Bulk payments startup Comma raises $6M Seed round led by Octopus and Connect

UK-based open banking bulk payment startup Comma has raised £4.34 million ($6m) in a Seed round of funding led by Octopus Ventures and Connect Ventures. They were joined by investors Village Global, and the founders of Wagestream, Peter Briffet...

UK-based open banking bulk payment startup Comma has raised £4.34 million ($6m) in a Seed round of funding led by Octopus Ventures and Connect Ventures. They were joined by investors Village Global, and the founders of Wagestream, Peter Briffet and Portman Wills.

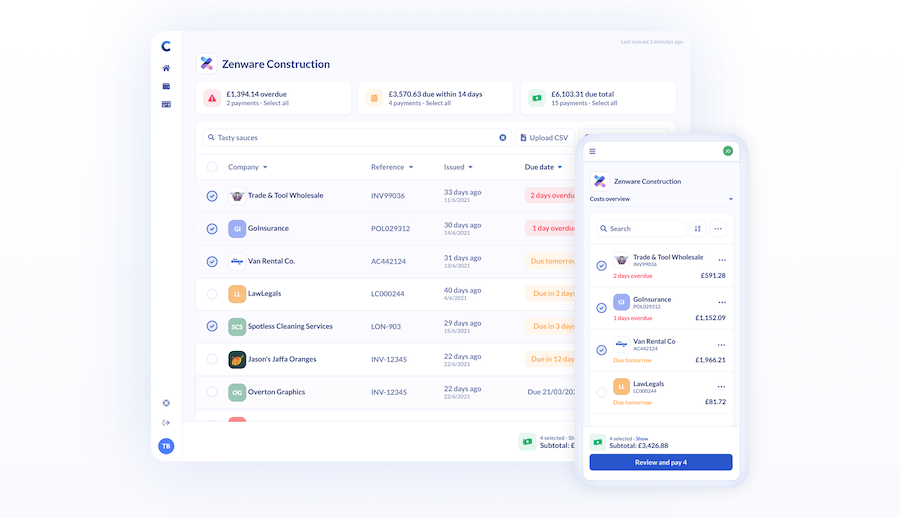

The company says it enables small and micro businesses to bulk pay bills, salaries, and taxes using existing high street small business bank accounts, saving them a lot of time and money in administration. This is because BACS is difficult to obtain and costly and virtual accounts require KYC to setup and add complexity to bookkeeping.

Comma says that during the pandemic, there was a large increase in outsourced financial operations. The availability of open banking bulk payment APIs from several of the High St banks made the product possible, which led to the startup picking up a great deal more business.

The Comma app connects to accounting systems (Xero, Quickbooks, Sage) and allows a business or their accountant to enter and manage supplier bank details without needing bank access. They can pay between 15 – 50 payees at once and the system posts payments against bills back to the accounting system to mark what has been paid.

Founder Tom Beckenham said: “I worked as COO of a business that was billing across continents and paying hundreds of staff. It was a very manual process. It occurred to me that larger businesses had corporate banking and systems that managed payments. Small businesses did not and were largely ignored. I noticed that traditional methods of solving the problem for small businesses had high setup costs – eliminating most of the market.”

He said he saw an opportunity to use new open banking technology to get to this long tail of businesses and solve payments holistically: “We have just got past the £1,000,000 in payments so far. We will get to £1m per week by the end of the quarter.”

In the UK the startup competes to some extent with Credec, Telleroo, and BACS bureaus such as ADP. Internationally, Melio in the US is the closest comparison. Libeo in France is also offering something similar.

Comma payments dashboard

Tfoso

Tfoso