Alibaba’s global e-commerce in trouble as Shopee is set to beat it by up to 30% this year

It's clear that Alibaba has missed enormous opportunities abroad, which its rival has successfully capitalised on.

Disclaimer: Opinions expressed below belong solely to the author.

Alibaba’s stock rallied yesterday by as much as 15 per cent on the company’s latest earnings, which beat analysts’ expectations.

While the tech giant from Hangzhou performed better than expected and, remarkably, continues to grow within China (despite its already strong position there), its retail international commerce operations continue to face headwinds, having increased their revenue by only four per cent year-on-year in the first quarter of 2022.

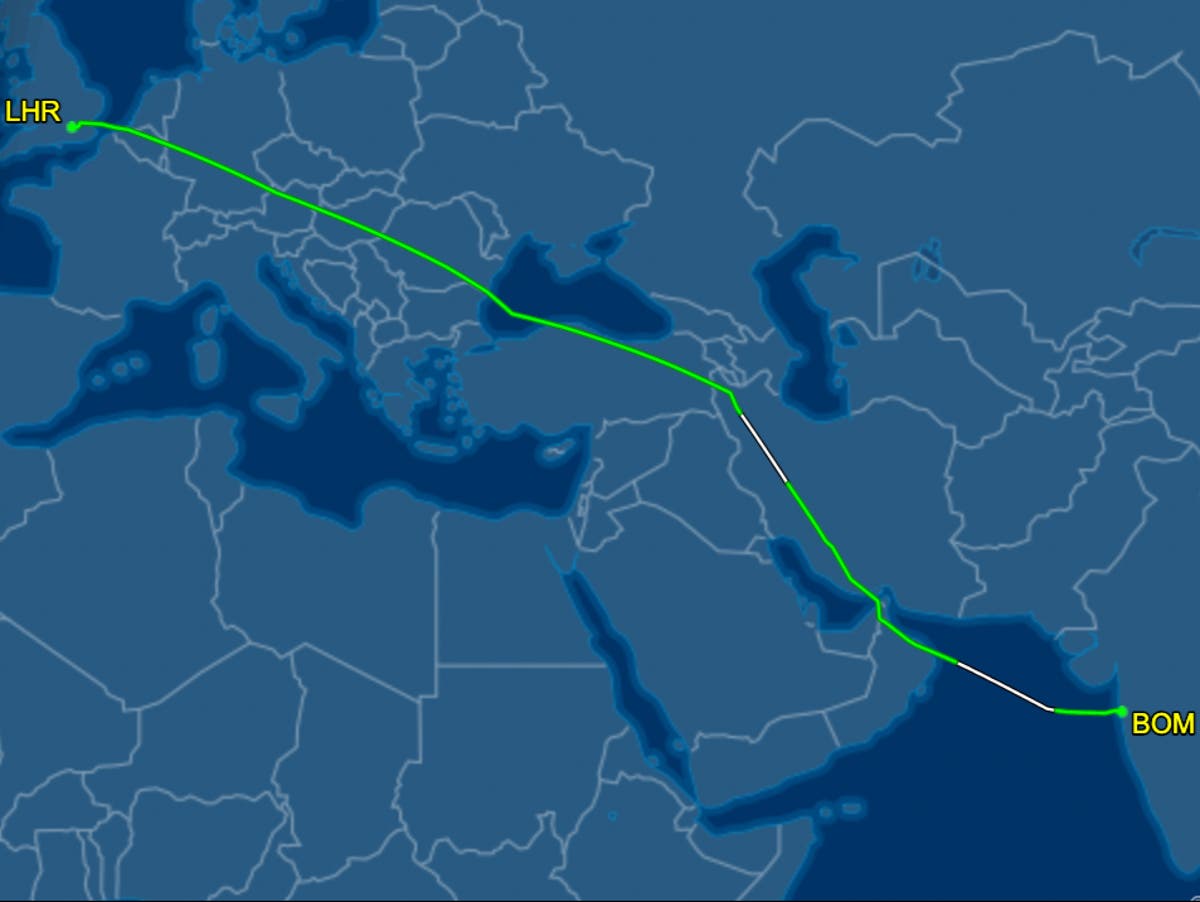

Source: Annual reports Sea Ltd. / Alibaba

Source: Annual reports Sea Ltd. / AlibabaThis may not sound all that terrible compared to the company’s Chinese business, which has grown by eight per cent — only in this case a single-digit expansion translates into an additional US$1.5 billion in quarterly revenue, compared to just about US$58 million more it earned outside of the mainland in the same time if we factor in global inflation, it may even suggest a de facto stagnation).

What is even worse, however, is that its chief competitor, Singapore-based Shopee, has rocketed by a whopping 94 per cent in the same period, bringing in virtually as much as Alibaba’s Lazada, Aliexpress, Trendyol and Daraz combined, at about US$1.5 billion for the quarter.

Clearly, despite its size, experience and money, Alibaba has missed enormous opportunities abroad, which others have successfully capitalised on.

Alibaba’s international retail revenue for the entire fiscal year (ending March 31) was US$6.7 billion. Meanwhile, Sea Ltd plans to reach anywhere between US$8.5 billion and US$9.1 billion for Shopee in 2022.

Sea’s guidance for Shopee, 2022 / Image Credit: Sea Ltd.

Sea’s guidance for Shopee, 2022 / Image Credit: Sea Ltd.Assuming a modest five to 10 per cent growth for Alibaba’s companies this year (in the absence of grand plans to turn the situation around), the rapidly rising Singaporean app can still beat Chinese giant’s stable by 15 per cent, to as much as 30 per cent, despite the latter’s enormous war chest built on profits from its mainland sales.

For the past few years, we’ve been wondering if Shopee — launched only in 2015 — can take on Lazada. Today, it’s clear that not only has already left it for dead, but is now in the process of embarrassing its big, wealthy parent too.

Bad decisions and missed opportunities

Shopee’s performance proves that it did not have to be this way, but it seems that Alibaba’s management expected the company to simply blossom abroad on the basis of their position, brand and money — without an actual strategy on how to build the business outside of its home market.

Image Credit: Vulcan Post

Image Credit: Vulcan PostAcquisition of Lazada appears to have been based on the assumption that it was only natural for the company to expand its sphere of influence in its nearest vicinity in Southeast Asia.

Buying the market leader (at the time) must have seemed like a sure bet. An already successful, recognised brand with cross-border presence received Alibaba’s support. Could any small upstart challenge the two merged giants?

And yet, it did, while they continue to struggle with providing a response.

But it’s not only in SEA where Alibaba got a bloody nose.

Its most well-known international venture, Aliexpress, was brought to an abrupt halt on the new EU regulations, which removed VAT exemptions for low-value goods shipped from China. All of a sudden, the price edge was blunted, considering that the tax adds 20 to 25 per cent in prices. As a result, Alibaba reported a fall in orders on AX in its annual report.

Still, there was and is business to be made in Europe, as Shopee has proved with its expansion to Poland, where Aliexpress has long been fairly popular.

Even today, traffic to Alibaba’s retail site is over 50 per cent higher than Shopee’s. At the same time, however, it shows that there was more growth to be found if only Alibaba put in as much effort as its Singaporean competitor did.

In its absence, however, it is growing where Alibaba has stalled.

The company’s entire international expansion was rather half-hearted and done very cheaply. Aliexpress was known abroad years ahead of Shopee, but focused on selling Chinese goods and organic growth, instead of building a platform with international presence, operations and marketing.

Even today, as Lazada’s executives are talking about quintupling the business’ GMV by 2030, and rumours are swirling about an entry into Europe, it’s hard to shake off a sense that nobody there has any vision or plan for how to actually do that.

And that’s excellent news for Shopee, of course.

Featured Image: ChinaImages / Depositphotos

FrankLin

FrankLin

.jpeg&h=630&w=1200&q=100&v=a905e78df5&c=1)