is spurring the growth of a vast cybercrime industry rife with numerous scams. Cunning wrongdoers are preying on unsuspecting Internet users, hoping to trick them into losing their Bitcoins. In this article, I will shed light on the most common cryptocurrency-related scams, providing tips on staying safe when using crypto.

Ponzi schemes

Some websites may entice you with irresistible crypto offers that seem too good to be true. They promise to multiply your Bitcoin holdings in a short span, like doubling them overnight. However, this is often a classic sign of a Ponzi scheme. Once you part with your Bitcoin, the chances of even recovering your original amount are slim to none.

Protection:

Be suspicious of any investment that promises guaranteed returns. Investments always come with risk, and anyone promising a sure profit is likely not being honest. Legitimate investments make money through a clear business model. If you cannot understand how an investment makes money, that is a red flag. Ponzi schemes are highly dependent on recruiting new members. If you are pressured to bring in more people to make money, it might be a Ponzi scheme. These websites often incorporate referral programs enabling members to earn money by bringing in new customers. If you spot a referral link in URLs, it should raise a red flag. These referral links typically look something like this: superwebsite.com/?ref=9472. Before investing, check with your country’s financial regulators to see if the company is registered and if any complaints or actions have been taken against it. Do not invest more than you can afford to lose.Cloud mining

Cloud mining is a cryptocurrency mining process that utilizes a remote data center with shared processing power. In essence, cloud mining providers rent out their mining hardware and their computational abilities to clients, who can then mine cryptocurrencies without having to purchase and maintain expensive mining equipment. While the concept itself is excellent and entirely legitimate, fraudsters often launch deceptive schemes. They entice potential investors with lofty promises, only to deliver significantly lower returns than promised if any at all.

Protection:

Ensure the website provides clear and transparent information about which mining pool is used and who manages it. This also includes information about their mining facilities, the types of hardware they use, and their mining capacity. Check contract details. In a legitimate cloud mining contract, details like the cost of the contract, the amount of processing power you will receive, and other terms should be clearly stated. If these details are not precise, be cautious. Seek advice from an independent cloud mining advisor or someone knowledgeable about cryptocurrency mining.Bogus crypto exchanges

Beware of advertisements promising to sell Bitcoins at bargain prices or with minimal transaction fees. These could be a bait to draw you to a fraudulent cryptocurrency exchange website. Another telltale sign of a scam is the PayPal to BTC exchange ruse. Websites running this scam typically present you with a form asking for your PayPal email and the amount you wish to spend. Following this, a QR code is generated to authenticate the transaction. But, alas, the promised Bitcoins never arrive, and you are left with a compromised PayPal account instead.

Protection:

Before using any Bitcoin exchange, do your research. Read reviews from reputable sources and seek opinions from experienced users. You can also check the exchange’s website for information about the company, including how long it has been operating, its physical address, and the names of its team members. Many countries require crypto exchanges to be registered and comply with specific regulations. Check if the exchange is compliant with these regulations in your country. Be careful not to click on any suspicious links that might be trying to lead you to a fake exchange. Always double-check the URL of the exchange before logging in.Fake wallets

Identifying deceptive Bitcoin wallets can be a bit trickier, as the main purpose of a wallet is to hold crypto, not to trade it or execute BTC smart contracts. This means that these scams are not usually about immediate financial gain. While they may ultimately pilfer your assets, these rogue wallets often first aim to snatch sensitive data.

Protection:

Always download wallet software from the official website or a reputable app store. Rogue wallets often disguise themselves as the real thing, but they can only be found in unofficial or unregulated app stores. Enable MFA for added security. This requires you to provide two forms of identification, usually a password and a verification code. If you are dealing with large amounts of cryptocurrency, consider using a hardware wallet. These are physical devices that store your cryptocurrency offline. Ensure your device and any applications you use are kept up to date. This includes the wallet software, your device’s operating system, and any security software. If the Bitcoin wallet comes as a downloadable application, it is a good idea to scrutinize it for any potentially harmful code first. Websites such as VirusTotal can be quite useful, as they scan software binaries for recognized threats using multiple antivirus programs at once. If the wallet is open-source, you can check its code on platforms like GitHub. While this may require some technical knowledge, it can provide insight into the wallet’s security and functionality. Many crypto wallets provide a way to back up your wallet, often in the form of a seed phrase. You can use this phrase to recover your funds if you lose access to your wallet. Keep this phrase safe and secure.Good old phishing

Phishing, arguably the most common scam in the digital realm, aims to trick users into visiting a deceptive website masquerading as a well-known and trustworthy service. The malicious email could seemingly come from a cryptocurrency exchange or wallet service you currently use. Cybercriminals typically gather your personal details from numerous past data breaches to use in their phishing emails.

Scammers might also employ online advertisements or dubious SEO tactics to lead you to a counterfeit Bitcoin exchange or wallet when you search for terms like “Buy Bitcoin,” or “Bitcoin exchange,” or “Buy Crypto.” These trapped sites often appear among the top search results.

Protection:

As a rule of thumb, avoid clicking on links within emails. A deceptive link might appear authentic at first glance, but it uses multiple redirection steps to ultimately land you on a hacker-controlled site. To avoid this risk, directly type URLs into your browser or use your bookmarked links. Also, be sure to treat every email attachment with caution. Hackers often use attachments as a means to distribute malicious software. Be suspicious of unsolicited communications. When in doubt, check the email address or phone number and get in touch with the company using the contact details provided on their legitimate website.On-the-spot crypto trading hazards

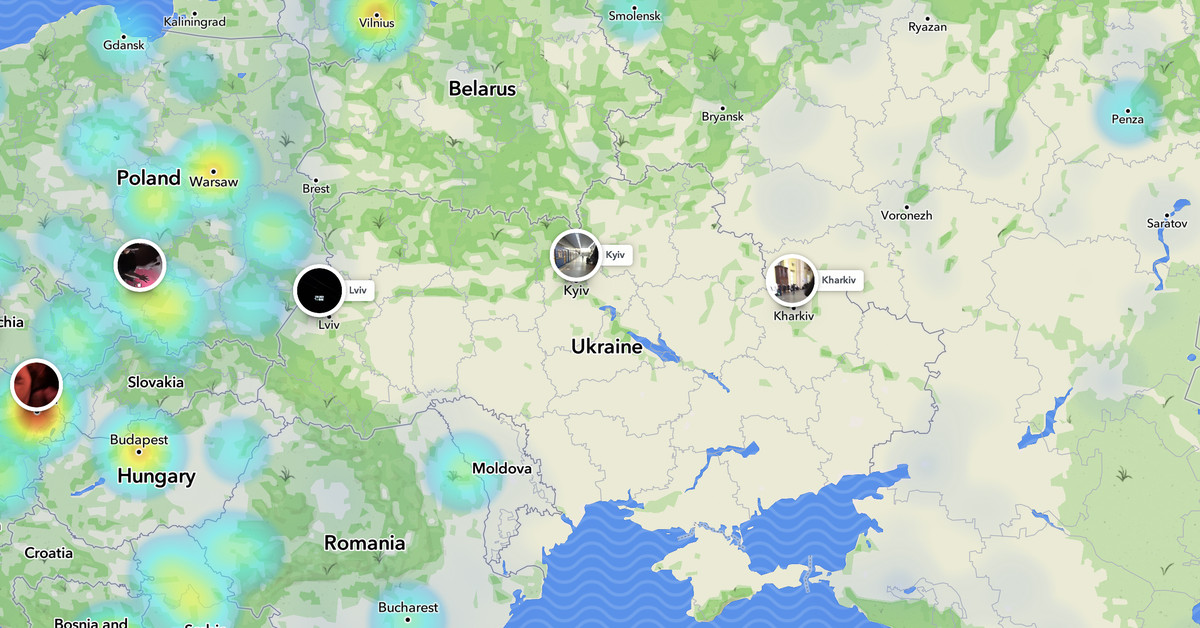

As Bitcoin theft reaches beyond the digital sphere, new laws and regulations controlling cryptocurrency trading are emerging globally. In some areas, these changes pose challenges to conventional online buying and selling of Bitcoins. This has spurred a shift in the Bitcoin economy, with traders turning to in-person meetings for transactions.

There have been several incidents highlighting the potential dangers of in-person Bitcoin exchanges. For instance, in India, an entrepreneur fell victim to a robbery while attempting to purchase BTC at an appealingly low price. He arranged a meeting with the alleged sellers at a shopping center, only to be ambushed by them and lose the $50,000 he had brought for the transaction.

Protection:

Avoid in-person meetings with strangers for Bitcoin exchanges, especially if you are carrying large amounts of money. If in need, conduct transactions in public places like coffee shops or shopping centers. These locations are generally safe as they are often crowded and have surveillance cameras. Inform others of your whereabouts. If possible, bring a friend along with you. Use reliable peer-to-peer platforms with features like blind escrow. Utilize the platform’s reputation and feedback systems to select trustworthy traders and thoroughly clarify all trading specifics using encrypted chat before proceeding with any transactions. Ensure the other party shows you the agreed sum of money first before you send any coins. Trust your instincts; if something does not feel right, walk away. It is better to miss out on a trade than to risk your safety.Pump-and-Dump schemes

Crypto “pump-and-dump” schemes are a type of manipulation where the price of a cryptocurrency is artificially inflated (pumped) through coordinated buying or spreading of misleading positive news. Once the price has significantly increased, the manipulators sell off their holdings (dump), leading to a rapid price drop. This can result in substantial profits for the scammers but causes significant losses for those who bought in during the pump. These schemes are illegal in many jurisdictions due to their fraudulent nature. However, cryptocurrencies’ decentralized and global nature can make them difficult to prevent.

Protection:

Do not rush into investments based on hype or pressure. “Fear of Missing Out” can lead you to rash decisions. Spread your investments across different assets. This can reduce the impact of a bad investment. Be skeptical of “Get Rich Quick” promises. If it sounds too good to be true, it probably is. Set Stop-Loss Orders. This will limit potential losses if the price of a cryptocurrency suddenly crashes.Fake airdrops

Fake airdrops are a common type of cryptocurrency scam where fraudsters promise free coins in an attempt to lure unsuspecting victims. These scams require participants to provide sensitive information like private keys or personal data or make a small payment to “unlock” their supposed reward. However, after fulfilling the conditions, victims receive nothing in return. By creating an illusion of a free giveaway, scammers prey on the desire for easy profits.

Protection:

Always confirm the airdrop is from a legitimate and reputable company. Check their official website and social media channels for announcements. Legitimate airdrops will never ask for your private keys. Your private key is your most sensitive piece of information. Never share it with anyone. Be cautious if an airdrop asks for excessive personal information. Although you might need to provide some data, consider any unreasonable requests as potential red flags. It is likely a scam if an airdrop requires you to send cryptocurrency to receive tokens. Legitimate airdrops do not require a purchase.Cryptojacking

Cryptojacking is a form of cybercrime where hackers covertly use other people’s computing resources to mine cryptocurrencies. This is often done by infecting a website or an individual’s computer with malicious code. Once the unsuspecting victim visits the compromised website or installs the infected software, their computer’s processing power is harnessed to mine crypto without their knowledge. This can lead to degraded system performance, increased power consumption, and hardware wear and tear. It is a stealthy and unethical way for hackers to profit at the expense of others’ resources and can pose significant cybersecurity risks.

Protection:

Use reliable and powerful antivirus software that includes features to detect and block cryptojacking scripts. Install browser extensions that can help prevent cryptojacking scripts from running in your browser. Regularly monitor your system’s performance. Unusually high CPU usage might indicate a cryptojacking attack. Regularly update your operating system and all software, including browsers, as updates often include security patches.Conclusion

Despite the initial hype surrounding cryptocurrencies subsiding, the industry continues to grow with the emergence of new projects. Cryptocurrencies are here to stay and will remain a part of our lives. However, as a relatively new form of currency, the crypto sphere will always attract new scammers. By being aware of popular scams and following the recommended protection measures, you can reduce the potential risks involved in trading cryptocurrencies.

![]()

Alex Vakulov

Alex Vakulov is a cybersecurity researcher with over 20 years of experience in malware analysis. Alex has strong malware removal skills. He is writing for numerous tech-related publications sharing his security experience.

Hollif

Hollif

.jpg&h=630&w=1200&q=100&v=154b70b92d&c=1)