Ethereum Spot ETFs Witness Unbroken 16-Day Inflow Streak: New ETH ATH Soon?

Ethereum spot exchange-traded funds (ETFs) have logged 16 consecutive days of positive daily inflows, renewing optimism for ETH’s potential new all-time high (ATH) in the coming weeks. However, for ETH to reach this milestone, it must surpass the critical...

Ethereum spot exchange-traded funds (ETFs) have logged 16 consecutive days of positive daily inflows, renewing optimism for ETH’s potential new all-time high (ATH) in the coming weeks. However, for ETH to reach this milestone, it must surpass the critical resistance level of $4,000.

Ethereum Spot ETFs Attracting Consistent Inflows

According to data from SoSoValue, Ethereum spot ETF inflows have remained consistently positive since November 22. The cumulative net inflows total $2.32 billion, with a significant $1.5 billion added between November 22 and December 16 alone.

Source: SoSoValue

Source: SoSoValueBreaking it down by weekly inflows, the week ending December 13 saw net inflows of $854.85 million, closely followed by $836.69 million during the week ending December 6. Moreover, the total net assets held by Ethereum ETFs have climbed to $14.28 billion, which represents approximately 2.93% of ETH’s total circulating supply.

Grayscale’s Ethereum Trust (ETHE) ranks as the largest holder with $5.87 billion in net assets, followed by Blackrock’s iShares Ethereum Trust (ETHA) with $4.02 billion. These strong inflows into Ethereum ETFs have bolstered bullish sentiment, with Ethereum bulls anticipating a possible rally to a new ATH for the second-largest cryptocurrency by market cap.

Crypto analyst Momin Saqib took X to share his thoughts on ETH price action. The analyst noted that ETH looks poised to break through the local highs of the $4,000 range and is eyeing the $4,500 price level. He added:

Ethereum inflows have been coming in non-stop for the last few weeks! After seeing $BTC at $107K…. I think institutions don’t have much options left to bet on higher upside of crypto industry! Higher!

Source: Momin Saqib on X

Source: Momin Saqib on XLooking at Ethereum’s weekly chart, the digital asset has made four significant attempts to break through the $4,000 resistance level. While it briefly surpassed this level during its second attempt, creating its current ATH of $4,878, it ultimately proved to be a false breakout, followed by a prolonged bear market over the next two years.

Analyst Rekt Capital noted that ETH’s post-breakout retest of the $3,100 price level was successful, propelling the cryptocurrency back into the $4,000 zone. They highlighted that ETH has held above the $4,000 zone as support for the second consecutive week, a key development that could pave the way for further upward momentum.

Source: Rekt Capital on X

Source: Rekt Capital on XDespite The Potential Upside, ETH Traders Remain Cautious

While strengthening fundamentals, bullish technical indicators, and persistent ETF inflows paint a positive picture for Ethereum, some analysts remain cautiously optimistic about ETH’s short-term price action.

For instance, analyst CryptoBullet emphasized that ETH may see a quick wick to $3,700 before rebounding. The analyst added that ETH’s ability to hold above key resistance levels indicates its strong bullish momentum.

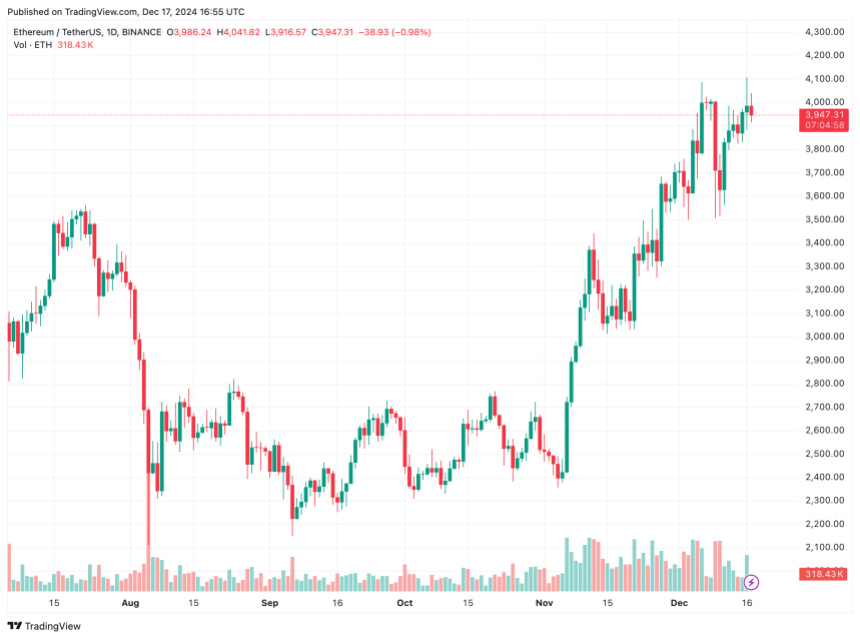

Another factor potentially dampening short-term optimism is Justin Sun, founder of Tron (TRX), who recently unstaked $208 million worth of ETH from Lido Finance. This move has raised concerns about potential selling pressure. ETH trades at $3,947 at press time, down 0.2% in the past 24 hours.

ETH trades at $3,947 on the daily chart | Source: ETHUSDT on TradingView.com

ETH trades at $3,947 on the daily chart | Source: ETHUSDT on TradingView.comFeatured image from Unsplash, Charts from SoSoValue, X and TradingView.com

Fransebas

Fransebas