SEC nearly doubles crypto unit staff to crack down on abuses in the booming market

The SEC announced Tuesday that it is almost doubling its staff responsible for protecting investors in cryptocurrency markets.

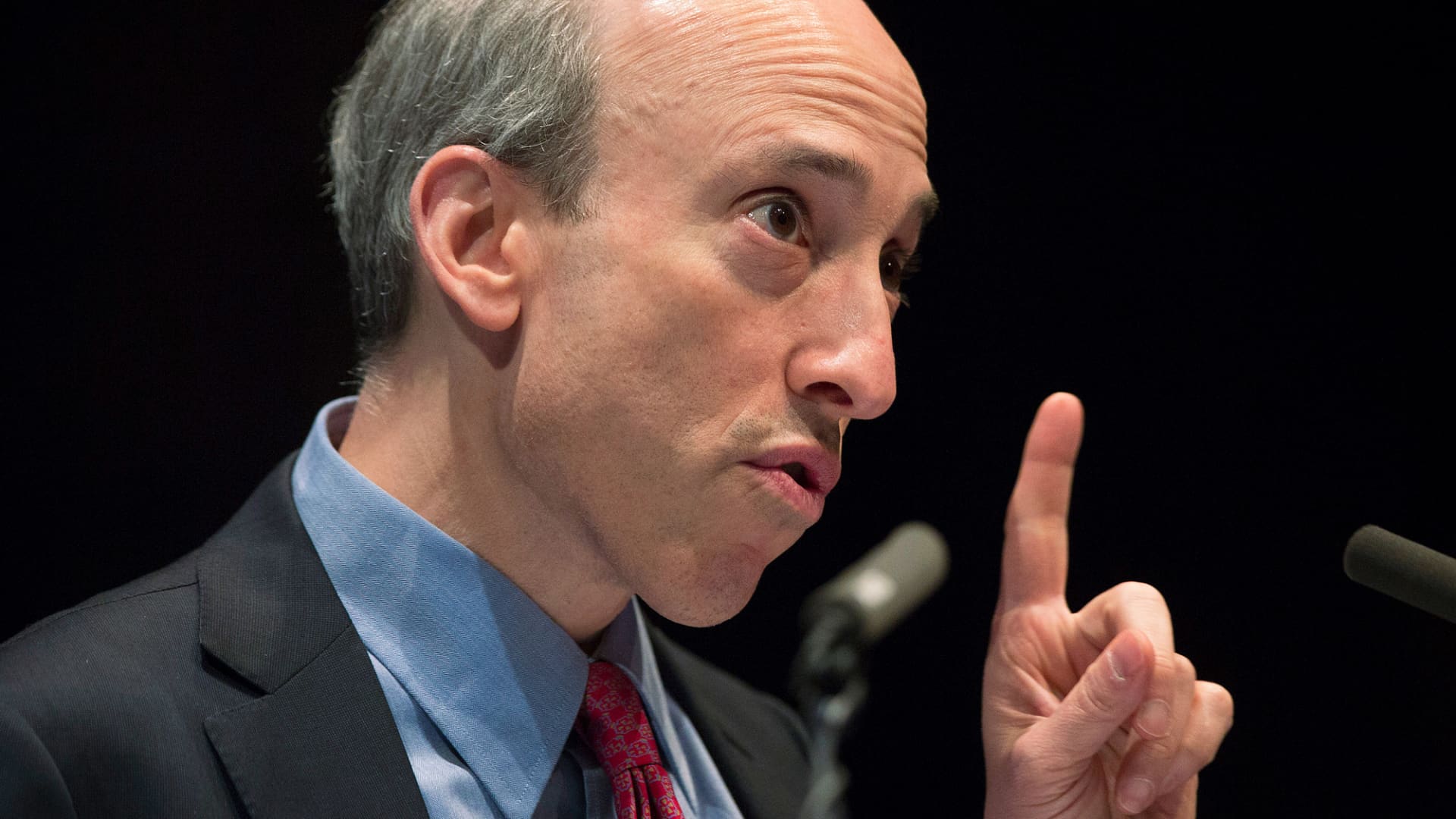

Gary Gensler

Simon Dawson | Bloomberg | Getty Images

The Securities and Exchange Commission announced Tuesday that it will almost double its staff responsible for protecting investors in cryptocurrency markets.

The regulator's Crypto Assets and Cyber team, a unit of the SEC's broader Enforcement division, will increase its head count by 20 for a total of 50 dedicated positions.

Wall Street's top law enforcer said that the 20 additions will include investigative staff attorneys, trial lawyers and fraud analysts. Both SEC Chair Gary Gensler and Enforcement Director Gurbir Grewal applauded the hires as overdue and key to regulating one of Wall Street's newest and most popular industries.

The SEC's crypto unit "has successfully brought dozens of cases against those seeking to take advantage of investors in crypto markets," Gensler said in a statement. "By nearly doubling the size of this key unit, the SEC will be better equipped to police wrongdoing in the crypto markets while continuing to identify disclosure and controls issues with respect to cybersecurity."

Grewal added that individual retail investors tend to comprise the bulk of victims of crypto-related securities fraud. Cyber threats continue to pose "existential" risks to the U.S. financial system, he added.

"The bolstered Crypto Assets and Cyber Unit will be at the forefront of protecting investors and ensuring fair and orderly markets in the face of these critical challenges," Grewal said in a statement.

The announcement comes nearly eight months after Gensler lamented to lawmakers that his agency needed more staff to handle the volume of new and complex financial technologies.

Gensler in September told Sen. Catherine Cortez Masto, D-Nev., that the regulator could use "a lot more people" to assess and regulate some 6,000 new digital projects.

"Currently, we just don't have enough investor protection in crypto finance, issuance, trading, or lending," Gensler told the Senate Banking Committee at the time. "Frankly, at this time, it's more like the Wild West or the old world of 'buyer beware' that existed before the securities laws were enacted."

Representatives for the SEC did not reply to an email seeking comment on whether the 20 additional hires would completely satisfy the need for a larger staff.

Since being confirmed by the Senate to lead the SEC in April 2021, Gensler has embarked on one of the most ambitious regulatory agendas in decades.

He has pushed for potential rule changes for brokers that sell customers' orders, more thorough climate disclosures from corporations and far-stricter oversight of the fast-growing cryptocurrency market.

While President Joe Biden and other Democrats have lauded Gensler's determined approach, Republicans have criticized his efforts as partisan and restrictive to innovation.

"As to the people and the companies that you regulate, do you consider yourself to be their daddy?" Sen. John Kennedy, R-La., asked Gensler in September. "Why do you impose your personal preferences about cultural issues and social issues on companies, and therefore their customers and their workers?"

Gensler has said that investors themselves want more clarity from the companies about the risks they face from climate change and bad actors who seek to steal digital assets.

Kass

Kass