China's exports rose 8.5%, continuing its growth streak at a slower pace

Economists polled by Reuters expected to see exports rise 8% while imports remain unchanged after declining by 1.4% year-on-year in the previous month.

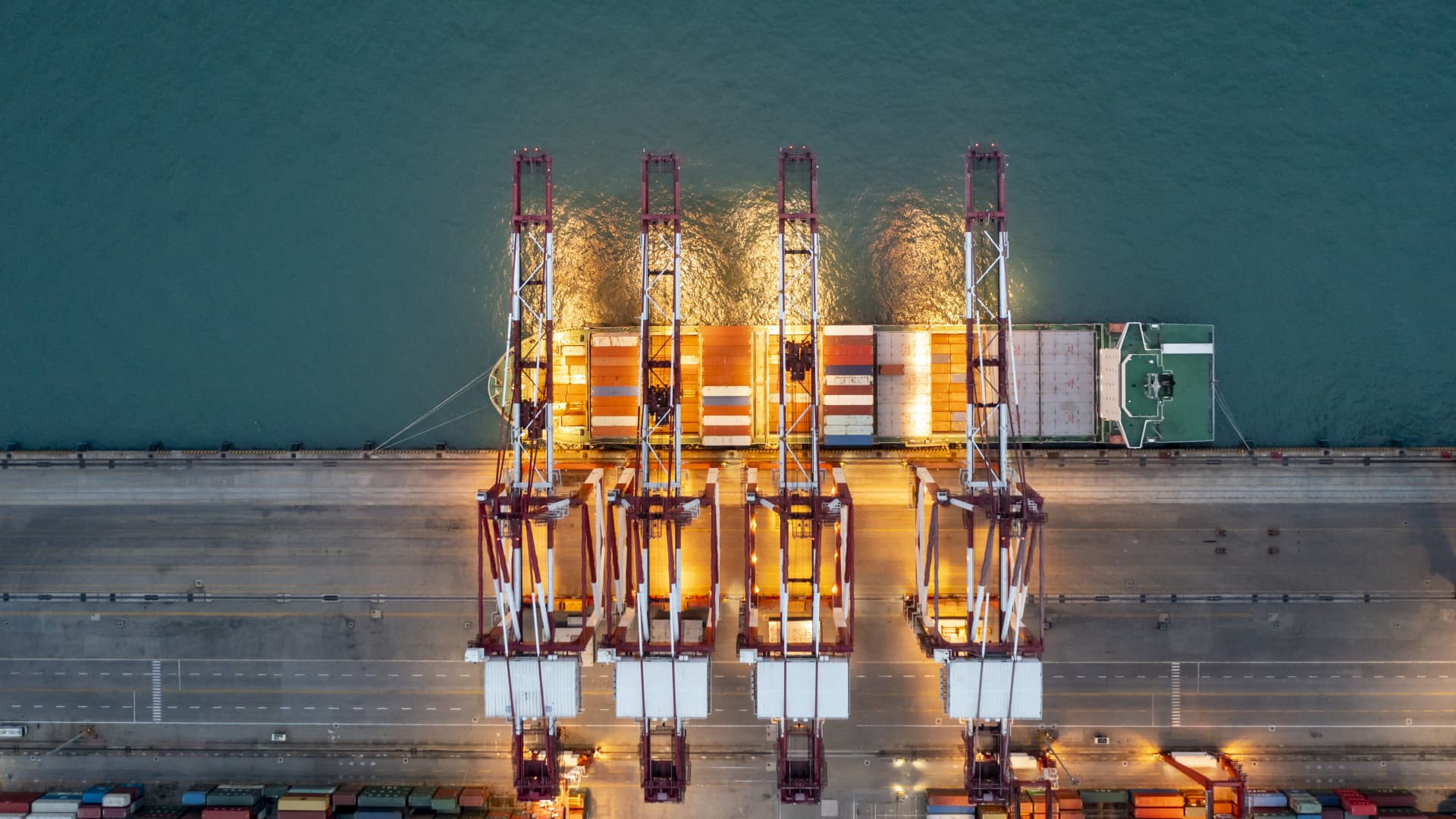

QINGDAO, CHINA - MAY 06: Aerial view of illuminated Qingdao Qianwan Container Terminal at dusk on May 6, 2023 in Qingdao, Shandong Province of China.

Vcg | Visual China Group | Getty Images

China's exports grew 8.5% in April in U.S. dollar terms, marking a second-straight month of growth, while imports fell 7.9% compared with a year ago.

Economists polled by Reuters estimated exports would rise 8% in April, while imports were forecast to remain unchanged. In March, imports declined 1.4% year-on-year while exports saw a surprise jump of 14.8%, government data showed.

China's trade surplus grew to $90.21 billion in April, up from the surplus of $88.2 billion in March.

Softer trade data in April is likely to reflect "residual seasonality" after this year's Lunar New Year, economists at Goldman Sachs said in a Monday note.

Goldman Sachs economists expected to see "the dissipation of this seasonal bias to slow export growth in April," they wrote in a note earlier this month previewing China's trade data.

Recent economic data released from the world's second-largest economy showed that China's service sector remained a bright spot despite disappointing factory data.

The National Bureau of Statistics' manufacturing purchasing manager's index reading missed expectations and fell into contraction territory with a reading of 49.2 in April from March's reading of 51.9.

"China is past the fastest stage of its reopening," Goldman Sachs economists wrote in a separate Friday note. It reiterated its forecast for China's economy to see full-year growth of 6% in 2023.

"Recent meetings with clients in the mainland suggest gradually fading pessimism on near-term growth, but some concern around deflationary pressures, though in our view this is not a major risk for 2023-24," they wrote.

Inflation ahead

China's inflation data is slated for release Thursday. Economists expect inflation slowed to a 0.3% year-on-year rise, according to a Reuters poll.

Month-on-month, prices are predicted to remain flat, according to the survey.

The economy's producer price index is forecast to mark its seventh-straight month of declines after the index fell 2.5% in March. Economists polled by Reuters expect to see a drop of 3.2%.

"Central bankers in China seemed to have little concerns about deflation, judged by the PBoC quarterly monetary policy reports and meeting minutes," BofA Global Research economists including Helen Qiao wrote in a note, adding that officials seem confident in a rebound for inflation ahead.

BofA economists said they "expect inflationary pressure to rise as the output gap narrows in 2H23, especially on the back of a new credit cycle kicking off."

Troov

Troov

.jpeg?trim=0,89,0,88&width=1200&height=800&crop=1200:800)