ESG adoption can be hard, Pantas & Solarvest want to simplify it for M’sian SMEs

Pantas signs MoU with Solarvest to partner up and accelerate ESG adoption rates for businesses in Malaysia using AI technology.

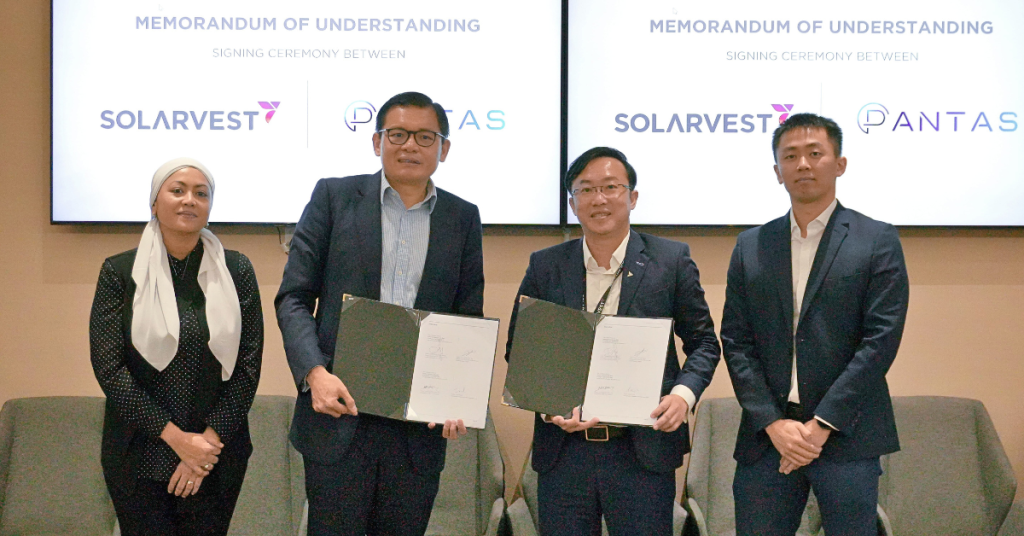

To promote sustainable energy practices, Pantas Software Sdn Bhd (a carbon management and ESG solutions provider) recently signed a Memorandum of Understanding (MoU) with Solarvest Holdings Bhd (a solar energy company offering a range of clean energy solutions).

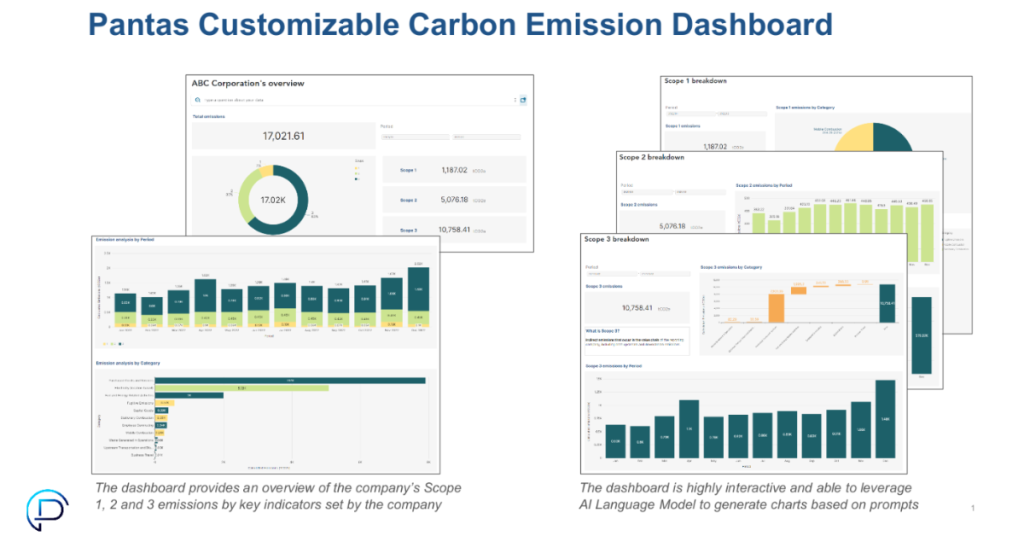

Specifically, the MoU is to integrate Solarvest’s clean energy solutions into Pantas’ AI-powered carbon management and ESG platform, which aims to measure, reduce, and report customers’ carbon footprint, and subsequently offer tailored decarbonisation solutions.

Together, they aim to co-develop a key smart metrics system for decarbonisation recommendations.

Elaborating on this, Pantas’ CEO and co-founder, Max Lee, said that the smart metrics system uses insights from partners like Solarvest while leveraging AI to analyse data from clients. It generates tailored decarbonisation strategies, including renewable energy, waste, and fleet management solutions.

He added, “The system estimates costs, ROI, and payback periods for solar solutions based on current market prices for solar panels and electricity tariffs. This enables our clients to make financially savvy decisions about solar energy adoption.”

The new collaboration, which was sealed on February 15, 2024, will be executed under the Bank Negara Malaysia’s Greening Value Chain (GVS) programme. For context, the programme is intended to help SMEs begin their journey in sustainability reporting.

As part of this MoU, Solarvest serves as the decarbonisation partner that will incentivise and assist local businesses to take the first steps towards sustainable operations.

On the other hand, Pantas serves as the digital partner and advocates for clean energy solutions that align with their actionable data insights.

Together, the two companies provide an end-to-end decarbonisation journey aimed to streamline and accelerate the adoption of renewable energy.

Businesses can leverage this latest offering from Pantas and Solarvest by accessing up to RM10 million in financing through BNM’s Low Carbon Transition Facility (LCTF), at a maximum financing rate of 5% per annum.

Image Credit: Pantas Software Sdn Bhd

Image Credit: Pantas Software Sdn BhdPivoting towards sustainability solutions

Some of you might remember this, but Pantas used to be in a different field before June 2022. The company was focused on e-invoicing and financing for SMEs before pivoting to become a carbon management and ESG platform.

Confiding in us, CEO Max Lee shared that their initial focus didn’t achieve the expected market penetration.

At the same time, they identified a significant yet unmet demand in Southeast Asia for automated solutions in carbon management and ESG reporting.

“Our market analysis revealed a strong appetite among businesses for such services, evidenced by their willingness to quickly commit to contracts of a year or longer,” he said.

In Malaysia particularly, they found that companies faced significant challenges with ESG reporting, especially in managing and reporting carbon emissions accurately.

Pantas comes in by offering services to streamline the reporting process, making it easier to manage and less resource-intensive for businesses.

Through this, the company assists clients in meeting stringent regulatory demands and facilitates a smoother transition towards sustainability.

Image Credit: Pantas Software Sdn Bhd

Image Credit: Pantas Software Sdn BhdFurther developing the local ESG landscape

Being part of the industry, Max shared that Malaysia’s ESG framework is gradually developing. The emphasis currently is on integrating ESG principles into various sectors.

Although still in its early stages, there’s noticeable momentum driven by regulatory initiatives and growing market interest.

To further enhance ESG adoption, he recommended three areas that we need to focus on:

Increasing education and awareness on the importance of ESG Introducing financial incentives like tax reductions for ESG-compliant companies Adopting standardised ESG reporting guidelines that’s similar to Bursa Malaysia’s Sustainability Reporting Guide for listed companiesThat said, since pivoting in June 2022, Max reported that Pantas has received a growing interest and inquiries from clients. This reflects a positive trend towards ESG integration in Malaysia.

So far, their clientele includes notable organisations like AmBank Group, SP Setia, Pos Malaysia, and Kasikorn Bank which is one of Thailand’s largest banks.

“For continued progress, it’s crucial for all stakeholders, including the government, businesses, and NGOs, to collaborate in promoting ESG practices. Such efforts can accelerate Malaysia’s journey towards sustainability and align it closer to global ESG standards,” he concluded.

Learn more about Pantas Software Sdn Bhd here. Learn more about Solarvest Holdings Bhd here. Read other articles we’ve written about Malaysian startups here.Featured Image Credit: Pantas Software Sdn Bhd

JaneWalter

JaneWalter