J&J, Merck and Bristol Myers CEOs defend high drug prices in Senate hearing, as Biden tries to cut costs

The push to cut drug prices is one of those rare hot-button issues that unites the two major political parties.

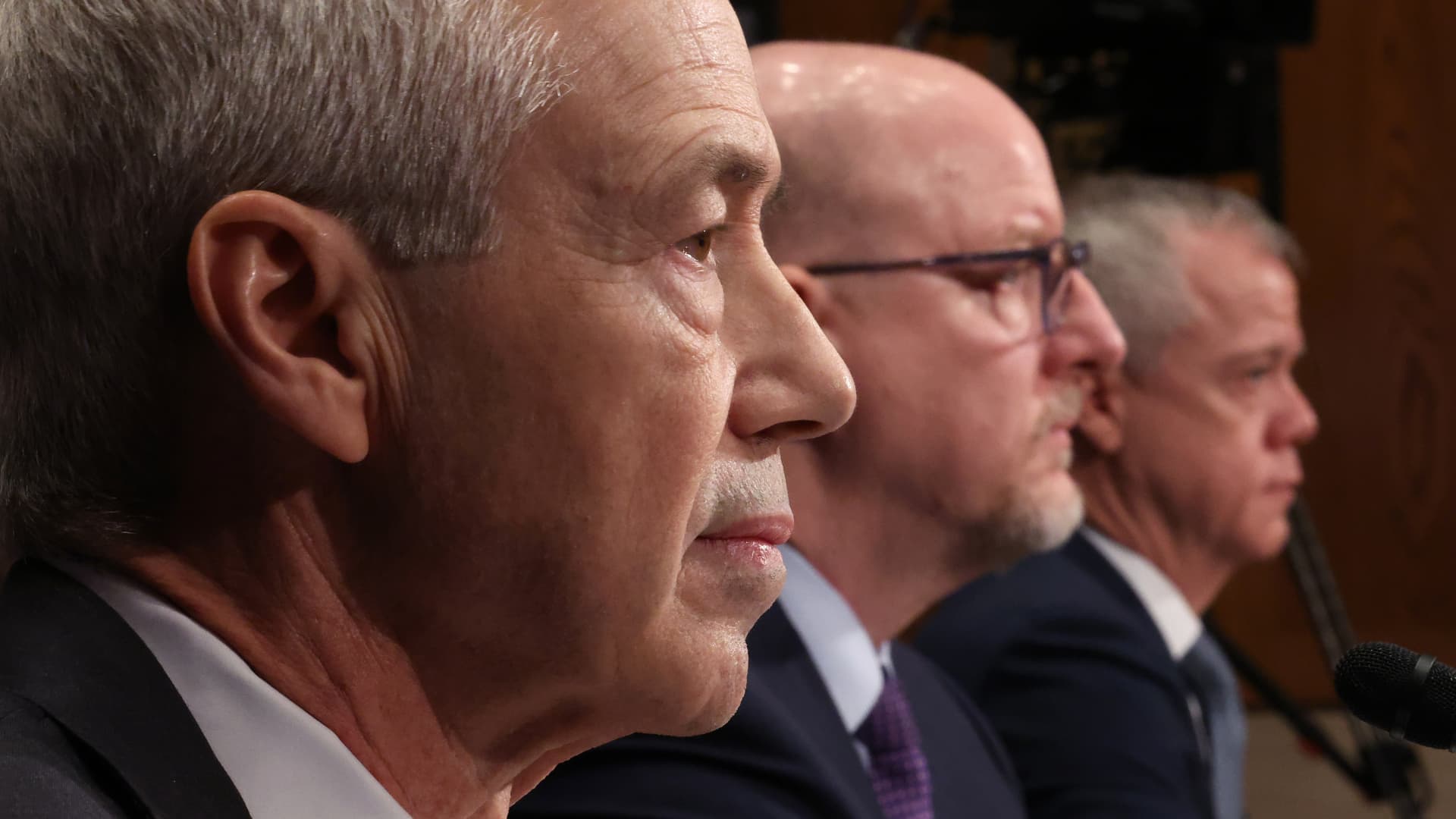

(L-R) Joaquin Duato, CEO of Johnson & Johnson, Robert Davis, CEO of Merck, and Chris Boerner, CEO of Bristol Myers Squibb, testify before the Senate Health, Education, Labor, and Pensions Committee at the Dirksen Senate Office Building on February 08, 2024 in Washington, DC. The Committee held to hearing to investigating the cost of prescription drugs. (Photo by Kevin Dietsch/Getty Images)

Kevin Dietsch | Getty Images News | Getty Images

The CEOs of Johnson & Johnson, Merck and Bristol Myers Squibb defended high drug prices in the U.S. at a Senate hearing Thursday, as the White House and lawmakers on both sides of the aisle work to rein in high health-care costs for Americans.

The push to cut drug prices is one of the rare hot-button issues that unites the two major political parties, though they often back different approaches to reducing costs.

The Senate Health, Education, Labor and Pensions Committee hearing comes at a pivotal time, as the Biden administration starts a long-awaited process to negotiate drug prices directly with manufacturers — which is expected to ease pressure on seniors' wallets.

At the hearing, Merck CEO Robert Davis and Bristol Myers Squibb CEO Chris Boerner did not commit to cutting the prices of certain drugs in the U.S. to match the lower prices in other high-income countries, such as Canada and Japan.

But they said they would welcome cheaper copycats into the market when the main patents on each of their top-selling drugs expire. Drugmakers are notorious for using different strategies to extend the exclusivity of lucrative drugs.

J&J CEO Joaquin Duato also committed to lowering the price of its immunosuppressive medication Stelara in 2025, when competing drugs will be allowed to enter the market.

Roughly 9 million American adults did not take their drugs as prescribed in 2021 due to the high cost of medications, according to a federal survey. Prescription drug prices in the U.S. are more than 2.5 times as high as those in other high-income nations, another federal report showed.

The Senate panel said that's especially true for some of the top drugs from the three drugmakers testifying Thursday, including Stelara, Merck's immunotherapy drug Keytruda and Bristol Myers Squibb's blood thinner Eliquis. Eliquis and Stelara are both among the first 10 drugs subject to the Medicare price talks.

"The overwhelming beneficiary of these high drug prices is the pharmaceutical industry," Sen. Bernie Sanders, who chairs the Senate Health panel, said during the hearing.

Robert Davis, CEO of Merck, testifies before the Senate Health, Education, Labor, and Pensions Committee at the Dirksen Senate Office Building on February 08, 2024 in Washington, DC.

Kevin Dietsch | Getty Images News | Getty Images

The three CEOs acknowledged the high cost of health-care in the U.S, but said their prices reflect the value of their life-saving drugs to patients and the broader health-care system, along with their high investments in research and development.

They also claimed that medicines reach patients far faster in the U.S. than they do in other countries, and contended pharmacy benefit managers — middlemen who negotiate drug discounts on behalf of insurers and other payors — often pocket savings instead of passing them down to patients.

"Patients bear the brunt of a complex U.S. system that sees increasing health care costs and a lack of affordability. We have to make the system work better for them," said Boerner, adding that drugmakers "have a role to play in addressing affordability."

But he added that Bristol Myers Squibb supports policies that "lower patient out-of-pocket costs without ultimately harming innovation." Boerner did not point to specific policies.

Drugmakers want to protect innovation

Duato noted that J&J prices its drugs to meet its commitment to innovate and develop new medicines for patients, which requires a "massive" investment. J&J has spent nearly $78 billion in research and development since 2016, he said.

Merck, for its part, invested $46 billion in R&D between 2011 to 2023, and expects to spend another $18 billion in the 2030s, Davis noted during his opening remarks.

Meanwhile, Bristol Myers Squibb has spent more than $65 billion in R&D over the past decade, according to Boerner.

Still, a report released Tuesday by the committee said J&J and Bristol Myers Squibb each spent $3.2 billion more on stock buybacks, dividends and executive compensation than they did on R&D for finding new drugs in 2022. Merck, however, spent less on executive compensation than on R&D that year, the report said.

"I think most Americans would be pretty surprised, given how much the industry talks about research and development, that you are actually spending more money, shelling out money to investors and buying back stock than you are on research and development," Sen. Chris Murphy, D-Conn., told the CEOs.

But Duato argued that paying dividends is how J&J remains operational and sustainable, which enables the company to develop medicines in the first place.

CEOs say medicines reach Americans faster

Senators highlighted the disparity between drug prices in the U.S. and in other high-income countries. For example, Sanders said the current annual cost of Eliquis is $7,100 in the U.S., but just $900 in Canada.

He asked Boerner to commit to lowering the price of Eliquis in the U.S. to the drug's price in Canada.

Bristol Myers Squibb CEO Chris Boerner testifies before a Senate Health, Education, Labor, and Pensions Committee hearing on high drug prices on Capitol Hill in Washington, U.S., February 8, 2024. REUTERS/Leah Millis

Leah Millis | Reuters

But Boerner said he could not make that commitment, primarily because the two countries have "different systems that prioritize very different things." He noted that medicines in Canada are often harder to access and take considerably longer to reach patients in Canada than they do in the U.S.

Merck's CEO offered a similar response after Sanders asked him to commit to lowering the price of Keytruda in the U.S. to its price in Japan. The panel said the current annual cost of Keytruda is $191,000 in the U.S., but significantly lower in Japan, at $44,000.

"I think it's also important to point out that the access [to drugs] in the United States is faster and more than anywhere in the world," Davis said.

He added that Keytruda has many more approved treatment uses in the U.S., which is partly why the price of the drug is higher than in other countries.

Keytruda has 39 approved uses, or indications, across 17 cancer tumor types in the U.S., Davis said. That number is in the 20s in Europe and even lower in Japan, he added.

But those other indications often give a drug other patents, which allows companies to extend a medicine's exclusivity on the market. Senators noted that Merck holds 64 active patents and 51 pending patents on Keytruda.

Meanwhile, J&J currently has 15 active patents and 21 pending patents on Stelara. Bristol Myers Squibb holds 18 active patents and two pending patents on Eliquis.

"Pharmaceutical companies are doing everything that they can to keep their prices and their profit sky high....one way that companies do this is by filing dozens, even hundreds of frivolous patents that lock in their exclusive right to sell their drug for decades," said Sen. Maggie Hassan, D-N.H.

Don't miss these stories from CNBC PRO:

Forget 'FANG' and 'Magnificent 7,' the new hot portfolio is 'MnM,' says Raymond JamesWalmart just split its stock. History shows what will happen next with the megacapAlibaba, ASML and more: Jefferies reveals its 'highest-conviction' stocks to buy — and one has 118% upsideTesla is one of the most oversold stocks in the S&P 500 and could be due for a bounce

KickT

KickT