Carl Icahn claims Illumina directors got extra insurance to close 'disastrous' $7.1 billion Grail deal

Carl Icahn claims Illumina directors demanded extra personal liability insurance before the biotech company signed off on a $7.1 billion acquisition of Grail

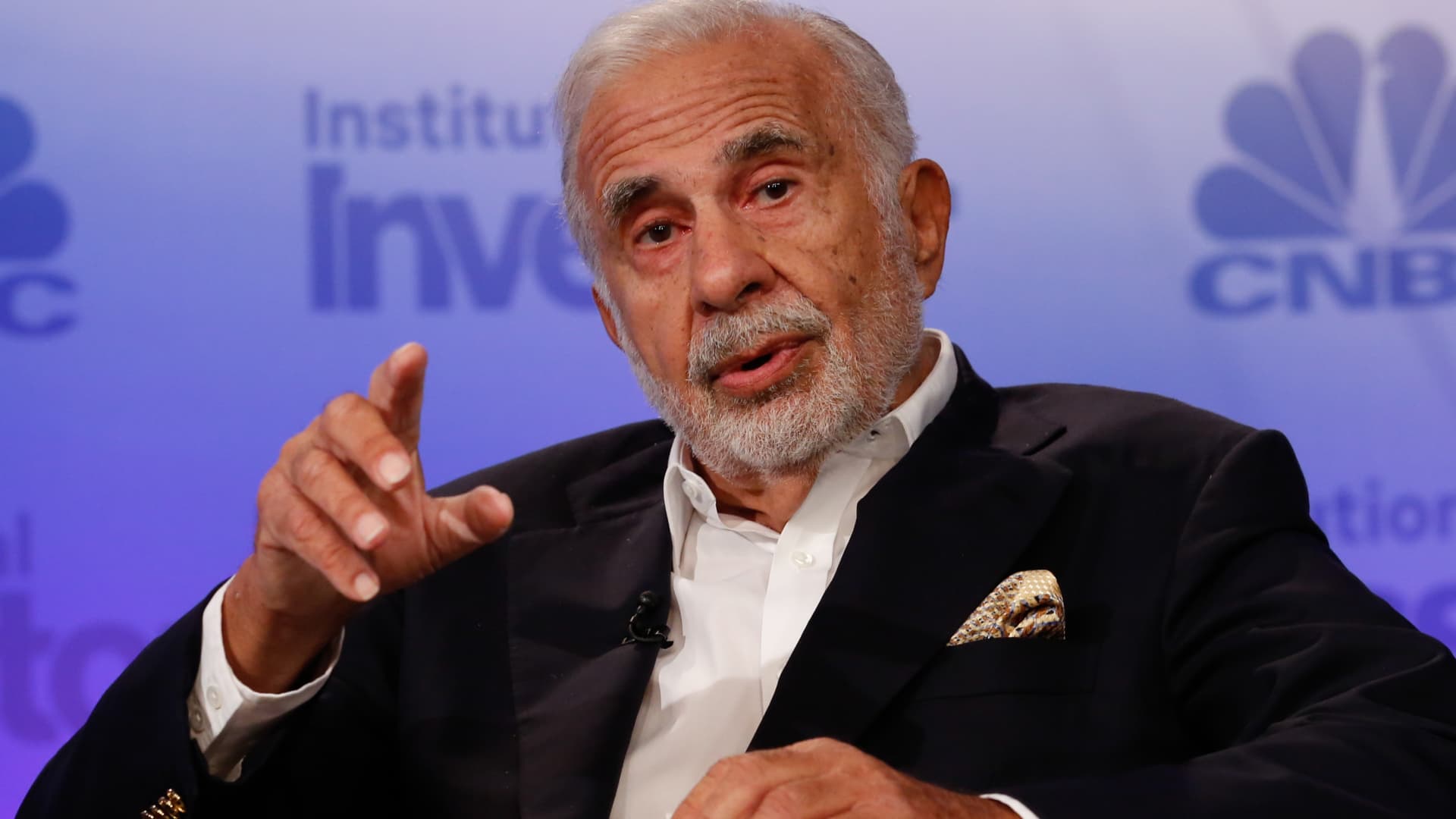

Carl Icahn speaking at Delivering Alpha in New York on Sept. 13, 2016.

David A. Grogan | CNBC

Carl Icahn on Friday alleged that Illumina's directors demanded extra personal liability insurance before the biotech company signed off on a $7.1 billion acquisition of cancer test developer Grail in 2021.

The claim is the latest development in a brewing proxy fight between the activist investor and San Diego-based Illumina, who have been trading jabs over the Grail deal that faces scrutiny from European antitrust regulators. Icahn, who owns a 1.4% stake in Illumina, is pushing for board seats at the DNA sequencing company. The investor also is calling for Illumina to unwind what he calls a "disastrous" acquisition that he believes represents "a new low in corporate governance."

In a new letter to Illumina shareholders, Icahn claimed that the company's directors required that it commit to providing them with an "unprecedented level of additional personal liability insurance" protection a day before the Grail deal closed on Aug. 18, 2021.

"It seems that, in private, the directors were terrified that their decision might cause them enormous personal harm," Icahn wrote.

He alleged that the purchase of additional insurance for directors was "buried in the hope no one would notice," adding that it was quietly disclosed in a routine filing to the Securities and Exchange Commission three months after the Grail acquisition.

He claimed the additional insurance was a fourth layer of liability protection on top of benefits like "extremely broad" directors and officers, or D&O, insurance coverage paid by Illumina. That insurance offers liability coverage for managers if they are personally sued by employees, vendors, investors or other parties for their actions in managing a company.

"This smells strongly to us like a quid pro quo – a group of trepidatious directors were dragged reluctantly, kicking and screaming, by management into an extremely risky deal and ultimately conditioned their approval upon receiving an even thicker blanket of immunity than the extremely luxuriant comforter which they already possessed," Icahn wrote.

He also alleged the Illumina board decided not to tell shareholders about other negative information when they closed the Grail deal, such as how it could incur significant tax liabilities if Illumina is forced to unwind the acquisition. The board only admitted those potential tax consequences in Illumina's most recent annual report filed on Feb. 17, he noted.

Illumina said in a statement Friday that D&O insurance and other protections are standard for companies and "support directors in making decisions in the best interests of shareholders." The company noted that it regularly reviews its D&O insurance to reflect "appropriate coverage."

Illumina added that the company follows appropriate risk management and disclosure practices.

"Illumina's disclosures are full, transparent and timely, consistent with SEC and other disclosure requirements," the company said in the statement. "To keep investors informed, Illumina regularly shares relevant corporate risk factors, including those related to GRAIL. Any suggestion otherwise is a mischaracterization of the facts."

Illumina prevailed over the U.S. Federal Trade Commission's opposition to the Grail deal in September, but is fighting for European regulatory approval.

Last year, the EU's executive body, the European Commission, blocked Illumina's acquisition of Grail over concerns it would hurt consumer choice. At the time, it unveiled details of a planned order that would force Illumina to unwind the deal. That could result in a fine of up to 10% of Illumina's annual revenue, which hit more than $4.5 billion last year.

Illumina has challenged the European Commission, arguing the agency lacks jurisdiction to block the merger between the two U.S. companies. A final decision is expected in late 2023 or early 2024, the company noted Monday. Illumina said winning a jurisdictional appeal would eliminate any potential fine and "gives the greatest optionality for Illumina to maximize value for shareholders."

The company on Monday also said it has interviewed Icahn's three nominees for its board of directors and found they lacked relevant skills and experience. In his latest letter, Icahn reiterated his intentions to present his board nominees during the company's annual meeting of shareholders.

"We feel strongly that our three highly qualified nominees (none of whom has ever elected voluntarily to engage in a value destructive war with powerful antitrust regulators) are particularly suited because of their experience to help keep Illumina's directors from painting themselves further into a corner," he wrote.

Icahn's proxy fight follows a rocky 18 months for Illumina. The company's market cap has shrunk to roughly $34 billion from about $75 billion in August 2021, the month it closed the Grail deal. Icahn has previously contended that the acquisition wiped out $50 billion in Illumina's market value, which he said "clearly shows that shareholders have lost faith in Illumina's management team and board of directors."

Illumina earlier this week touted Grail, which claims to offer the only commercially available early screening test that can detect more than 50 types of cancers through a single blood draw. The test generated $55 million in revenue in 2022 and is slated to rake in up to $110 million this year, according to Illumina.

Grail is based in Menlo Park, California.

UsenB

UsenB