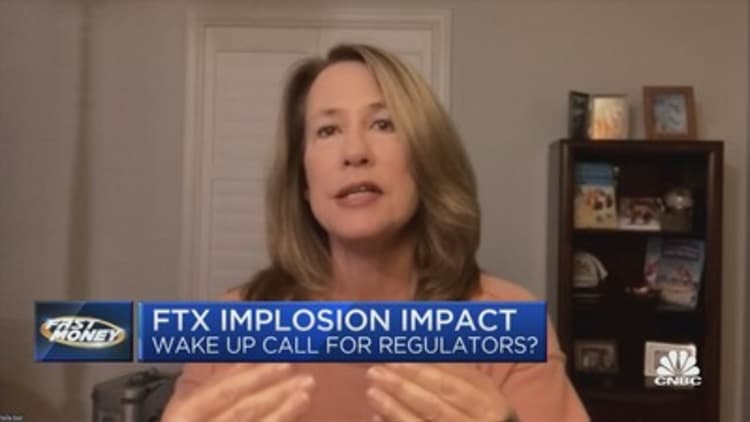

FTX tells court it has evidence Sam Bankman-Fried transferred assets to Bahamas government custody after bankruptcy

FTX lawyers said Bahamian regulators directed Sam Bankman-Fried to transfer digital assets to the custody of the Bahamian government.

Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange, speaks during an interview on an episode of Bloomberg Wealth with David Rubenstein in New York, US, on Wednesday, Aug 17, 2022.

Jeenah Moon | Bloomberg | Getty Images

FTX in a bombshell emergency court filing Thursday said it has credible evidence that Bahamian regulators directed former CEO Sam Bankman-Fried to gain "unauthorized access" to FTX systems to obtain digital assets belonging to the company after it had filed for Chapter 11 bankruptcy protection.

The filing said Bankman-Fried transferred those assets to the custody of the Bahamian government. It cites an interview published by Vox on Wednesday, in which Bankman-Fried expresses serious disdain for regulators.

"F--- regulators," he said in the interview. "They make everything worse. They don't protect customers at all."

"You know what was maybe my biggest single f---up?" he asked. "Chapter 11."

In the motion, filed in the U.S. Bankruptcy Court in Delaware, FTX said the alleged conduct puts "in serious question" a request by Bahamian regulators for recognition as liquidators in the bankruptcy.

"[I]n connection with investigating a hack on Sunday, November 13, Mr. Bankman-Fried and [FTX co-founder Gary] Wang, stated in recorded and verified texts that "Bahamas regulators" instructed that certain post-petition transfers of Debtor assets be made by Mr. Wang and Mr. Bankman-Fried (who the Debtors understand were both effectively in the custody of Bahamas authorities) and that such assets were "custodied on FireBlocks under control of Bahamian gov't," the motion said.

Read more about tech and crypto from CNBC Pro

"The Debtors thus have credible evidence that the Bahamian government is responsible for directing unauthorized access to the Debtors' systems for the purpose of obtaining digital assets of the Debtors—that took place after the commencement of these cases. The appointment of the JPLs and recognition of the Chapter 15 Case are thus in serious question," the motion said.

Bankman-Fried was not immediately available to comment. The law firms representing FTX, Landis Rath & Cobb and Sullivan & Cromwell, did not respond to requests for comment. CNBC did not immediately receive a response to an email to the Securities Commission of the Bahamas.

Tfoso

Tfoso