Inside Dollar General's retail media network that includes Meta partnership

Fastest-growing store in the U.S. builds in-house ad operations to service brands such as Unilever.

Dollar General is building an in-house retail media network, with a recent assist from Meta, as the discount chain store packages its large audience of rural customers into media deals with large brands.

Dollar General is the fastest-growing retailer in the U.S., after opening more than 1,000 stores last year, and its customer base is mostly in the rural parts of the U.S. Last year, Dollar General took its biggest step into retail media by in-sourcing all of its ad operations, which used to run through Quotient, the retail advertising platform. Dollar General is growing its in-house ad sales, ad operations and analytics team, and it is forging marketing tech partnerships, including one with Facebook parent Meta.

“The most interesting piece is that it’s rural America and that it’s lower-income America,” said Chad Fox, Dollar General’s chief marketing officer, talking about the retailer’s media services. Dollar General has more than 19,000 stores in the U.S., but people in big cities like New York and Los Angeles might not know that, since about 75% of the stores are outside major metropolitan areas, Fox said.

Related: A guide to retail media networks

Like so many retailers, Dollar General is evolving its marketing services for brands that appear in the stores. Dollar General’s budding retail media network went from 21 vendors last year to 51 so far this year, Fox said. The vendors are consumer goods companies such as Unilever, with multiple brands under their umbrella. The retailer plans to rev up to almost 125 vendors, but would not share exact ad sales figures with Ad Age.

Dollar General has a “scrappy” retail media team, Fox said, and it's grown tenfold in the past 18 months. Fox would not say the exact size of the team. It’s going up against some much larger players, such as Walmart, which has been quickly moving into advanced advertising services for the brands in its stores. Target, Walgreens and Kroger are as well. U.S. retail media ad spending is expected to cross $50 billion in 2023, rising 26% from 2022, according to Insider Intelligence. In a tighter economy, as advertisers count every penny spent and shoppers deal with inflation, retailers see media services as one of their best growth opportunities.

Earlier this year, brands were surveyed about the rise in retail media networks, and they were conflicted on the concept. Advertisers were called “reluctant buyers” by the Association of National Advertisers, because they felt pressured to invest in them by the retailers that carry their goods.

Read more: Retail media networks attract 'reluctant buyers'

Dollar General generated $37.8 billion in sales in 2022, an increase of 10.6% from 2021, but expects sales growth to slow, predicting 6% growth in 2023. By comparison, Walmart handled $572.8 billion in sales in 2022, up 2.4% from 2021.

Retail tech

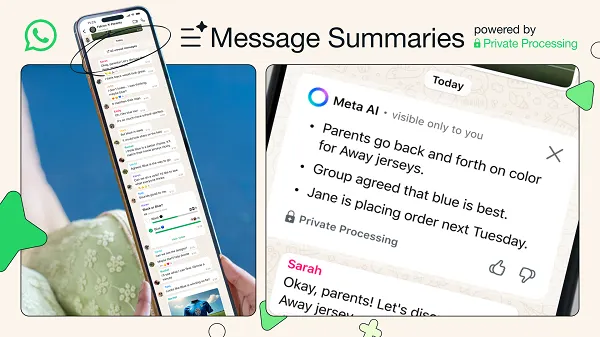

Now, Dollar General has its strategy set in ad tech, with the Dollar General Media Network. Last month, Dollar General struck a measurement partnership with Meta, which has also been working with retailers such as Walgreens. Last month, Meta was at ShopTalk, the retail industry confab in Las Vegas, discussing new integrations with major stores. At the event, Meta talked about new products for retailers, which connect data from customer relationship management platforms to target ads.

“Retailers are more closely partnering with the CPG brands they stock to create ad campaigns that reach customers across a variety of online surfaces, from apps to e-commerce sites and social media,” Meta said in its announcement at ShopTalk.

Also read: TikTok-Instagram rivalry heats up with search marketing

Retail media is viewed as such a lucrative category because brands are looking for more ways to apply data to ad campaigns under new privacy restrictions across the web. One of the biggest changes in recent years has been around third-party cookies. Apple has constrained the use of cookies on Safari web browser, and Google is expected to do the same on Chrome by the end of next year. Without cookies and other trackers, marketers can’t readily target ads on the open web, and they can’t track whether an ad worked. That’s where retail media networks are stepping in.

The retailers have direct relationships with customers to get permission to use their information. Platforms and publishers, including Meta, are creating new marketing infrastructures to use the data without leaking or compromising it.

One way Meta keeps limits on its data is by using aggregates of consumers, not sharing one-to-one matching that could point to an individual, Fox said. Dollar General uses Meta’s marketing API—application programming interface—to connect sales data from stores to ad campaigns. It cannot sync an individual sale to a particular Facebook user, it can only look at anonymized cohorts comprised of 100 people. Fox calls the Meta integration an “advanced measurement API environment.”

Last year, Walmart Connect, the ad platform by the retail behemoth, crafted measurement partnerships with Snap, TikTok and Roku.

Dollar General started testing the Meta partnership last year and worked with Unilever, a general merchandising brand and a large beverage brand, Fox said, without disclosing all the names. Unilever is using the Dollar General media network to “gain more valuable insights and data on our campaign performance,” according to Jennifer Bryce, head of U.S. retail media at Unilever, commenting in a press release about the partnership. The measurement is “closed loop,” because Dollar General matches actual sales in the stores back to the ads that ran online.

Data crux

Dollar General is using its first-party data to track sales and analyze advertising spending investments on Meta, Fox said. Dollar General has more than 90 million customer profiles with 14,000 unique attributes that go into the picture. “We really built out our first-party data and that’s really the crux of everything,” Fox said. “We’ve got a very clear picture of who these customers are, and we can reach them with paid media.”

Dollar General also ties into The Trade Desk, the demand-side ad platform, and uses LiveRamp, online identity platform, for clean room services. Clean rooms are data vaults where marketers take their customer information sets to analyze them alongside data from publishers and other sources.

“Those two partnerships enabled us to take our unique data set, our large first-party data set,” Fox said, “and then match that up from an identity graph standpoint, so that we can reach those people on their many devices and reach them on the open internet.”

Dollar General’s website and app see about 5 million active users a month, Fox said. Its brands in the media network place product listing ads there, which the brands can do through a self-serve ad platform. But 90% of the media is bought off site, on Meta, connected TV, and the open internet, Fox said. Dollar General provides managed services to handle that buying. On The Trade Desk, where advertisers use the platform to transact across dozens of ad exchanges, those buyers can access Dollar General audiences and measurement services, Fox said.

“So, if you’re a CPG … maybe you’ve shifted a lot of your linear TV into CTV or with [online display],” Fox said. “You have the ability, if you’re one of our advertisers, to tap into our audiences, or work with us directly to build bespoke audiences that can be available to you on The Trade Desk. … And then get measurement at the granular level of how it performed.”

Tekef

Tekef

.jpeg&h=630&w=1200&q=100&v=a905e78df5&c=1)