Bitcoin’s Silent Whales: Rising Exchange Inflows Hint at Market’s Next Big Move

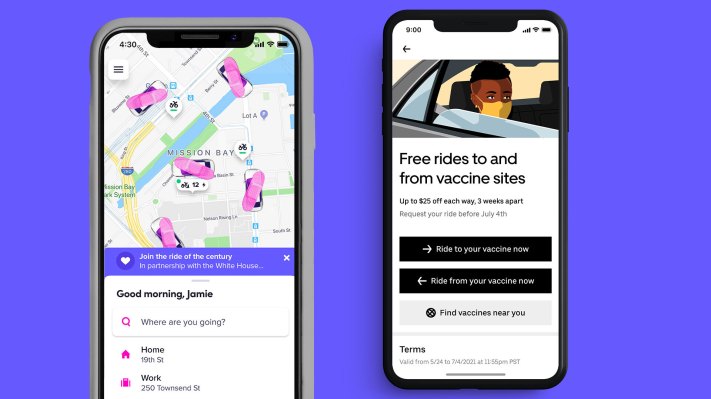

Bitcoin has experienced notable whale activity since the conclusion of the US election on November 5, with an increase in the volume of Bitcoin transferred to exchanges by active whale addresses. However, contrary to what one might expect, there...

Bitcoin has experienced notable whale activity since the conclusion of the US election on November 5, with an increase in the volume of Bitcoin transferred to exchanges by active whale addresses.

However, contrary to what one might expect, there hasn’t been a significant surge in profit-taking activity among these large holders, a CryptoQuant analyst named onatt revealed in a recent post on the QuickTake platform.

Whale Activity Suggests Market Stability but Signals Potential Risks

The report by CryptoQuant analyst Onatt sheds light on this whale activity, emphasizing the lack of immediate selling pressure despite the increase in Bitcoin inflows to exchanges.

Instead of liquidating their holdings, whales appear to be employing a “wait-and-see strategy,” the analyst wrote. They seem to utilize their Bitcoin for purposes like hedging, over-the-counter (OTC) transactions, or collateral.

Although this approach points to market stability, onatt advised that “these movements should be closely monitored to anticipate any possible market impact.”

Providing more details of this development, Onatt’s analysis reveals that the Adjusted Spent Output Profit Ratio (SOPR) metric, which tracks profit-taking activities, does not yet signal significant movements.

Historically, large inflows of Bitcoin into exchanges have often been associated with increased selling pressure, but the current scenario deviates from this trend. Instead, these movements may reflect strategic maneuvers by whales as they prepare for potential market shifts.

Onatt also noted that while the immediate risk of sell-offs appears low, the ongoing rise in Bitcoin exchange inflows could foreshadow future volatility.

Bitcoin Market Performance

Bitcoin so far appears to have hit a wall ever since it traded above $95,000. Over the past weeks, Bitcoin has been unable to move further from this price level but has managed to maintain it despite the bears attempts to push it below $95,000.

Over the past week, BTC hasn’t moved much and only registers 2.5% increase and in the past 24 hours, the asset has seen just a slight decrease by 1.2% to trade for $95,837 at the time of writing currently.

As for Bitcoin’s daily trading volume, interestingly, there has been an opposite trend. Despite Bitcoin’s small price movement into decline, BTC daily trading volume has notably increased from below $60 billion on November 29 to now at $94.5 billion.

Given Bitcoin’s current price trajectory, it is worth noting that this increase in BTC’s trading volume over the past few days might be from sell-offs. According to a renowned analyst known as Ali on X, Bitcoin has formed a head and shoulder pattern on its 1-Hour chart which now signals a correction to $90,000 levels.

#Bitcoin $BTC could be forming a head-and-shoulders pattern, which could trigger a price correction to $90,000! pic.twitter.com/mWLDabsYRV

— Ali (@ali_charts) December 3, 2024

Featured image created with DALL-E, Chart from TradingView

Aliver

Aliver