China's strong demand for commodities to exceed post-2008 crisis, mining giant says

China's reopening will boost demand for commodities more significantly than it did after the 2008 financial crisis, says Andrew Forrest, executive chairman of Fortescue.

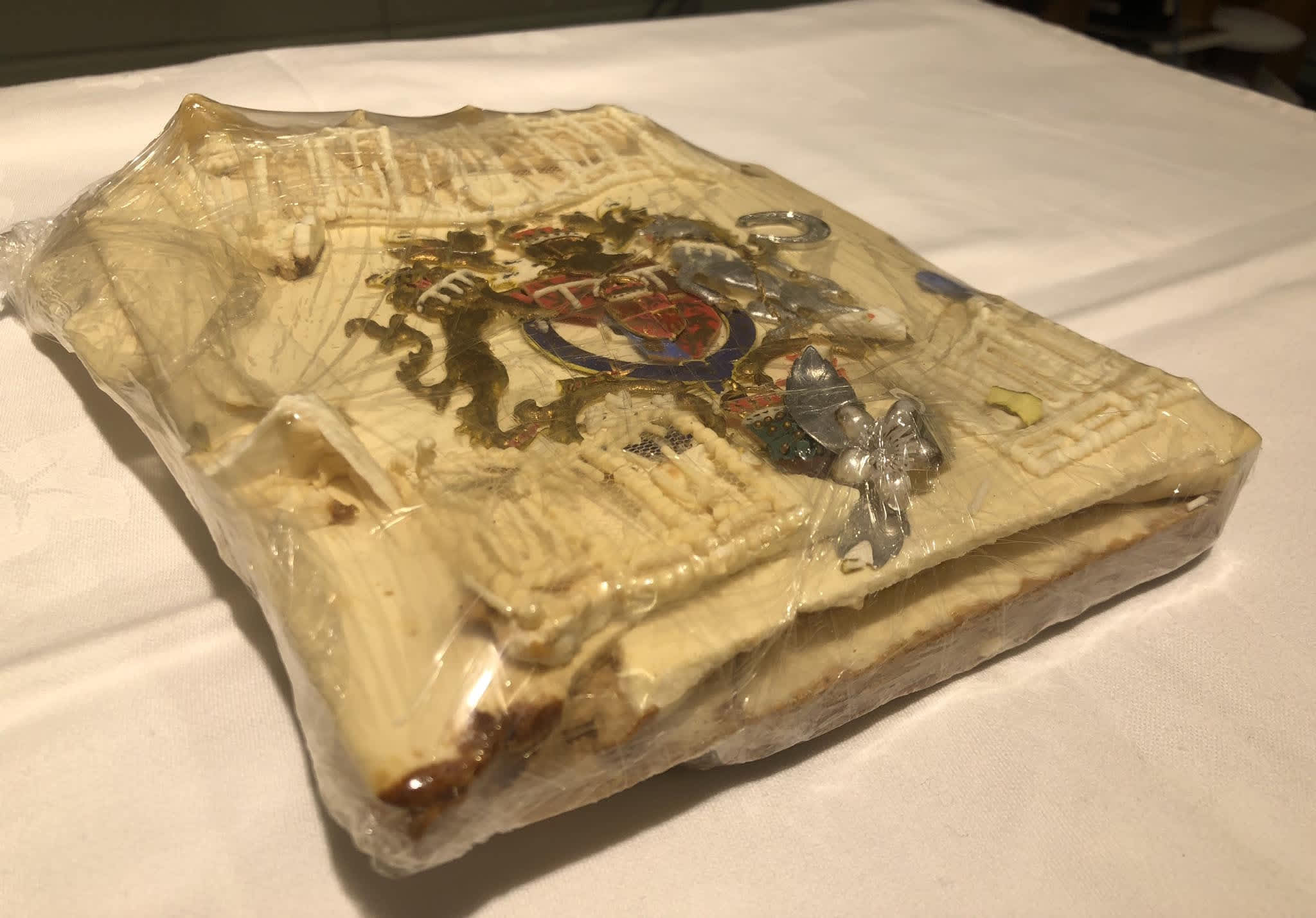

The Shoei Kisen Kaisha cargo ship Mineral Shikoku, heading for Tianjin, China, loaded with iron ore at the ship loading facility at Fortescue Metals Group berth in Port Hedland in the Pilbara region of Western Australia.

Bloomberg | Bloomberg | Getty Images

BO'AO, China — China's post-pandemic reopening will boost demand for commodities more significantly than it did when the country emerged from the 2008 financial crisis, according to Andrew Forrest, executive chairman of Fortescue.

The Australian iron ore giant began business in China with a 180,000-metric ton shipment of iron ore in 2008, according to the company's website.

At that time, China managed to avoid a prolonged recession with a massive stimulus program that supported infrastructure development — which drove up demand for commodities.

"It's like that, but this time it's only going to be bigger in volume," Forrest told CNBC on Wednesday, when asked how China's post-Covid demand might compare.

"Probably around the same or a little less in percentage," he said on the sidelines of the Boao Forum for Asia. Government leaders and business executives are at the high-profile conference held annually in Hainan province and sometimes likened to the Asian version of the World Economic Forum's annual event in Davos, Switzerland.

What we're seeing now is uniform demand across China.

Andrew Forrest

executive chairman, Fortescue

China's economy is far larger today than it was during the global financial crisis in 2008. In 2010, China surpassed Japan to become the second largest economy in the world.

Forrest pointed out the volume represented by a percentage is greater when the "cake" is larger.

"What we're seeing now is uniform demand across China," Forrest said, "and uniform demand but increasing, thankfully, in the supply chain, the ecosystem which will create [for the] renewable energy industry."

Forrest did not specify which commodities he was referring to. In the six months ended Dec. 31, Fortescue said it shipped a record 96.9 million metric tons of iron ore — up 4% from a year ago.

The Australian miner expects to keep up a similar pace of shipments in the first half of this year, according to guidance shared in February.

This year's Boao Forum is the first since China ended its Covid-era border controls, allowing more foreign businesses to visit the country.

Renewable energy: enormous demand

Forrest told CNBC Wednesday that one of the big changes during the pandemic was the acceleration of global warming. He said the other was the acceleration of China's technological development, especially in automation.

The renewable energy ecosystem — including manufacturing, automation and robotics — is "the most exciting investment sector in the world" right now, he added.

"The demand is absolutely enormous," he said.

China has the "most advanced" technology in that industry, Forrest said, citing his travels through more than 70 countries during the pandemic.

Read more about China from CNBC Pro

Fortescue has announced a goal of net zero operational emissions by 2040. The company said in February it had $1 billion in unused capital commitments for Fortescue Future Industries, its subsidiary launched in 2020 to develop renewable energy projects.

More specifically, Forrest said "wind is a little over invested" but there's a need for solar manufacturing globally. He added there's more opportunity to tap water for energy.

Fortescue will be doing joint ventures with Chinese companies, and is partnering with Hunan and two other Chinese provinces, he said, declining to elaborate.

"So we're encouraging Chinese companies to join with western companies to invest overseas with western companies, collaborate, get cracking, bring your technology, your know-how," he said.

"There's huge business opportunities in North America and Europe, Australia, Asia for Chinese companies to bring their technology."

JimMin

JimMin