Google to Alibaba: Here are 5 global tech giants competing for supremacy in the AI arms race

Ever since the launch of ChatGPT, AI development has been kicked into overdrive. Here are the tech giants looking to conquer this field.

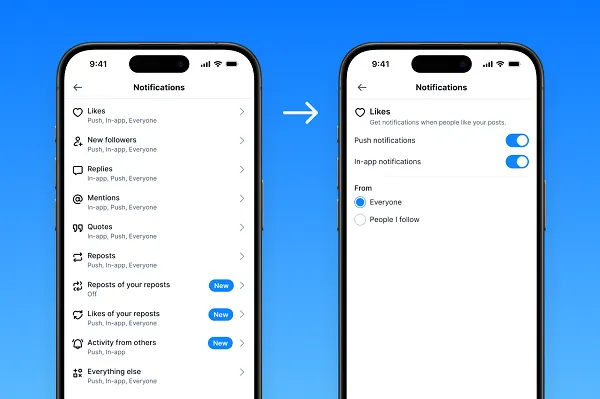

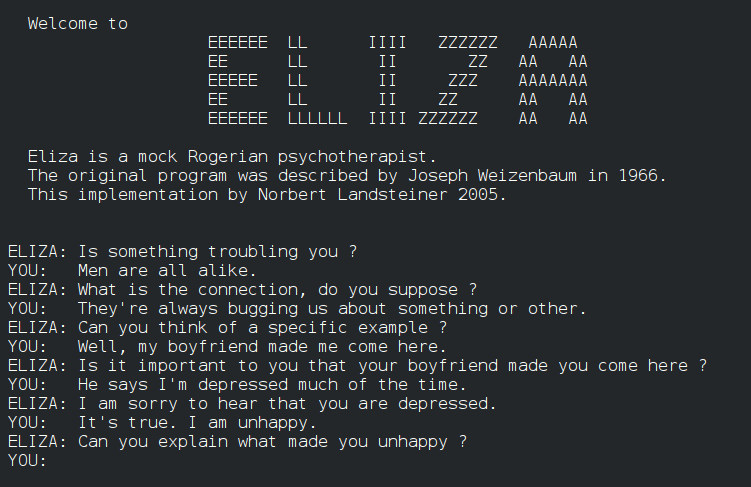

Chatbots aren’t a new concept — in fact, the first one, Eliza, dates way back to 1966.

Eliza was trained to recognise keywords and in turn, ask relevant questions. It didn’t have any real knowledge of the world, but could get away with sounding human for short, superficial conversations.

Eliza is known to be the first ever chatbot, created to mimic a psychotherapist

Eliza is known to be the first ever chatbot, created to mimic a psychotherapistSince then, the technology has evolved leaps and bounds. Online retailers often use chatbots in place of customer support, saving man-hours on generic and straightforward queries.

Virtual assistants like Siri and Alexa are another example, capable of providing weather forecasts, sending calendar invites, and scouring the web to answer questions.

Take it a step further and we arrive at the launch of ChatGPT. Its functionality goes beyond simple call-and-response to answering open-ended questions, summarising existing text, and even writing creative content. The following iteration GPT4 can even take visual inputs and describe the contents of an image.

Since its launch last November, ChatGPT has been a disruptive force in the world of technology. Within five days, the app had a million users and by the second month, that number had grown to 100 million.

At the time, OpenAI – the company behind ChatGPT – had received over US$1 billion in funding from Microsoft dating back to 2019.

With this launch, the two companies extended their partnership and in January 2023, Microsoft committed US$10 billion to their collaboration. By doing so, the tech giant took an early lead in the AI arms race which is unfolding today.

Heading forward, here’s a look at the major players fighting for generative AI supremacy.

1. Google

Following the launch of ChatGPT – a direct threat to Google’s search engine services – Google issued a ‘code red’ to devote greater effort to its AI-related products. Within the company, teams switched gears to work on prototypes which could generate art and other graphics.

Within two months, they had come up with a response to OpenAI: Bard, a conversational AI tool powered by Google’s own language processing model LaMDA. Unfortunately, Bard’s debut didn’t go according to plan.

In an announcement video showcasing the chatbot’s prowess, viewers noticed that Bard had been inaccurate in one of its responses.

This caused Alphabet – Google’s parent company – to lose US$100 billion in market value the following day as its shares dropped by around nine percent.

In late March, Google launched Bard for public access in the US and UK with plans to expand to more countries and support more languages over time. As research and public opinion would have it, Bard lags behind ChatGPT – not even GPT4 – in many functions, suggesting that Google’s search engine monopoly may still be under threat.

2. Amazon

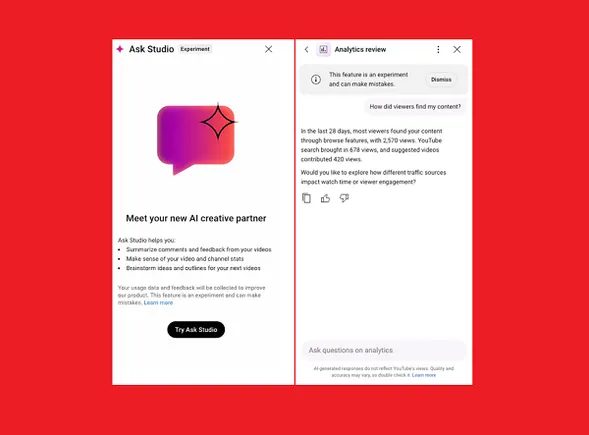

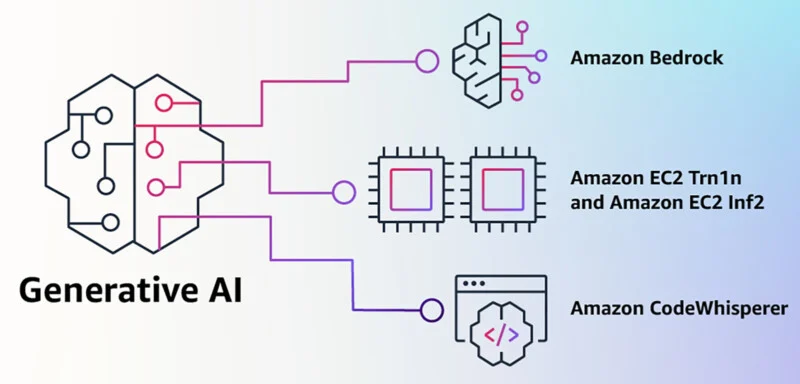

Amazon is among the latest tech giants to join the AI race with a number of services targeted at developers and businesses.

The first, Amazon Bedrock, is a B2B tool which will allow companies to build chatbots and generative AI tools without having to manage their own infrastructure or language models. Companies will be able to customise models with their own data to build personalised search tools, customer service bots, or text generators.

Image Credits: Amazon

Image Credits: AmazonAs part of Bedrock, Amazon has also launched two of its own large language models including Amazon Titan, which is capable of functions such as text summarisation and answering open-ended questions.

Beyond this, Amazon is building chips which are optimised for generative AI applications and has launched a free software called CodeWhisperer, which can provide real-time coding assistance to developers.

3. Baidu

The AI arms race has attracted companies from around the world including Baidu, the builders of China’s leading search engine.

As of December 2022, Baidu represented over 60 per cent of China’s search engine market share – Bing took third place at 12 per cent and Google didn’t even make the top five with three per cent.

Upon announcing its chatbot – called ERNIE Bot in English – in February, Baidu’s stock price rose by over 15 per cent in a single day. This was quickly reversed in March when the bot was actually unveiled.

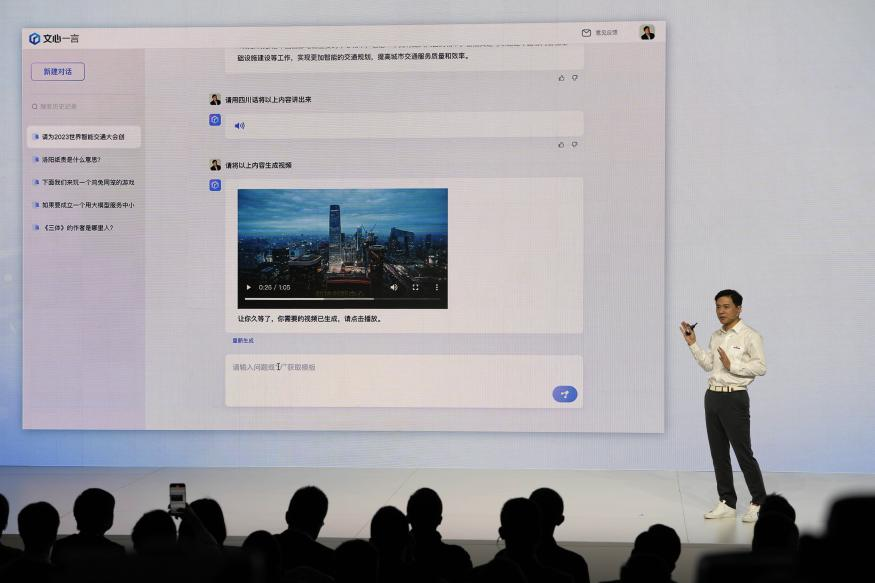

The unveiling of ERNIE Bot / Image Credits: Baidu

The unveiling of ERNIE Bot / Image Credits: BaiduA presentation of ERNIE Bot’s capabilities wasn’t well-received as it seemed scripted and didn’t show off the bot being used in real-time. CEO Robin Li even mentioned that the tool wasn’t perfect and they were only unveiling it due to the market demand.

As it stands, ERNIE Bot isn’t open for public use. Those who have used the bot reveal that it’s far better optimised for subjects concerning the Chinese market. It also adheres to the country’s censorship standards and doesn’t answer questions which may be considered “sensitive” by the government.

4. Microsoft

Following its partnership with OpenAI, Microsoft remains the leading player in generative AI. It has introduced this technology across a range of services, most notably the Bing search engine.

With the launch of the Bing Chat, the search engine crossed 100 million daily active users for the first time ever. According to SimilarWeb, the integration of ChatGPT accounts for a 15 per cent increase in traffic.

This is in line with Microsoft’s aim to grow its digital ad revenue stream. In the past 12 months, the company has grown its advertising business by around 80 per cent, largely supported by the growth of Bing.

That being said, Microsoft still lags well behind Google which generated more than 10 times the amount from advertising in 2022.

Apart from Bing, Microsoft is also introducing generative AI technology across its suite of Office products. Dubbed Microsoft Copilot, users can now make use of AI to help create presentations, write content, and visualise spreadsheet data.

5. Alibaba

Chinese e-commerce giant Alibaba has also thrown its name in the hat, with CEO Daniel Zhang acknowledging that generative AI heralds a watershed moment for the tech industry.

In April, the company announced plans to debut its own ChatGPT-style bot called Tongyi Qianwen. While there’s no set date on the launch, the company plans to integrate this product across its range of apps.

Image Credits: Code & Hack

Image Credits: Code & HackStarting off, Tongyi Qianwen will be available as part of DingTalk – a popular enterprise communication app with over 100 million users in China – wherein it’ll help users draft emails and summarise notes among other functions.

Similar to Amazon, Alibaba will also take on B2B clients who can build their own large language models and deploy AI apps using Tongyi Qianwen.

Featured Image Credit: Forbes / Reuters / BBC / CNBC

MikeTyes

MikeTyes