How OTA Taxation Benefits the Global Economy

Written by Ritesh Raj, Co-Founder and COO The concept of online travel agencies (OTAs) has revolutionized the way people book their travel accommodations. As the co-founder of one of the current market leaders, I know first hand that one...

Written by Ritesh Raj, Co-Founder and COO

The concept of online travel agencies (OTAs) has revolutionized the way people book their travel accommodations. As the co-founder of one of the current market leaders, I know first hand that one often overlooked aspect of OTAs is their impact on the global economy through taxation. By collecting and remitting taxes on behalf of their users, OTAs play a crucial role in supporting local economies and government budgets. In this article, we will explore how OTA taxation benefits the global economy. Let’s get deeper into this notion:

Promotes Transparency and Compliance

One of the key benefits of OTA taxation is that it promotes transparency and compliance. OTAs are required to collect and remit taxes on behalf of their users, ensuring that governments receive the revenue they are owed. This helps to prevent tax evasion and ensures that all businesses are operating on a level playing field.

Additionally, by providing a centralized platform for tax collection, OTAs make it easier for governments to track and monitor tax payments. This reduces the burden on tax authorities and helps to increase overall tax compliance.

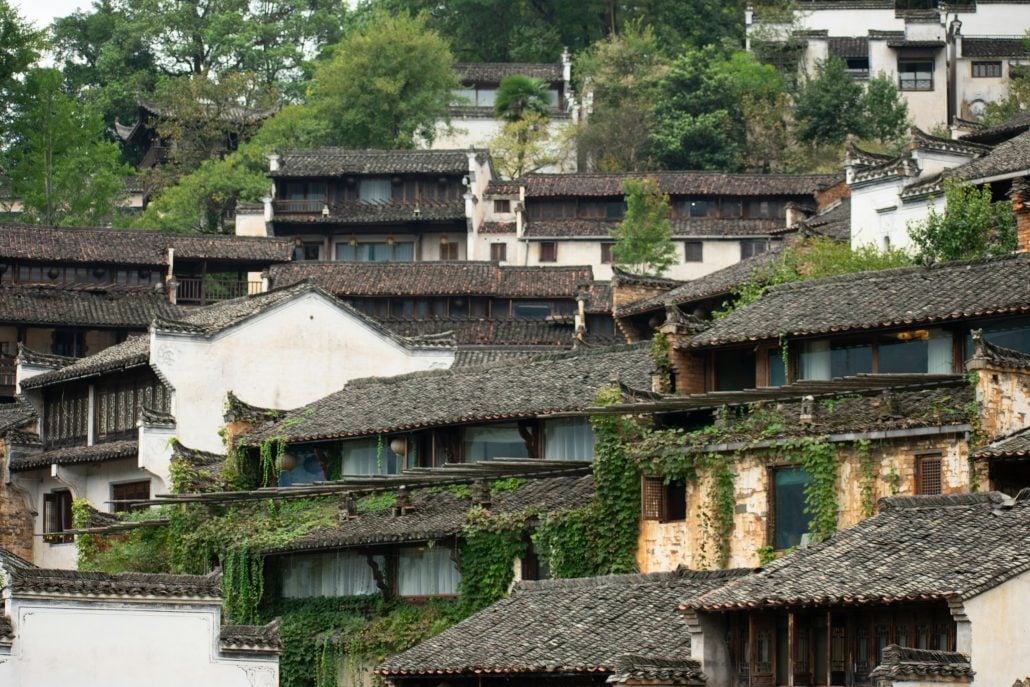

Supports Local Economies

Another important benefit of OTA taxation is that it supports local economies. When travelers book accommodations through OTAs, a portion of the revenue generated is collected as taxes and remitted to the local government. This tax revenue can be used to fund essential services such as infrastructure improvements, public transportation, and education.

By supporting local economies, OTAs help to create jobs and stimulate economic growth. This can have a positive impact on the overall well-being of communities and help to reduce poverty and inequality.

Did you know that CuddlyNest was designed to help every type of traveler, find any type of accommodation, for every type of trip? Try it here!

Fosters International Cooperation

OTA taxation also fosters international cooperation. As travelers increasingly book accommodations across borders, it is essential that taxes are collected and remitted to the appropriate jurisdictions. OTAs play a critical role in facilitating this process, ensuring that taxes are paid in accordance with local regulations.

By working with governments around the world to collect and remit taxes, OTAs help to strengthen international cooperation and promote economic stability. This can lead to increased trust between countries and foster a more harmonious global economy.

Promotes Sustainable Tourism

Finally, OTA taxation can help to promote sustainable tourism. By collecting taxes on behalf of their users, OTAs can incentivize environmentally friendly practices and responsible tourism. For example, governments may choose to impose a “green tax” on hotels and accommodations to fund conservation efforts and promote sustainable development.

By supporting sustainable tourism, OTAs can help to protect natural resources, preserve cultural heritage, and promote responsible travel practices. This can have a positive impact on the environment and ensure that future generations can continue to enjoy the benefits of tourism.

The CuddlyNest Promise was implemented in 2023, and addresses our responsibility to this issues in relation to the customers we serve.

UsenB

UsenB