Carvana stock tanks 20% in continued sell-off

Shares of Carvana were briefly halted Monday due to volatility, down more than 20% to below $7 per share — its lowest point on record.

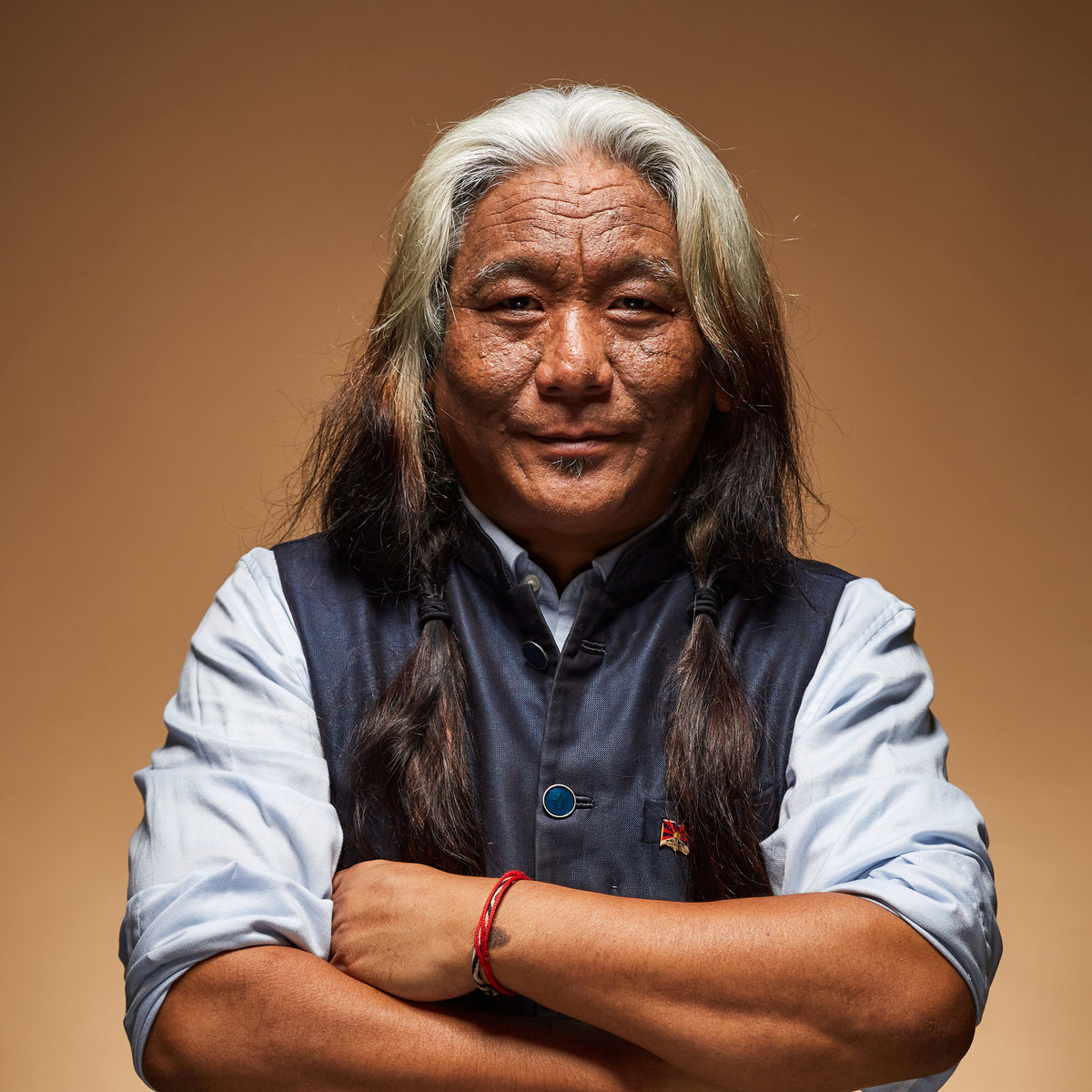

A Carvana used car "vending machine" on May 11, 2022 in Miami, Florida.

Joe Raedle | Getty Images

Shares of Carvana were briefly halted Monday due to volatility, down more than 20% to below $7 per share — its lowest point on record.

Carvana stock posted its worst day ever Friday after the company missed Wall Street's top- and bottom-line expectations for the third quarter as the outlook for used cars falls from record demand, pricing and profits during the coronavirus pandemic.

Volume spiked on the beaten-down used car seller name Monday. In just the first 22 minutes of trading, more than 9.2 million Carvana shares had exchanged hands. That's more than 65% of the stock's 30-day average volume of 14.14 million.

Shares of Carvana have plummeted by 97% this year after hitting an all-time intraday high of $376.83 per share on Aug. 10, 2021.

Morgan Stanley on Friday pulled its rating and price target for the stock. Analyst Adam Jonas cited deterioration in the used car market and a volatile funding environment for the change.

Pricing and profits of used vehicles have been significantly elevated as consumers who couldn't find or afford to purchase a new vehicle opted for a pre-owned car or truck. Inventories of new vehicles have been significantly depleted during the coronavirus pandemic largely due to supply chain problems, including an ongoing global shortage of semiconductor chips.

But rising interest rates, inflation and recessionary fears have led to less willingness by consumers to pay the record prices, leading to declines for Carvana and other used vehicle companies such as CarMax.

–CNBC's Fred Imbert contributed to this report.

This is a developing story. Please check back for additional updates.

Troov

Troov

.jpeg?trim=0,0,0,0&width=1200&height=800&crop=1200:800)