Adobe shares slip 10% on soft sales forecast

Adobe paid a $1 billion termination fee to fast-growing startup Figma after regulators pushed back on the two companies combining.

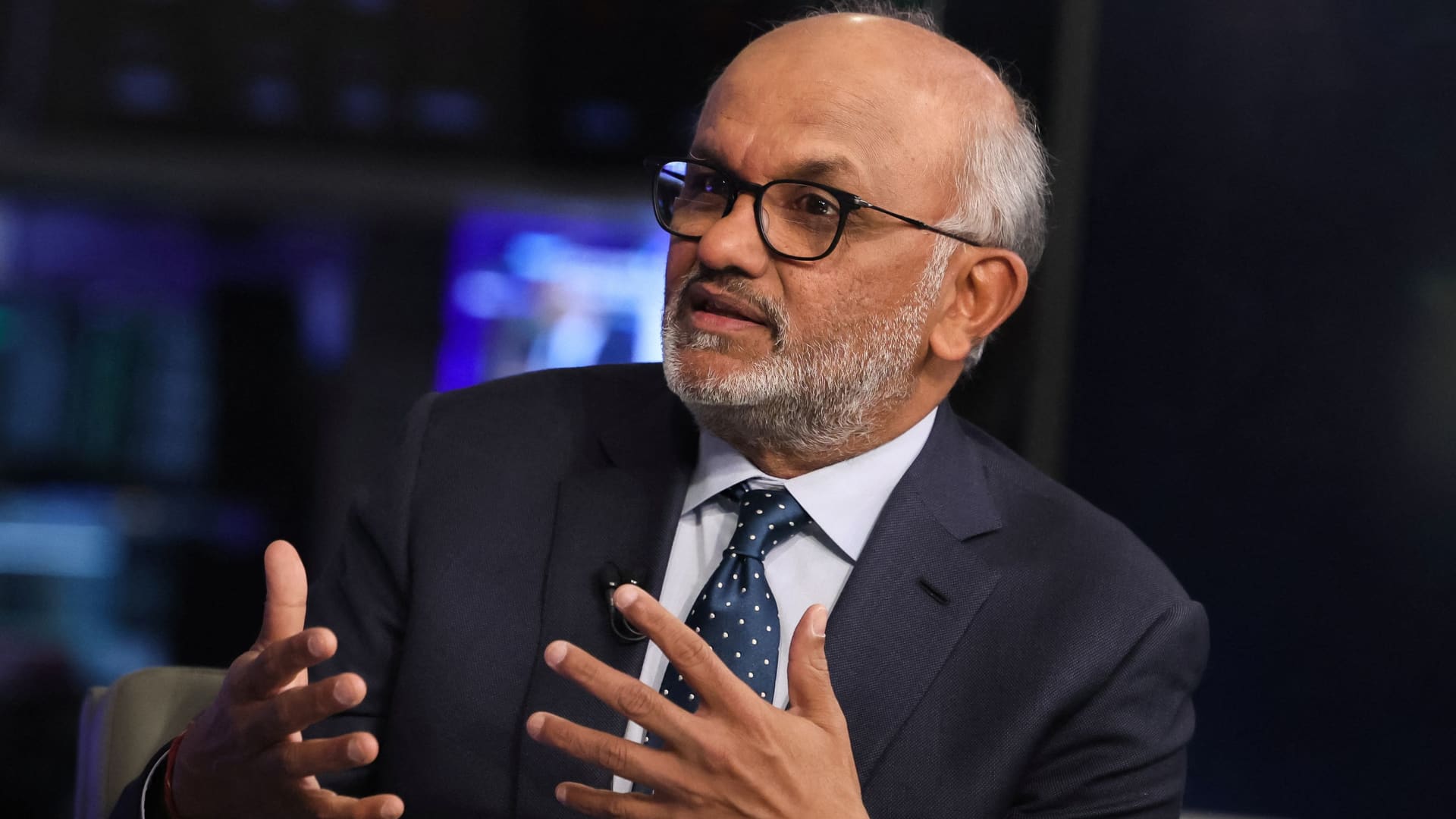

Adobe CEO Shantanu Narayen speaks during an interview with CNBC on the floor of the New York Stock Exchange on Feb. 20, 2024.

Brendan Mcdermid | Reuters

Adobe shares tumbled as much as 11% in extended trading Thursday after the design software maker issued strong fiscal first-quarter results but came up slightly short on quarterly revenue guidance.

Here's how the company did, compared with estimates from analysts polled by LSEG, formerly known as Refinitiv:

Earnings per share: $4.48 adjusted vs. $4.38 expectedRevenue: $5.18 billion vs. $5.14 billion expectedAdobe's revenue grew 11% year over year in the quarter, which ended March 1, according to a statement. Net income decreased to $620 million, or $1.36 per share, from $1.25 billion, or $2.71 per share, in the same quarter a year ago.

During the quarter, Adobe abandoned its $20 billion acquisition of design software startup Figma after U.K. regulators found competitive concerns. The company paid Figma a $1 billion termination fee.

Adobe recently announced an early version of an artificial intelligence assistant for its Reader and Acrobat apps.

Meanwhile, in February, OpenAI announced Sora, which can generate a video based on a person's written description. Adobe will work with OpenAI around Sora, David Wadhwani, president of Adobe's digital media business, said on the earnings call.

"You're going to see us obviously developing our own model," he said. "You're going to see others developing a model. All that creates a tailwind, because the more people generate video clips, the more they need to edit that content."

Adobe sees fiscal second-quarter earnings of $4.35 to $4.40 per share on an adjusted basis, with $5.25 billion to $5.30 billion in revenue. The middle of the range implies 9% growth. Analysts polled by LSEG had been looking for $4.38 in earnings per share and $5.31 billion in revenue.

Product enhancements in the Adobe Express app, the Firefly Services AI offering and the new Acrobat assistant should lead to acceleration in digital media annualized recurring revenue in the second half of the year, Wadhwani said.

The company said it was setting aside $25 billion for share buybacks.

Leaving out the after-hours movement, Adobe shares have fallen 4% so far this year, while the S&P 500 index has gained 8% during the same period.

Don’t miss these stories from CNBC PRO:

BigThink

BigThink

![The Most Followed Gen Z Celebrities on Instagram [Infographic]](https://imgproxy.divecdn.com/JKpBFjSX_y0W1otFFRdybO8P8atJALo0ncJMhOZjaiA/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9tb3N0X2ZvbGxvd2VkX2dlbl96X2NlbGVicml0aWVzMi5wbmc=.webp)