CEOs do matter when picking stocks. 5 things we look for in a leader and examples from our portfolio

Our goal is to invest in businesses that make money over the long run. That's why we care so much about who is charge.

The New York Stock Exchange (NYSE) stands in the Financial District in Manhattan on January 28, 2021 in New York City.

Spencer Platt | Getty Images

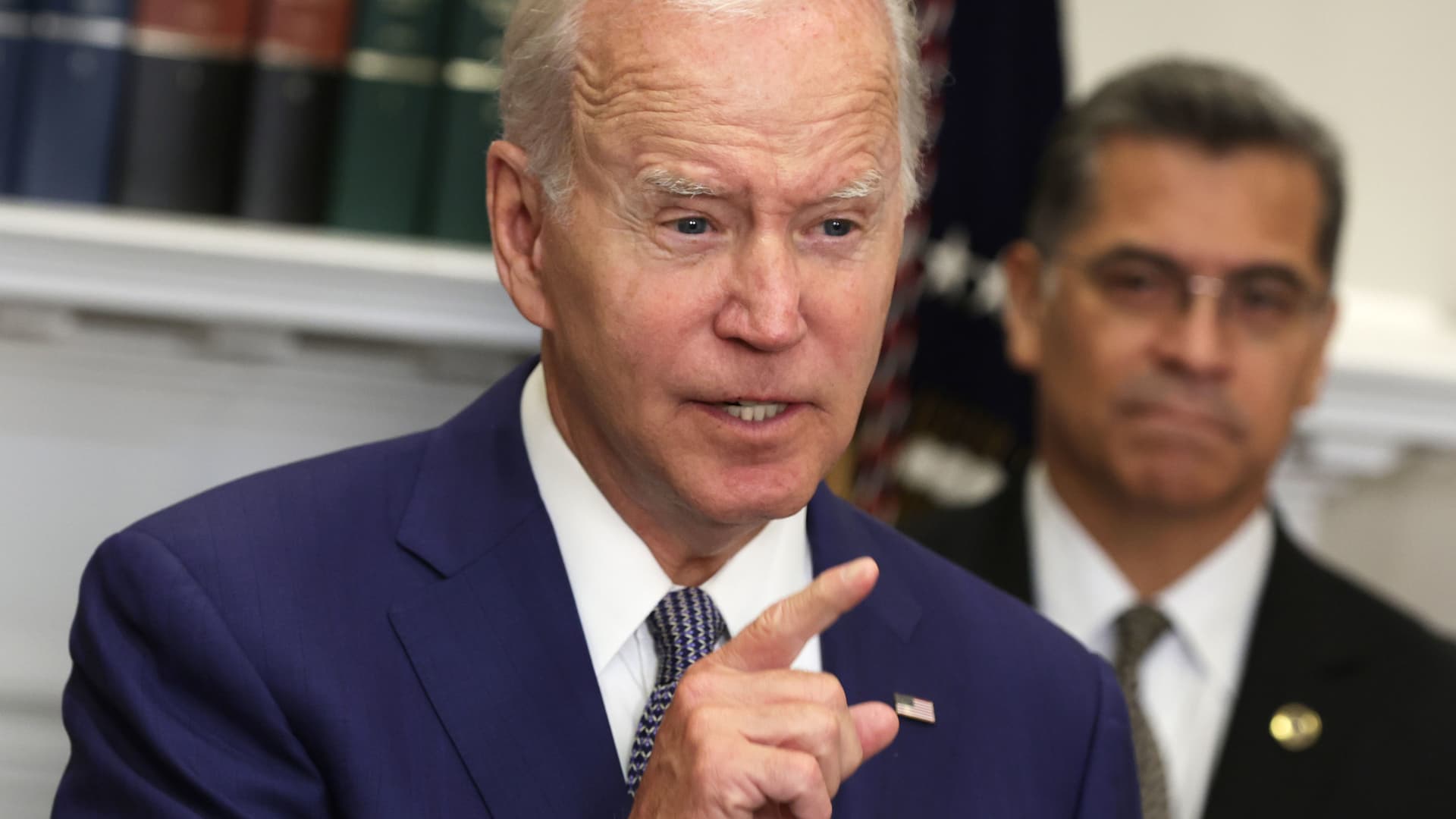

It's not unusual for a company's stock price to soar — or sink — on news of a CEO shakeup. When Mary Dillon, revered on Wall Street for her eight-year run at Ulta Beauty (ULTA), was named to the top job at Foot Locker (FL) last year, the shoe retailer's stock jumped 20% in a single session. Dillon's track record of turning Ulta around is why the Club started a position in Foot Locker back in March. We hope she can work her magic again.

The reaction to Dillon's appointment highlights a CEO's outsized influence over a company's direction — and perception by the market. In fact, up to 45% of a company's performance is tied to a CEO's influence, according to estimates from McKinsey & Co. So, CEOs matter when picking stocks — and at the Club, these are the five things we look for when evaluating the leaders of our holdings.

Lynk

Lynk

.jpg&h=630&w=1200&q=100&v=6e07dc5773&c=1)