Bourse Direct Review 2024 with Rankings By Dumb Little Man

Bourse Direct Review Forex brokers play a crucial role in facilitating the trading of foreign currencies for retail and institutional clients. They offer platforms for buying and selling currencies, providing essential tools and resources for traders to execute their strategies...

| |

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like: User Experience Profit Potential Reliability Broker Expertise Cost-effectivenessBy integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies Bourse Direct as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

Bourse Direct Review

Forex brokers play a crucial role in facilitating the trading of foreign currencies for retail and institutional clients. They offer platforms for buying and selling currencies, providing essential tools and resources for traders to execute their strategies effectively. The choice of a Forex broker can significantly impact trading outcomes, making it important for traders to select a reliable and efficient service provider.

Bourse Direct is a prominent French stockbroker that specializes in providing online services. Established in 1996, it operates as a subsidiary of VIEL & Cie, a major European holding company renowned for its long-term investments in various financial assets. Bourse Direct’s focus on online trading services makes it a competitive choice in the financial market.

In this detailed review, we aim to deliver a comprehensive evaluation of Bourse Direct, highlighting its unique selling propositions and potential drawbacks. Our objective is to offer essential insights into the broker, covering aspects such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. Our balanced perspective, combining expert analysis and actual trader experiences, will equip you with the necessary information to make an informed decision about considering Bourse Direct as your preferred brokerage service provider.

What is Bourse Direct?

Bourse Direct is a well-known French online broker that specializes in providing online services. The company was founded in 1996 as a subsidiary of VIEL & Cie, a prominent European holding company with a focus on long-term investments in various financial assets.

In 1999, Bourse Direct achieved a significant milestone by getting registered on the Euronext Paris exchange, previously known as the Bourse de Paris. This registration underscores the broker’s credibility and presence in the financial market.

Bourse Direct is regulated by the ACPR (Autorité de Contrôle Prudentiel et de Résolution) and the AMF (Autorité des marchés financiers), which are the French Prudential and Resolution Authority and the French Financial Markets Authority, respectively. These regulatory bodies ensure that Bourse Direct operates within strict financial guidelines and maintains a high standard of service.

Safety and Security of Bourse Direct

The safety and security of Bourse Direct are key aspects that traders should consider. According to thorough research conducted by Dumb Little Man, Bourse Direct operates under the stringent regulations of VIEL & Cie, a large financial holding firm. The company’s activities adhere to the Sapin II Law and the single European maximum transparency certificate, ensuring a high level of compliance and transparency.

Bourse Direct’s activities are approved by the CECEI (Comité des établissements de crédit et des entreprises d’investissement), which is the Committee for Credit Institutions and Investment Companies. It is also regulated by the ACPR and the AMF, two prominent French regulatory authorities that oversee financial markets and institutions. Additionally, the broker is registered with ORIAS, a registry of insurance, banking, and finance intermediaries, further solidifying its credibility and reliability.

Bourse Direct offers negative balance protection, ensuring that clients do not lose more than their initial investment. The broker also emphasizes the transparency of executed trades, providing clients with clear and accurate information about their transactions. This commitment to safety, security, and transparency makes Bourse Direct a trustworthy option for traders.

Pros and Cons of Bourse Direct

Pros

Comprehensive real-time newsfeeds Free global news access Combine technical and fundamental analyses No minimum deposit requirements Extensive online education system Webinars and expert tips Paid individual lessons and small group trainingCons

No Forex bonus offers Educational materials only in French Withdrawals limited to EUR High spreads on Standard account Website lacks English versionSign-Up Bonus of Bourse Direct

As of this writing, Bourse Direct does not offer a sign-up bonus for new traders. This means that new clients will not receive additional funds or incentives when they open an account.

While the absence of a sign-up bonus might be a drawback for some traders, Bourse Direct compensates by providing other valuable features and services. Prospective clients should consider these benefits when evaluating the broker.

Minimum Deposit of Bourse Direct

Bourse Direct offers a significant advantage by having no minimum deposit requirement. This feature allows traders to open an account and start trading without needing to deposit a specific amount of money upfront.

This flexibility is especially beneficial for new traders or those with limited capital. By eliminating the minimum deposit requirement, Bourse Direct makes it easier for a broader range of individuals to participate in the financial markets.

Bourse Direct Account Types

Our team of experts at Dumb Little Man tested the account types offered by Bourse Direct and discovered the following details after thorough research:

Standard Account Available on MT4 and TradeBox FX Trading leverage up to 1:200 Spreads starting at 2.4 pips No minimum deposit requirements Premium Account Professional account type Floating spreads based on daily trading volume and initial depositBourse Direct Customer Reviews

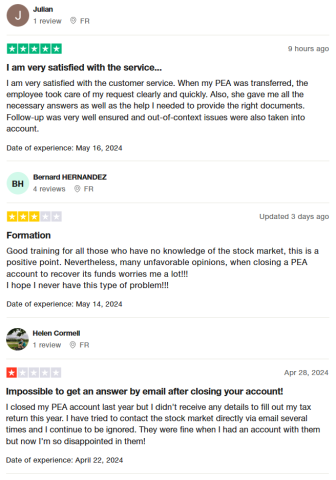

Bourse Direct receives mixed customer reviews. Many clients appreciate the excellent customer service and efficient handling of account transfers, such as PEA accounts, where employees provide clear instructions and necessary assistance. The broker also offers good training for beginners, helping those with no prior knowledge of the stock market. However, some users have expressed concerns about difficulties in closing accounts and recovering funds, with reports of inadequate follow-up and unresponsive support. Additionally, the new platform using MT5 has received criticism, with some clients preferring other platforms like TradingView.

Bourse Direct Fees, Spreads, and Commissions

Bourse Direct offers a straightforward fee structure for traders. No deposit fees are charged, making it cost-effective to fund your account. For trading currency pairs, the only fees involved are the spreads, while other instruments incur a minimum fixed fee of €0.99, depending on the asset.

The broker stands out by not charging additional fees for account maintenance, trading platforms, or analytics. This approach helps traders save on overall costs. Additionally, no withdrawal fees are imposed, further enhancing the appeal for cost-conscious traders. However, swap fees are applied for positions held overnight.

Deposit and Withdrawal

Our trading professional at Dumb Little Man tested Bourse Direct’s deposit and withdrawal processes and found several key details. Withdrawals are available 24/7, providing flexibility for traders to access their funds at any time. Transfers are made to bank cards or bank accounts based on the provided bank details.

It’s important to note that EUR is the only transaction currency, meaning there is no conversion into other national currencies. While withdrawal fees can be refunded if certain bonus program requirements are met (excluding Forex), verification of personal and payment data is required to ensure security and compliance.

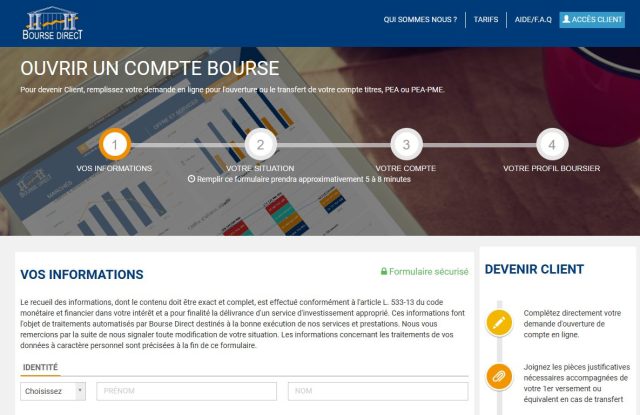

How to Open a Bourse Direct Account

Click the “Ourvir un compte” button on the main page of the broker’s official website. Enter your personal data in the provided fields. Agree to the user agreement and the processing of your personal data by ticking the appropriate boxes. Submit your application to receive your login and password, which will also be sent to your email. Choose the type of account you want to open from the available options. Select one of the trading platforms offered by Bourse Direct. Upload the required documents for verification of your identity and address. Wait for the verification process to be completed by Bourse Direct. Once verified, you can start funding your account and begin trading.Bourse Direct Affiliate Program

Bourse Direct offers an attractive affiliate program with several benefits. By partnering with Morgan Stanley, Bourse Direct covers all expenses for clients who switch to their platform. Additionally, brokerage fees do not apply to partner trading instruments if trades are executed for €500 or more.

This partnership allows stock trading from 8:00 to 22:00, providing extended trading hours for clients. Moreover, the collaboration with Morgan Stanley enables Bourse Direct’s clients to reduce trading fees and access over 30,000 new assets, enhancing their trading opportunities and portfolio diversification.

Bourse Direct Customer Support

Based on the experience of Dumb Little Man, Bourse Direct provides efficient and accessible customer support through multiple communication channels. Clients can reach technical support by using the phone numbers provided on the website, ensuring direct and prompt assistance for urgent issues.

Additionally, support is available via email, allowing clients to send detailed queries or concerns that can be addressed in a structured manner. For more immediate help, users can utilize the live chat feature on the website or within their user account, offering quick resolutions to common problems and questions.

Advantages and Disadvantages of Bourse Direct Customer Support

|

|

Bourse Direct vs Other Brokers

#1. Bourse Direct vs AvaTrade

Bourse Direct is a French stockbroker focused on providing online services, with no minimum deposit requirement, and offers comprehensive real-time newsfeeds. However, it lacks an English version of its website and has higher spreads on its standard account. AvaTrade, established in 2006, serves over 300,000 customers globally, offers more than 1,250 financial instruments, and is heavily regulated across multiple jurisdictions. AvaTrade also provides robust trading platforms but excludes US traders.

Verdict: AvaTrade is better due to its global reach, extensive regulation, and broader range of financial instruments.

#2. Bourse Direct vs RoboForex

Bourse Direct provides essential online trading services with no minimum deposit and extensive educational resources but has higher spreads and limited language support. RoboForex, operating since 2009, offers over 12,000 trading options across eight asset classes and provides various trading platforms like MetaTrader and cTrader. RoboForex also runs ContestFX, enhancing trader engagement with demo account contests.

Verdict: RoboForex is better because of its extensive trading options, advanced technology, and wide selection of platforms.

#3. Bourse Direct vs FXChoice

Bourse Direct excels with no minimum deposit requirements and detailed real-time news but falls short with high spreads and limited language support. FXChoice, established in 2010, offers quality services for active and passive trading, professional ECN accounts with tight spreads, and a loyalty program for high-volume traders. However, FXChoice is more suited for experienced traders and lacks cent accounts and optimal leverage for beginners.

Verdict: FXChoice is better for experienced traders due to its professional ECN accounts and tight market spreads.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an extensive educational program covering stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentor: At Asia Forex Mentor, students benefit from the guidance and insights of an experienced mentor who has demonstrated remarkable success in stock, crypto, and forex trading. Ezekiel provides personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

>> Also Read: Interstellar FX Review 2024 with Rankings By Dumb Little Man

Conclusion: Bourse Direct Review

In conclusion, Bourse Direct provides valuable services and tools that can benefit many traders, but it’s important to weigh these pros and cons before making a decision. For those who can navigate the language barrier and manage the higher spreads, Bourse Direct remains a strong contender in the online trading space.

Based on the assessment by our team of trading experts at Dumb Little Man, Bourse Direct is a reputable option for online trading. The broker offers several advantages, such as no minimum deposit requirements, comprehensive real-time newsfeeds, and a robust online education system. These features make Bourse Direct an attractive choice for both new and experienced traders.

However, potential users should be aware of some drawbacks. High spreads on the standard account and the absence of an English version of the website can be significant disadvantages. Additionally, all educational materials are only available in French, and withdrawals are limited to EUR, which may not be convenient for all traders.

Bourse Direct Review FAQs

What are the minimum deposit requirements for opening an account with Bourse Direct?

There are no minimum deposit requirements for opening an account with Bourse Direct. This makes it accessible for traders with different budget levels, allowing them to start trading without needing a specific initial investment.

Does Bourse Direct offer customer support in English?

No, Bourse Direct does not offer customer support in English. All communications and educational materials are available only in French, which might be a barrier for non-French-speaking traders.

Are there any fees for withdrawing funds from Bourse Direct?

Bourse Direct does not charge withdrawal fees. However, all withdrawals are processed in EUR, and verification of personal and payment data is required before processing the withdrawals.

Astrong

Astrong