Fox World Travel Details Controlled Growth Strategy

TMC Fox World Travel has set aggressive growth plans for the next several years, having already recently doubled the size of its sales team. CEO Chip Juedes spoke recently with BTN's Michael B. Baker about his strategy to grow...

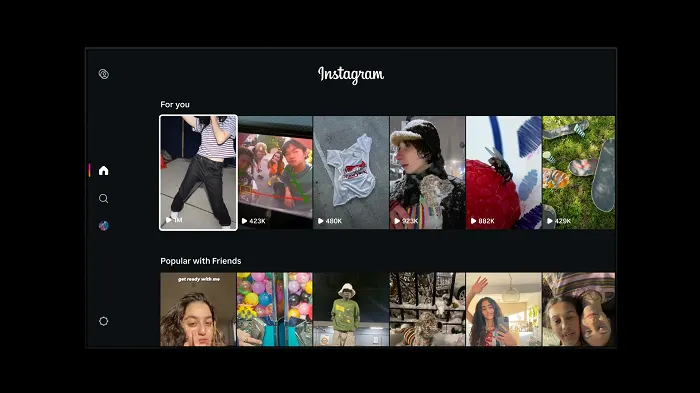

/Management/ChipJuedes.jpg?n=2595&tr=w-1200%2Cfo-auto)

Fox World Travel's Juedes discusses:

Growth without playing the "acquisition game"Data opportunities for TMCsLimitation of AI in the managed travel spaceMidsized travel management company Fox World Travel has set aggressive growth plans for the next several years, having already recently doubled the size of its sales team. Chip Juedes, CEO of the Wisconsin-based TMC, spoke recently with BTN executive editor Michael B. Baker about his strategy to grow Fox without acquisitions, how he sees the TMC competitive landscape evolving and Fox's strategy in keeping up with data and distribution trends. An edited transcript follows.

BTN: What's Fox's current growth trajectory?

Chip Juedes: We're on a path to double the size of our business. It would be the third time in company history that we're doing that, all based on the virtuous circle: Take care of our associates, which leads to happier associates, which leads to happier customers, which leads to more revenue, which we can invest back into the associate experience.

The reality is, if we don't grow, we are simply getting smaller by all the acquisitions that are around us. Our plan is to continue to grow organically, by hiring the right people and the right cultural fits for Fox, and giving them the tools, the training and the technology to be successful in their role here.

It's not to say we wouldn’t ever go back into the acquisition game. That was my father's claim to fame in his run here, near 30 acquisitions. To me, [acquisitions are] assimilating two families together, which takes your eye off the ball of what your overall focus is, which should be on the customer. So, the plan is to continue to grow organically as an organization.

We believe there is a sweet spot in the industry which has since been vacated, north of $1 billion but south of $3 billion in terms of total gross sales, that fits the need where we can still deliver the customer service and custom solutions that we're known for, but that we aren't becoming a nameless, faceless organization, not only to our associates internally but to our customers.

BTN: How big do you think you could potentially be?

Juedes: The way I look at it, we can continue to grow. I don't want to get to the point where we're so large that we're unable to keep the culture. Part of my new hire speech I give is that I don't want to get rid of the reason that you chose to call Fox home. I say that whether it's our associates internally or our customers and partners externally. I send out a weekly email to the company from me, and it's truly from my fingers, what I'm seeing, feeling, thinking, hearing in the industry—what I'm worried about, what we're excited about. The second people start to not understand who I am, who we are as a leadership team and what makes us tick, that's when we stop growing. The endgame isn't size. It's how do we grow to a size where we don't lose who we are at our core but still maintain relevance within the market.

The reality is, if we don’t grow, we are simply getting smaller by all the acquisitions that are around us.”

BTN: Will it remain a largely U.S. footprint?

Juedes: It's largely U.S. We're a BCD affiliate, so we use them and a handful of other small agencies for out-of-country. We have some onsite [agents] that do some out-of-the-U.S. stuff as well. We are seeing some popularity into using us in the U.S. and other TMCs outside of the U.S. In many cases, 85 percent of their program is based in the United States with a smattering in other countries. We can be the aggregator of the data if they are in love with a TMC in another country. We can parse the data and get them a global data program without having to move the people in Spain or Munich away from the team or booking tool they love.

BTN: Any plans as far as ownership structure?

Juedes: We're also committed to remaining privately held. We're a third-generation family business started in 1960 by my grandfather Harold. We're in our 65th year right now. My wife and I have three little ones under 11, so if this is going to become a fourth generation, you're going to be looking at me until I have more gray in my hair.

But there's a difference in the way we approach the business. We can make decisions not based just on quarterly earnings or annual profit. We have goals around that, but we can make some longer-term decisions today for what's going to set us up for success 10 years from now. That's a huge differentiator, as I've watched many of my father's contemporaries sell, as they had no succession plan. I believe there's going to be even more as we go forward. It's not uncommon that I'm one of the youngest ones at the table when I sit at industry events. I take some pride in that, but I also know that the industry is going to change, which is why we charted our course and our strategic plan around that growth by 2030.

BTN: With all that consolidation happening, how would you characterize the TMC competitive market today?

Juedes: It depends. If you focus on the 60, 70, or 80 percent that's transactional, the online booking, there's a commoditization afoot. People believe they can focus on just that, and everything else will come along with it. I could take my transactional business anywhere, but they're not thinking about the rest—it could be 5 percent, or it could be 30 percent—the times you need to talk to an advisor, someone with some level of specialty or skill set that's going to be getting you home or on that business trip for a sales presentation or to fix a machine.

We're starting to see the pendulum swing, where it's going to swing to "everything can be automated," where maybe things haven't been automated enough, and it's going to level somewhere in the middle, when people realize automation can't solve for everything. I realize it makes me sound a little old-fashioned, but the reality is, I watch our team and the skill sets we have. There are things they are doing and value they are adding that no amount of AI or technology is going to be able to solve for—some of that simple travel knowledge. When you talk about hundreds of different airlines, hotels, car rental companies, there has to be some level of customer service that comes with it.

The other piece depends on who you're talking about. If you're a global account that has 50 countries, and you're trying to make a move or change, you look at things a little differently. You have resources internally and finances internally to build and do a lot of these things. Many times, when you are talking about the under $50 million in air spend [segment], they have no resources, and in many cases, they're found on an island within their organization. They can't get the tech teams or IT or data teams to do anything, and that's where we really shine. They look to us to help augment what they're doing.

We use the wedding planner analogy. Some people don't want you to know they had a wedding planner put everything together, and others want to be proud about that. We can be both. We can be out in front of it, and we can be behind the scenes, but we're also helping them by being their partner in their travel program internally, from writing policy to enforcing things.

Often, we ask the magic-wand question when we're in the bid process: "If you had a magic wand, what would you wish for in your travel program that you've been told no to or that would make your life easier?" The one thing we often hear is "reduce noise." That's what we try to solve for. By staying in the size we're trying to grow to, we can continue to deliver that instead of saying that you have options A, B and C.

Some of the value we add is going to have to continue to change. The expectations of us from our customers are going to change. We're a transparent and open organization. We talk to our customers about their needs today, what their needs are tomorrow. We ask them what we could be doing differently. Sometimes you get the answer about faster horses, and we know we have to build an automobile. Other times, they tell you things you weren't expecting and where that paradigm is going to shift.

AI is going to increase an already high level of customer service, so we’re not having to ask too many questions on the front end.”

BTN: Our recent research has indicated TMCs are still the biggest sources of data for travel buyers. What are your clients' expectations in terms of data?

Juedes: In many cases, unless they have the resources internally, which most customers don't necessarily have, we look at it as a huge part of our value proposition, to be able to deliver them the data that leads to a successful travel program. If they believe there's leakage, and they want to bring it back into the travel program, we can take their expense feed, bring it in and give them a report of those that were in and out of the program.

We do custom credit card reconciliation for a number of customers. It's some of the least sexy stuff you can talk about, but it's that magic-wand question. We are the aggregator of their data. Some comes directly from the vendors that we have hooked up, some comes from their expense feed, some from their HR feed, and much of it comes from what we're booking on their behalf or what they're booking through the self-booking tool. Then, it's slicing and dicing it in every way possible. Their goal might be to get their spend up on one carrier so they can get a discount or a better contract. We can work with them once we have that data, and obviously, the biggest piece is that it's trusted data.

BTN: What impact will AI, and particularly agentic AI, have on the business?

Juedes: In certain industries we're going to see it. I don't know that it's necessarily going to be within the managed travel space. I don't want to sound like I'm trying to hold onto the past, but if someone is calling into a vendor directly and wants something from them, they only have a window of so much they can come back with. We're coming back with different results, different pricing and different everything. That's where there still needs to be some level of logic built into what's being returned. Cost is still going to be the driving force in many travel programs. Do I think we can do a cull of that data, so it's not taking you through New York City to get to Los Angeles? There's a much better opportunity to bring back smarter data on the front end so the results are more logical.

It's going to be the best of all worlds. Take your best five customer experiences that you've ever had, and that's where we're aiming to get right now. We know who you are when you're calling. We know if you are in-trip or not in-trip. It's popping up a little box that shows what your last five trips were and the carriers, because I don't want to price you on Carrier A if you are a loyalist to Carrier B, or if you always take the 8 am flight. It's going to increase an already high level of customer service, so we're not having to ask too many questions on the front end.

BTN: How are you navigating the continued fragmentation of content?

Juedes: The biggest piece of this is staying close to our partners, understanding what their roadmaps look like. It's ensuring we're completely transparent with our customers: Here's what you get and here's what you're going to give up. You have pros and cons, because we're in transition. Some want to be on the front end of this because they see the value where the fare differences are big enough, but it's about understanding the servicing side of it is going to look different today than it will be in a couple of years. Right now, it's picking best of breed, but I don't expect it will be that way going forward. As the industry evolves, we're all going to be able to deliver the same level of content.

NDC is here. It’s going to continue to improve and change our value proposition in what we bring and deliver, and it will change the expectations the customers in what we’re able to bring and deliver to them.”

BTN: What's your strategy for New Distribution Capability integration?

Juedes: From the highest of levels, we are open to just about any technology, whether it be a third-party technology or any way of booking that our customers need, want or believe they are going to need. I'm a realist. If I'm going to be doing this for the next 20 to 30 years, NDC is here. It's going to continue to improve and change our value proposition in what we bring and deliver, and it will change the expectations the customers in what we're able to bring and deliver to them.

From a true third-party perspective, we're plugging into our proprietary data in [Fox's business intelligence platform] Cognition, all kinds of third parties. It's not uncommon that we hear from someone in the bid process that they want this price shopping technology or something like that. Often, we have that. Right now, they're getting sold on the sizzle and not necessarily the steak, and we can do a better job of touching on some of that, but it's the new entrant and what might be important to that organization, because everyone has a different driver at what success looks like in their travel program. We're also rolling [Fox's proprietary] Colby AI within [the Cognition tool] so that they can ask the question, and it brings back the data, instead of them having to know how to run a query or have to call us to ask for some of that. They can self-serve and get to the right place.

From the highest level, we're in that transition mode from what was a legacy booking to what a new booking is going to look like, but not every airline is in the same place, not every hotel company is in the same place and not every car rental company is. How do we do this in a way that doesn't create more angst for our team internally and doesn't create a disparate booking process for our customers? Some of that is going to rely on third parties. Some of that is going to rely on some aggregators, whatever that looks like in the GDS companies, or potentially direct connects with some of the carriers themselves.

BTN: Is that a bigger challenge for small and midmarket buyers, who might not have the bandwidth to stay on top of this?

Juedes: They are extremely confused by what's happening, and travel might only be a portion of their job on a given day. We look at it as our job to reduce their noise. That noise could be unhappy travelers. That noise could be someone saying, "I found it cheaper elsewhere." That noise could be a credit link that breaks when it gets to their internal accounting system, so we can pull in their expense data and give them the total travel package. We're trying to make their lives easier. That's where that difference between looking at it as a transaction and looking at it as a partnership.

ValVades

ValVades /Management/ChipJuedes.jpg)