Full Guide On How To Trade Unusual Options Activity In 2021!

There was a time, when trading was not limited to open interest based online trading software like today. A time when people were more interested in using raw talent and keen observatory skills to predict any major market shift...

There was a time, when trading was not limited to open interest based online trading software like today. A time when people were more interested in using raw talent and keen observatory skills to predict any major market shift coming there way. Gentlemen, we are talking about the era of unusual options activity based trading.

The unusual options activity is more than just keeping record of the underlying stock like in the regular day trading.

The open interest ratio will be within the hands of potential large scale buyers of various options. All you need to do is look for any unusual activity.

But what kind of unusual activity? Well, according to experts of the field, you need to keep a record of any large scale orders going around.

But remember, the order will only be suspicious enough if the volume is closer or higher than the daily average agreements.

Image from ventsmagazine.com

Image from ventsmagazine.comHere Is Unusual Options Activity

Do unusual options activity have some kind of expiry date?

Back in the old days and even today, this is by far one of the hard facts associated with unusual option activity that is still frequently ignored by most traders.

To be honest, small details like these play a vital role in determining your day trading skills.

Options do have an expiration. They aren’t like regular stock/shares that can be traded through various online tools or platforms.

‘Options’ means a competitive market of buyers that are there to play the game in the bullish trajectory if nothing else. That’s why the potential buyers/investors of these options aren’t just sitting and waiting there for all eternity before someone makes a big profit.

The options come with a fixed expiry limit set by the buyer/investor. Till this expiration date, the buyer expects the underlying stock options to show some move made.

In other words, in the world of ‘unusual option activity and trading,’ these buyers are the true ‘market maker’. They often buy these options in large trading volume to generate hefty profits by taking the right investment advice. Once a major move is closed, the market itself begins to indicate.

Monitoring the activity like expert traders

So, you are an options trader looking for the exact way to monitor any unusual activities to predict your jackpot move? Remember, before diving deep into the details, you need to focus on a single trick of predicting any upcoming major event.

Once the options marketplace is ready to surprise you any minute, you will be able to observe the average daily option multiplying at an exponential rate.

The volume of open interests can go as high as possible but the healthy increase to predict and bet will be at least 5 times higher than the daily average pool.

Once the average volume of the option is skyrocketing, now is the time to direct your attention towards any potential large-scale orders coming your way. In other words, a major options market boost indicates a large-scale movie that’s about to happen in the form of a major or a series of major individual orders.

But what does it even indicate? Well, according to experts, such an input hike is mostly a result of someone having some ‘insider knowledge’ about any major development going on with any option. Because of this, the unusual activity becomes quite noticeable most of the time.

Can I elaborate further with an example?

Of course, I can. Don’t worry if you don’t fully understand all the open interest and marketplace technicalities right now.

It takes time to gain experience and strengthen your base in the market. After all, even I didn’t become an expert in the field in a single day or so.

Let us say, we are dealing in a market with an average daily volume of 10,000 trading contract.

On any regular day, the average daily volume for the marketplace will lie around the 10,000 per day contracts limit. It can increase or decrease occasionally but mostly it will be around this limit.

But a day comes, when you are noticing some kind of unusual options activities going on.

Now, you are going to face two basic scenarios in this case. first, the average daily volume will suddenly skyrocket to the range of 20,000 contracts or more associated with a single trade move.

Most large institutions and bulk option buyers use another strategy instead of going with single large-scale trade activity. To minimize the element of suspicion, the parse down a big trading move like this into various fragments of different volumes.

But don’t worry, all the transactions will eventually pass through a single unified point from where you can predict the marketplace trends.

Image from reddit.com

Image from reddit.comScanners to monitor unusual options activity

You might have heard about the term ‘stock screeners’, but I bet most of the option traders don’t even know to effectively use one. This is something that usually comes under the assistance’s duties.

If we talk about the current decade, in particular, the option for scanning stock for any kind of unusual options market activities going around comes in the built-in form in most of the trading platforms.

In this way, traders can easily monitor and get notified regarding any suspicious options contracts.

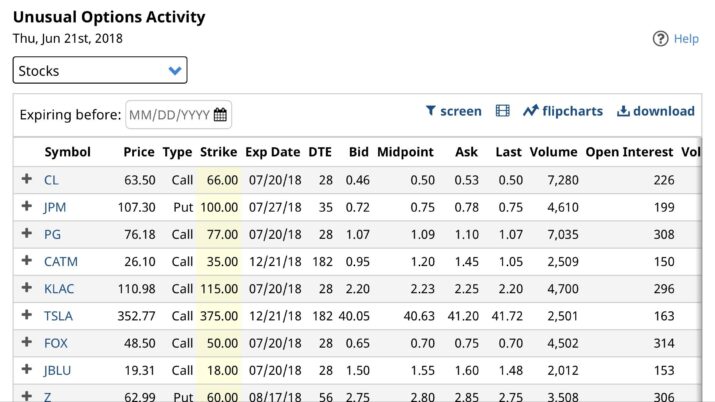

Which is the best screener in the marketplace today?

Well, if you are particularly looking for screeners/scanners that even generate earnings reports as well, then screeners offered by BlackBox Stocks and Benzinga are the ones most preferred by options chain analysts throughout the globe marketplaces.

Also, the scanner will detect any possible unusual option activities with great accuracy and even in a short period, the earnings report and long-term accuracy depend upon the kind of screener you are using.

Going with the paid unusual options activity will be the better option in the long run as compared to the free sites.

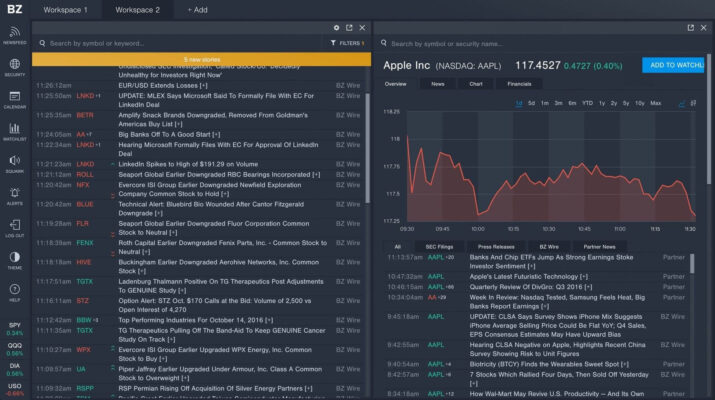

Benzinga

According to experts, when it comes to options activities scanners and monitors, there is no way you are going to find any option better than Benzinga in terms of build and work dynamics.

Along with keeping a keen eye on all the upcoming trades and potential trading outcomes your way, Benzinga also offers its services as a trading platform.

Plus, as an option monitoring day trading expert, you already know the credibility associated with the Benzinga Pro name when it comes to providing real-time stock, trading, and volume alerts with great accuracy.

The big movement monitoring and stock alerting system integrated with the Benzinga terminal is based on the ‘Squawk Box Feed’ model. In other words, whatever major development or marketplace changes are taking place, traders are going to get reports direct from on-the-spot reporters within a matter of minutes.

Proving to becomes an essential tool for traders focused on options and stock day trades, you can get the Benzinga Pro complete trading and monitoring setup at 1/10th price of what you will be eventually paying for the Bloomberg terminal.

But you aren’t going to find much of the amazing trading features offered by Benzinga even in the Bloomberg Terminal.

Image from vantagepointtrading.com

Image from vantagepointtrading.comCLICK HERE TO READ MORE ABOUT BENZINGA

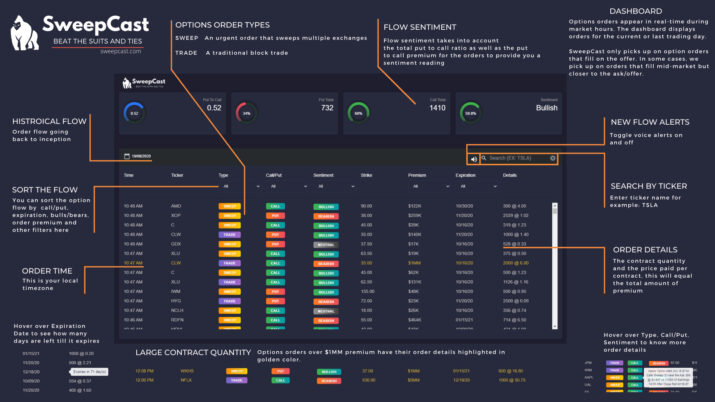

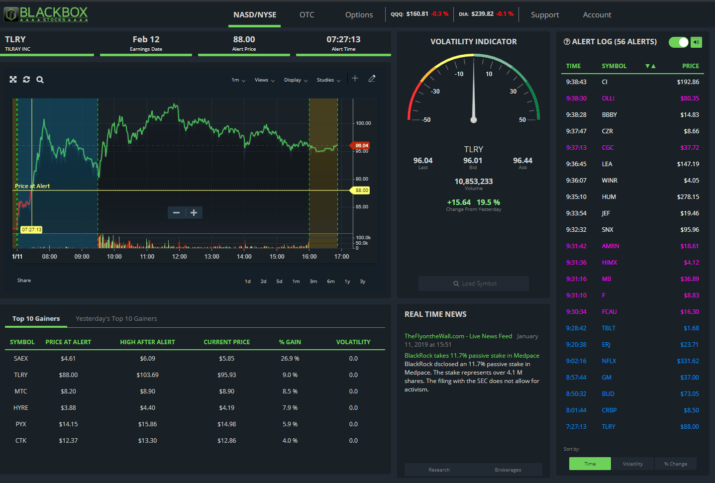

BlackBox Stocks

Another one of the all-time popular trades volatility and volume scanning platform that you can access at a super price plan.

According to the official stats launched by the platform for the year 2021, the trading and scanning platform deals with real-time new and buy order details related to around 8000+ stock and roughly 900000 options agreements.

And with the unique tools accessible to traders around the globe, the BlackBox Stocks scanner has become the preferred choice among trades monitoring and unusual options activity monitors quite fast.

But how exactly do the BlackBox options trading and stock scanner even work? Well, the company claims to use an integrated model that allows the real-time monitoring and news delivery system to sync in with a power AI-powered website engine.

As a result, the traders get real-time accurate trading data within seconds.

In my expert opinion, the one true Rockstar feature that gives BlackBox Stocks a prominent edge over other popular trading and agreement scanners is the volatility indicator.

Besides volume, the volatility indicator chart will also make projections for the future and how trades will be affected under the influence.

Image from tradingreview.net

Image from tradingreview.netCLICK HERE TO READ MORE ABOUT BLACKBOX STOCKS

The perfect strategy to use scanners!

Once you have selected the best scanner according to your trading and monitoring requirements, now is the time to focus on potential strategies traders can use to operate the scanner.

Remember, the strategy you are going to choose will greatly influence your trading buy/sell choices and results.

Besides informational purposes, you must fully understand and implement strategies the scanning strategies that will create exceptional volume evaluation and trades data in the end.

But with the level of technology integration we are experiencing in the field of stock and options trading, traders can easily find a scanner as well that will do all your work for you.

All you need to do is to manually set the scanner for a maximum and minimum money volume and any unusual trades. As a result, the scanner will become your AI-powered 24/7 scanning assistance making sure that everything is in order. However, if you are an old-schooler like myself, you have to keep a keen eye on three basic trends to evaluate any unusual trades going on.

Increased short-dated options and volume in the OTM, Current Volume-Open interest, and finally large-scaled money-based inter-marketplace orders under the umbrella of a single CONTRACT.

Unusual Options Activity and the concept of Hedging trade

If you are dealing in the open interest-based setup, you must have heard the trading term of ‘hedge fund’ or ‘hedging’. Well, traders can consider it as the big move or trump card of large-scale trading giants.

9 out of 10 large-scale corporates have their very team of trading experts ( traders) that are working and accessing the marketplace 24/7 with high-end paid scanners.

Once the options price reaches a certain limit, the big movement will get in action acquiring options in bulk quantities.

After setting expiration deadlines, corporates like these will cease trade for some time.

This is a gesture showing that the corporate is expecting a big movement sometime shortly. As a trader, you should focus on such a ‘big move’.

But why do corporates prefer the hedging approach to do so?

As you already know, large-scale traders aren’t like most traders analyzing the shares and options on a short-term basis.

They are using the client’s money to trade and deal with shares/options.

That’s why, instead of selling shares and disrupting the open interest trade activities within a matter of minutes, they use a hedging approach to lower their influence on the short-term impact of options. Eventually indicating unusual options activity.

Conclusion

So, you have finally got the idea of how a prominent shares is actually traded under the umbrella of unusual daily volume options activities.

Besides informational purposes, now it is your duty to implement the marketplace knowledge you have acquired so far. Don’t worry, you will ace your way out for sure.

Just try to keep a few things under control. First, don’t make any big movement in haste. It doesn’t matter if someone is all set to buy order in the next minute or so. You have your database with you to help you make the best choice.

Second, the market will swindle more than you like. For instance, one day the daily mass would be hitting the mark of 10,000 and the very next day hardly 1000.

This is the beauty of options activities marketplace according to experts. You just simply don’t know what is coming your way.

And third, keep a keen eye on the shares and who is pilling them up. Once the contracts begin to flood in for traders, the marketplace is going to become too condense for you to even use.

That’s why planning early is the best planning you can do when it comes to options activities trading. And if you are someone who acknowledge the power latest technology, using platforms like Benzinga and BlackBox Stocks share screeners can come in handy.

Image from tradermentality.com

Image from tradermentality.comCLICK HERE TO GET BENZINGA AT A DISCOUNTED PRICE

F.A.Q.

How To Find Unusual Options Activity?

The secret to successfully trade and find potentially powerful shares depends upon your ability to keep an eye on daily contract getting updated.

Once the limit crosses the average daily mass for a particular traders’ option, you can say that you have got closer to a big move coming.

For example, if the average money/stock flow for one day was limited to 10,000 contracts, how can you predict a big move coming up?

That’s right, if the trade volume is about to hit 20,000 a day, then you can successfully predicts that the merchant has already some insight knowledge regarding an upcoming hike.

How To Find Unusual Options Activity using Thinkorswim?

Once you have logged in the Thinkorswim setup, you can easily start accessing the current marketplace trends and any unusual options activity by going with the ‘sizzle scan’ option.

It will allow you to target a particular stock and even help you take a look at the current earnings report of it.

For example, if you think that ABC stock is showing options options activities that’s a bit peculiar for the trade market today, you can use sizzle scan to verify any current large scale contracts going around.

How To Scan For Unusual Options Activity Thinkorswim?

First, click on the bottom left corner of the Thinkorswim platform in order to access the sizzle scan module. Once opened, you can already see stock options activity along with date of the contracts and the money made so far. From here on, you can take a look at the stats quite easily.

But lets say, the options activity trade you were looking for is not showing. Don’t worry, you can customize the scan dynamic by clicking on ‘options’. Once clicked, you will be able to adjust the marketplace money cap as well as the buy/sell earnings report associated with a stock.

How To Spot Unusual Options Activity?

Here’s the real deal, keep an eye on the marketplace trends traders price activity related to a particular stock. Once you start noticing some peculiar buy/sell activity going with a particular stock on a particular day, understand that a big move is coming your way.

Take the necessary buy/sell actions before the big move and enjoy the perks of acting on the right stuff at the right moment.

Even if you don’t want to trade at the very moment, you can invest your money in a particular stock and wait for the next big movement shown by the merchant which will be very soon.

How To Track Unusual Options Activity?

Tracking any kind of unusual options activities is all about keeping an eye on stock and volume. Once the trades begin to fill in, you would have already lost the perfect opportunity trading.

That’s why, using a tracking platform like Benzinga or Blackbox shares can come in real handy for traders around the globe.

Make sure to enable any notifications regarding the underlying stock as well, it will prove to become extremely beneficial in the near future when it comes to earnings report.

The notifications will also help you to know more about the options markets and what buyers are thinking now.

CLICK HERE TO GET BENZINGA AT A DISCOUNTED PRICE

Like this Article? Subscribe to Our Feed!

Author: J Maver

Passionate in tech, software and gadgets. I enjoy reviewing and comparing products & services, uncovering new trends and digging up little known products that deserve an audience.

JaneWalter

JaneWalter