Eightcap Review 2023: Is It The Ultimate Broker Choice?

Eightcap Review Looking for a trustworthy broker to support your success in the stock market? The only place to go is Eightcap! With its emphasis on openness, client satisfaction, and cutting-edge trading strategy and tools, Eightcap has swiftly gained...

Eightcap Review

Looking for a trustworthy broker to support your success in the stock market? The only place to go is Eightcap! With its emphasis on openness, client satisfaction, and cutting-edge trading strategy and tools, Eightcap has swiftly gained favor with traders all around the world.

What distinguishes Eightcap from other brokers, though? To begin with, their sophisticated trading platform provides a number of tools and features to aid traders in making wise choices. And if you’re new to trading, don’t worry; the platform is simple to use and intuitive, so traders of all experience levels can use it.

To help traders stay informed on the most recent market trends and news, Eightcap also provides a variety of educational resources and market analysis tools. Additionally, there is an account type to suit every trader’s needs thanks to the variety of account types available.

However, Eightcap’s dedication to providing excellent customer service really sets them apart. They have a team of skilled and qualified professionals on hand around-the-clock to help traders with any inquiries or problems that may come up. For new traders who might be navigating the market for the first time, this level of support can be extremely helpful.

So don’t look any further than Eightcap if you’re looking for a broker who provides cutting-edge trading tools, affordable fees, and unmatched customer support. Start trading with confidence and take your trading to the next level with Eightcap.

Let’s get right into the details!

What is Eightcap?

Photo: Eightcap Official Website

Photo: Eightcap Official WebsiteA worldwide internet broker called Eightcap was established in 2009. The company has offices in Shanghai and London in addition to its Melbourne, Australia, headquarters. In order to give traders access to international financial markets while putting a strong emphasis on transparency and customer care, the company was founded.

Since its inception, Eightcap has experienced rapid growth and established a solid reputation as a reliable broker. The firm offers access to a wide range of cutting-edge trading tools and resources, as well as a range of trading services like FX, indices, commodities, and cryptocurrencies.

Eightcap is overseen by the Financial Conduct Authority (FCA) in the United Kingdom and the Australian Securities and Investments Commission (ASIC) in Australia. An extra degree of security is offered to traders thanks to this regulatory control, which also guarantees that Eightcap abides by stringent financial rules.

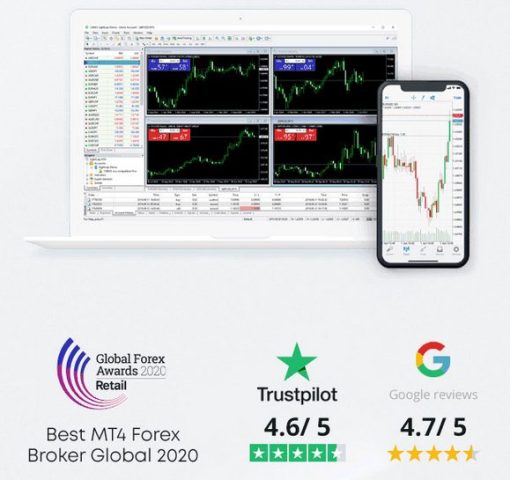

The proprietary trading platform used by Eightcap is called MetaTrader 4 (MT4), and it’s well renowned for its intuitive user interface, advanced charting tools, and an extensive collection of technical indicators.

Safety and Security of Eightcap?

Eightcap prioritizes the safety and security of its clients, providing a secure trading environment. Here are the key factors that contribute to the safety and security of trading with Eightcap:

Regulation

Eightcap is a regulated broker, licensed by reputable financial authorities. The company adheres to strict regulatory standards, ensuring transparency, fairness, and client protection.

Client Fund Protection

Eightcap maintains a segregation policy, keeping client funds separate from the company’s operational funds. This helps safeguard client funds in the event of any financial difficulties or insolvency.

Secure Trading Platforms

Eightcap offers robust and technologically advanced trading platforms that incorporate industry-standard encryption protocols. This ensures that all client data, including personal information and financial transactions, are encrypted and protected against unauthorized access.

Risk Management Tools

Eightcap provides a range of risk management tools to assist traders in managing their positions effectively. These tools include stop-loss orders, take-profit orders, and negative balance protection, which help mitigate potential losses and protect against excessive market volatility.

Customer Support

Eightcap has a dedicated customer support team that is available to assist clients with any inquiries or issues they may encounter. Traders can reach out to the support team via various channels, such as live chat, email, or phone, ensuring prompt assistance when needed.

Sign Up Bonus of Eightcap

EightCap does offer sign-up bonuses to its clients. However, the specific details of the bonus, such as the percentage or amount, are personalized and discussed directly with the client’s personal account manager. The sign-up bonus is tailored to each individual client based on their trading needs and requirements.

To learn more about the sign-up bonus and explore the options available, you can reach out to their personal account manager at EightCap. They will provide all the necessary information and assist clients in taking advantage of the sign-up bonus offer.

Minimum Deposit of Eightcap

The minimum deposit requirement at EightCap varies depending on the type of trading account you choose. For the Standard Account, the minimum deposit is $100. This account type offers competitive spreads and is suitable for most traders.

If you opt for the Raw Account, which provides even tighter spreads, the minimum deposit is $2,000. Finally, for the Pro Account, which is designed for professional traders seeking advanced features and personalized services, the minimum deposit is $25,000.

It’s important to note that these minimum deposit requirements are subject to change, and it’s always a good idea to check the official EightCap website or contact their customer support for the most up-to-date information.

Account Types

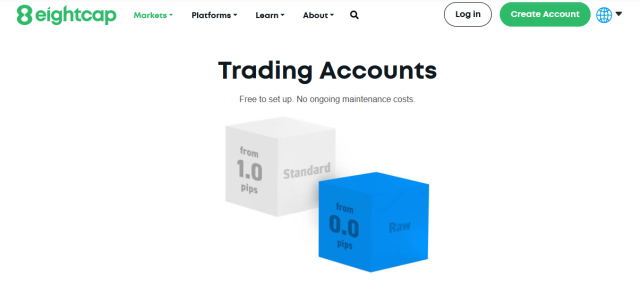

EightCap offers two main types of live trading accounts:

#1. Raw Account

The Raw Account is designed for traders who prefer tight spreads and direct market access. With this account, traders can access raw spreads from leading liquidity providers with no additional markups. The Raw Account is suitable for traders who require fast execution and are comfortable with a commission-based fee structure.

#2. Standard Account

The Standard Account is a commission-free account that offers competitive spreads. It is suitable for traders who prefer a more straightforward fee structure without paying separate commissions per trade. The Standard Account provides access to a wide range of tradable instruments, including forex, indices, commodities, and cryptocurrencies.

Eightcap Customer Reviews

Customer reviews of EightCap are mixed, with a range of opinions and experiences shared by traders. Some customers have expressed satisfaction with the platform, highlighting its user-friendly interface, competitive spreads, and reliable execution. They appreciate the variety of trading instruments offered, including forex, indices, commodities, and cryptocurrencies.

However, there are also negative reviews from customers who have encountered issues with customer support, platform stability, or withdrawal processes. Some traders have reported delays in customer service responses or difficulties in resolving their queries. Others have mentioned occasional technical glitches or platform downtime that affected their trading experience.

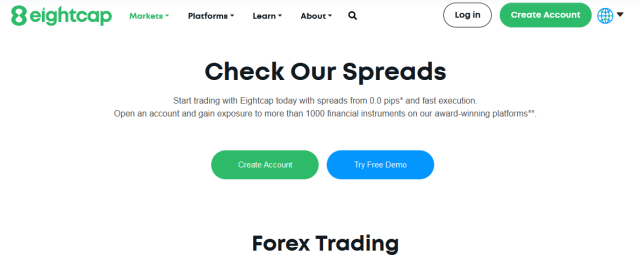

Eightcap Spreads, Fees, and Commissions

Eightcap offers competitive and transparent pricing, with low spreads and commissions. The exact commissions and Eightcap fees depend on the account type and the instrument being traded.

For forex traders or forex trading, Eightcap offers both Standard and Raw account types. The Standard account has no commission fees, and the spreads start from 1 pip. On the other hand, the Raw account charges a commission fee of $3.5 per side and offers spreads starting from 0.0 pips.

For indices, commodities, and crypto trading, Eightcap offers a Raw account type only. The commission fees and spreads vary based on the instrument being traded. For example, the commission for trading the S&P 500 CFD is $3 per side, and the spreads start from 0.3 pips.

It’s worth noting that Eightcap does not charge any deposit or withdrawal fees. However, clients may incur fees from their payment providers, such as bank wire transfer fees.

Deposit And Withdrawal

EightCap offers a variety of convenient and secure deposit and withdrawal methods to accommodate the needs of its clients. Here are some key details regarding deposit and withdrawal processes with EightCap:

Deposit Methods:

Bank Wire Transfer: Clients can deposit funds into their EightCap trading account through a bank wire transfers. This method allows for secure and direct transfers from your bank account to your trading account. Credit/Debit Cards: EightCap accepts major credit and debit cards, such as Visa and Mastercard, for instant deposits. This provides a quick and convenient way to fund your trading account. E-wallets: EightCap supports popular e-wallets like Skrill and Neteller, offering clients an additional option for depositing funds securely and efficiently.Withdrawal Methods:

Bank Wire Transfer: Withdrawals can be processed via bank wire transfer, allowing clients to transfer funds from their EightCap trading account directly to their bank account. Credit/Debit Cards: If you have made a deposit using a credit or debit card, you may also be eligible to withdraw funds back to the same card. This method is subject to the policies of your card issuer. E-wallets: Withdrawals can be processed to support e-wallets, providing a convenient way to receive your funds quickly.It’s important to note that the availability of specific deposit and withdrawal methods may vary depending on your location and the regulations in your country.

How To Open an Eightcap Account?

Photo: Eightcap Official Website

Photo: Eightcap Official WebsiteEightcap is a global online broker that offers access to the global capital markets to traders around the world. The company provides a range of trading services, including forex, indices, commodities, and cryptocurrencies. Traders can access the markets through Eightcap’s proprietary trading platform, MetaTrader 4 (MT4), which is known for its user-friendly interface and advanced charting tools.

Also, traders can Trade on TradingView, MT4, and MT5 across web trader, desktop, and mobile, all on our powerful and secure technology infrastructure. Traders can also benefit from a range of tools and resources, including educational materials, market analysis tools, and economic calendars. Additionally, Eightcap offers a range of account types to suit the needs of different traders and provides access to competitive spreads and low commission fees.

Here is a step-by-step explanation of how Eightcap functions:

Step 1: Create an account (trading account)

The first step is to register for an Eightcap account. This entails completing a registration form and entering personal data like a name, address, and email. You will get an email with instructions on how to validate your account after submitting the form.

If you’re unsure about trading with real funds just yet, you may want to consider opening a demo account with Eightcap. Raw accounts are also available for traders who want to start trading with real funds but are not yet ready to deposit large amounts. Additionally, Eightcap users have access to a range of account types, including Standard, Raw, and Islamic accounts.

With a global presence and a wide range of instruments available for trading, Eightcap has become a popular choice for traders of all experience levels. A demo account allows you to practice trading using virtual funds, giving you a risk-free opportunity to familiarize yourself with the trading platform and hone your skills before diving into live trading.

Once you’re ready to start trading with real funds, you can easily switch to a live account. To open a demo account with Eightcap, simply follow the same registration process as you would for a live account and select the demo account option when prompted.

Step 2: Funding the account

You can fund your account after it has been validated using a number of different payment options, including a credit card, a bank transfer, or online payment systems. Depending on the type of account you select, a minimum deposit may be needed.

You can fund your account after it has been validated using a number of different payment options, including a credit card, a bank transfer, or online payment systems. Depending on the type of account you select, a minimum deposit may be needed. It’s important to note that trading can carry a high level of risk, and traders can lose money rapidly, especially when trading with leverage.

However, Eightcap Global offers negative balance protection, ensuring that traders will not lose more than their account balance, which can help to mitigate risk. With a wide range of currency pairs available for trading, including major, minor, and exotic pairs, Eightcap Global is a popular choice for forex traders of all experience levels.

Step 3: Choosing a trading platform

Eightcap offers two trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms can be downloaded onto your desktop or mobile device. The MT4 platform is the most popular and is known for its user-friendly interface, advanced charting tools, and extensive library of technical indicators.

In addition, Eightcap offers a web trader platform, which can be accessed directly from your web browser, as well as a proprietary mobile app for trading on the go. As a forex broker, Eightcap Global is committed to providing traders with a seamless trading experience and a range of tools to help them succeed in the markets.

Step 4: Trading (trading strategies)

Once you have funded your account and chosen a trading platform, you can start trading. Eightcap offers a range of financial instruments to trade, and you can access these through the trading platform. You can place trades manually or use automated trading strategies through Expert Advisors (EAs).

Step 5: Monitoring and evaluating trades

As soon as you begin trading, you can use the trading platform to keep track of your trades and evaluate their performance. To assist Eightcap traders in making wise selections, Eightcap provides a variety of analysis tools, including charts, technical indicators, and news feeds.

Step 6: Withdrawing funds

You can use the trading platform to withdraw money from your account. Simply choose the withdrawal option, enter the desired withdrawal amount, and then adhere to the instructions.

Eightcap Affiliate Program

EightCap offers an affiliate program that allows individuals to earn commissions by referring new clients to the platform. As an affiliate, you can benefit from competitive commission rates based on the trading volume of your referred clients.

The program provides dedicated support, advanced tracking and reporting systems, and marketing tools to help you attract new clients. With timely payouts and a straightforward registration process, the EightCap affiliate program offers a rewarding opportunity to earn income through referrals.

Joining is easy – simply visit the EightCap website and complete the registration form. Make sure to review the program’s terms and conditions for specific requirements and the commission structure.

The EightCap affiliate program includes:

Competitive commission rates based on client trading volume. Dedicated support and access to advanced tracking and reporting systems. Marketing tools to help promote and attract new clients. Timely payouts for earned commissions. The simple registration process on the EightCap website.Eightcap Customer Support

EightCap offers comprehensive customer support to assist traders with their inquiries and concerns. The customer support team is accessible and responsive, aiming to provide timely and helpful assistance. Users can take advantage of the live chat feature available on the EightCap website, which provides instant support through real-time chat.

For more detailed inquiries and assistance, email support is accessible. Additionally, users can receive direct and personalized assistance through phone support. The website also hosts a comprehensive FAQ section, addressing common questions and concerns.

For self-help and learning, EightCap provides a knowledge base with resourceful articles, guides, and tutorials. Furthermore, EightCap maintains an active presence on social media platforms, engaging with users for updates and addressing inquiries.

Advantages and Disadvantages of Eightcap Customer Support

Eightcap Vs Other Brokers

Let’s compare Eightcap to competitors!

Eightcap, AvaTrade, RoboForex, and FXChoice are all popular online brokers that offer a range of trading services to clients around the world. While each broker has its own unique features and strengths, there are some key differences between them that may influence which broker is the best choice for individual traders.

#1. Eightcap Vs AvaTrade

Capital Street FX is a regulated forex broker known for its competitive spreads, advanced trading platforms, and a wide range of trading instruments. Avatrade, on the other hand, is a well-established broker with a strong global presence and multiple regulatory licenses.

Both brokers offer a variety of trading instruments, including forex, stocks, commodities, and cryptocurrencies. Avatrade provides a choice of trading platforms, including MetaTrader 4 and AvaTradeGO, while Capital Street FX offers the popular MetaTrader 5 platform.

Verdict: Both Capital Street FX and Avatrade offer competitive trading conditions and a wide range of trading instruments. However, Avatrade’s strong global presence, multiple regulatory licenses, and diverse trading platforms give it an edge in terms of reputation and accessibility. Therefore, Avatrade may be considered the better option for traders seeking a well-established and regulated broker with a global reach.

#2. Eightcap Vs RoboForex

Capital Street FX and Roboforex are both reputable forex brokers with distinct offerings. Capital Street FX is known for its tight spreads, diverse range of trading instruments, and advanced trading platforms. Roboforex, on the other hand, provides a wide range of account types, including cent accounts, and offers competitive trading conditions with low spreads and high leverage.

Verdict: Capital Street FX and Roboforex both have their strengths, with Capital Street FX offering advanced trading platforms and a diverse range of trading instruments, while Roboforex provides various account types and competitive trading conditions.

Depending on your specific trading preferences, either broker can be a suitable choice. Consider factors such as available trading platforms, account types, and trading conditions to determine which one aligns better with your needs.

#3 Eightcap Vs FXChoice

Capital Street FX and FXChoice are both respected forex brokers, each with its own unique features. Capital Street FX offers competitive trading conditions, a wide range of trading instruments, and advanced trading platforms. FXChoice, on the other hand, provides traders with a choice of trading accounts, including ECN accounts, and offers competitive spreads, high leverage, and a variety of trading platforms.

Verdict: Capital Street FX stands out with its competitive trading conditions and advanced trading platforms, while FX Choice offers a variety of trading accounts, including ECN accounts, and a selection of trading platforms. Ultimately, the choice between the two depends on your specific trading requirements and preferences. Evaluate factors such as available platforms, trading instruments, and trading conditions to make an informed decision.

Conclusion: Is Eightcap a Good Platform for investors and traders?

Eightcap is a good option for both new and seasoned traders wishing to access the international financial markets, according to the characteristics and products that have been covered. It appeals to traders of all experience levels because of its user-friendly trading platform, wide selection of trading products, and affordable fees and charges. A further layer of protection and assistance is offered to traders through its dedication to openness, regulation, and customer service.

Even though there can be some drawbacks, such as a lack of a custom trading platform and few training resources, Eightcap’s total package is intriguing. Eightcap stands up as a formidable competitor in the online brokerage market when compared to its rivals, like eToro and AvaTrade.

In the end, a trader’s preference and needs will determine whether or not they choose Eightcap as their trading platform. But Eightcap is undoubtedly a good platform for traders and investors to take into account given its solid reputation, affordable fees, and dedication to customer service and transparency.

Eightcap FAQs

Is Eightcap regulated?

Yes, Eightcap is governed by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the United Kingdom.

What trading platforms does Eightcap provide?

Eightcap provides its own trading platform, MetaTrader 4 (MT4), as well as the MetaTrader 5 (MT5) platform.

What are the deposit and withdrawal methods accepted by Eightcap?

Eightcap accepts a variety of deposit and withdrawal methods, including bank transfers, credit/debit cards, Skrill, Neteller, and FasaPay.

Like this Article? Subscribe to Our Feed!

Author: John V

John is an avid researcher and is deeply passionate about health and finance. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.

KickT

KickT

![Are You Still Optimizing for Rankings? AI Search May Not Care. [Webinar] via @sejournal, @hethr_campbell](https://www.searchenginejournal.com/wp-content/uploads/2025/06/1-1-307.png)