GoGet integrates an easy-to-use EPF savings feature in its app to empower gig workers

GoGet has partnered EPF to provide gig workers with access to financial security via an integrated saving feature on its app.

GoGet Malaysia, a Malaysian community platform that connects gig workers to businesses, has launched an integrated savings programme with Employees Provident Fund (EPF).

EPF is a Malaysian government agency that manages a compulsory savings plan and retirement planning for private and non-pensionable public sector employees.

According to the GoGet team, they’re likely the first gig work platform in the world to provide gig workers access to financial security through the GoGetter app.

The company’s partnership with EPF is a continuation of its vision to bring flexible work to the world sustainably, according to CEO and co-founder Francesca Chia.

Via a new in-app feature on GoGet, the team aims to simplify savings for gig workers by allowing them to customise their EPF contribution seamlessly.

Image Credit: GoGet

Image Credit: GoGetBut why carry out such an initiative? Francesca’s answer was simple: to ensure gig work is taken as a serious option, workers must receive the benefits of full-time employment. And through GoGet’s new integrated feature, those benefits can now be accessed on an on-demand basis.

Importance of EPF

During the signing of the memorandum of understanding (MoU) between EPF and GoGet on 23 February, EPF said in a statement that the collaboration was part of its agenda to cast the social security net wider and extend coverage to those in the informal sector and gig workers.

EPF has signed a similar MoU with Grab Malaysia previously, but GoGet really hones in on the seamless aspect of their app.

“There have been other business modes in the nation where it’s just an encouragement to save but they don’t support the actual act of saving seamlessly,” Francesca said. “Whereas what we do is we have really done a feature in the app where through a click of the button, you can automatically [enable] a portion of your savings to go to EPF.”

Image Credit: GoGet

Image Credit: GoGetAside from EPF, GoGet has also partnered with other government bodies such as SOCSO, PDIM, and MDEC’s B40 programme. In doing so, the company is able to offer social security, free in-app financial literacy content, and job placements for those in the B40 programme.

The company’s actions seem to align with their commitment to supporting the platform’s gig workers. In fact, GoGet’s CEO was recently appointed to the National Employment Council, an initiative to come up with strategies that create and preserve jobs in Malaysia.

GoGet’s vision for the gig economy

The inspiration for GoGet to provide this feature stems from the GoGetters themselves, who have requested statements of income in the past to apply for loans.

“It hit me that there are financial solutions that the hardworking B40 segment of Malaysia, which is the backbone of our labour market, is trying to tap into,” Francesca shared. “The question was, was the financial protection system really serving the hardworking individuals?”

Thankfully, she found that the Malaysian government was open to ideas. The main challenge for introducing the EPF feature then is education and adoption for GoGetters.

The barriers to the adoption of the feature are mitigated by making the process as seamless as possible. Gig workers don’t have to visit a different site to contribute as their EPF accounts are linked to their GoGet profile.

“It’s very similar to full-time EPF, you don’t see you saving but it’s integrated into your pay slip process,” Francesca explained.

As for the education portion, EPF has provided GoGet with content discussing the benefits, and the information is incorporated into the EPF feature on the app itself.

In the future, GoGet hopes to continue supporting the gig economy by providing more benefits such as rewards and possibly micro-loans.

EPF and self-employment

The EPF functions by requiring a contribution of at least 9% of each member’s monthly salary, which is then stored in a savings account. The member’s employer is obligated to additionally fund at least 13% of the employee’s salary to the savings at the same time.

Things work a little differently for those who are self-employed. There are two options for such individuals: self contribution or i-Saraan.

Through the Voluntary Contribution with Retirement Incentive (i-Saraan), self-employed individuals who don’t earn a regular income can make voluntary contributions towards their retirement. At the same time, they can receive additional contributions from the government.

The difference between voluntary contribution and self-contribution is that the latter doesn’t receive additional governmental contributions.

But regardless of whether a GoGetter qualifies for i-Saraan or only self-contribution to EPF, GoGet enables them to contribute easily from within the app itself.

With 26% (about 4 million people) of Malaysia’s labour force forming part of the growing gig economy, GoGet’s EPF initiative is a good step towards safeguarding the welfare of gig workers, by providing them with tools and access to save voluntarily.

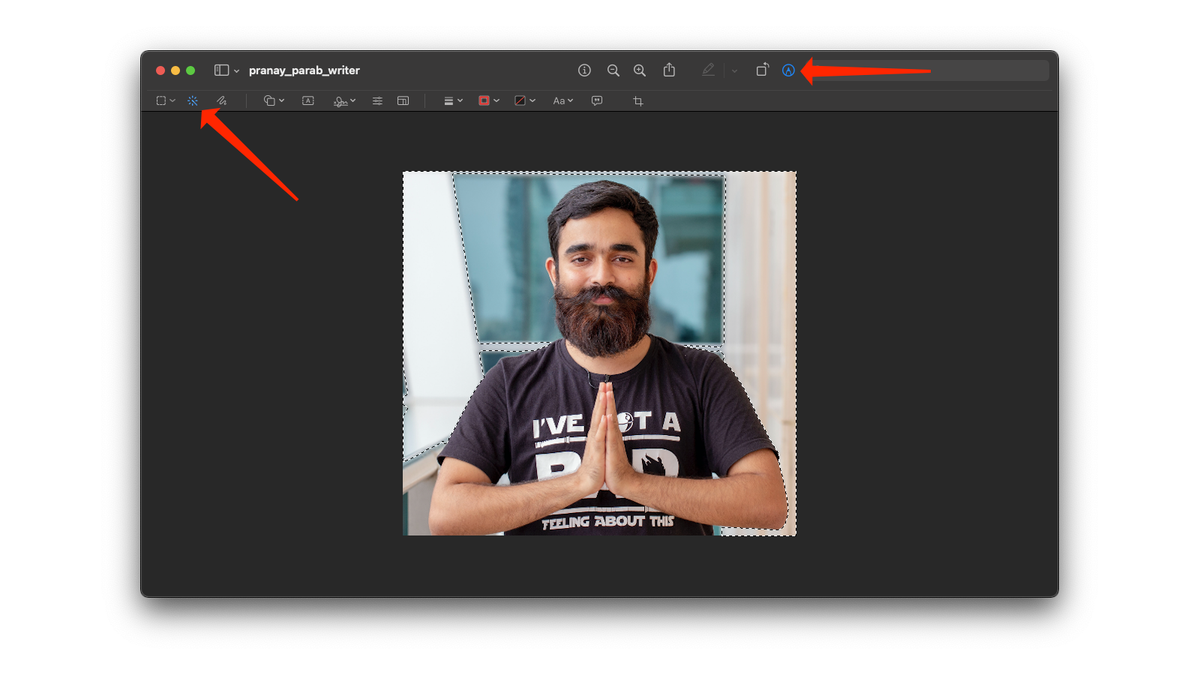

Learn more about GoGet here.Read other articles we’ve written about Malaysian apps here.Featured Image Credit: Francesca Chia, co-founder and CEO of GoGet

FrankLin

FrankLin