China invests in green, transition finance systems and frameworks

The regional leader in green bonds will keep looking at labelling and internationally aligned standards, such as the common ground taxonomy with the EU, experts discussed at ICMA's inaugural summit. Meanwhile transition finance taxonomies are being rolled out in...

The regional leader in green bonds will keep looking at labelling and internationally aligned standards, such as the common ground taxonomy with the EU, experts discussed at ICMA's inaugural summit. Meanwhile transition finance taxonomies are being rolled out in Chinese provinces.

March 26, 2024

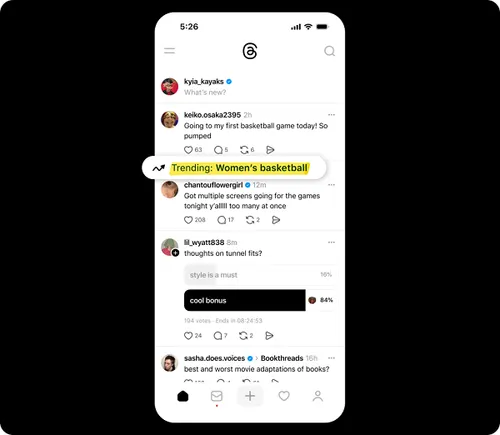

With China home to a green credit loan market sized at Rmb30 trillion, with Rmb2.5 trillion $346.3 billion of green bonds outstanding. , market participants are seeking ways, to leverage the potential of green finance in the world’s second largest credit market, including developing green standards, taxonomies and product systems.

Showing the potential momentum, data compiled by SP Global Market Intelligence suggested that sales of internationally aligned green bonds in China totalled $21.8 billion in the last three months of 2023, topping the list of global green bond issuances by country, followed by the US with total sales of $12.9 billion.

International alignment is...

¬ Haymarket Media Limited. All rights reserved.

FinanceAsia has updated its subscription model.

Registered readers now have the opportunity to read 3 articles from our award-winning website for free.

To obtain unlimited access to our award-winning exclusive news and analysis, we offer subscription packages, including single user, team subscription (2-5 users), or office-wide licences.

To help you and your colleagues access our proprietary content, please contact us at [email protected], or +(852) 2122 5222

ValVades

ValVades