Kids store Camp offers ‘BANKRUN’ deal in plea for cash following SVB bank collapse

Kids store Camp asks customers for help following cash loss from Silicon Valley Bank's collapse.

The fallout from the Silicon Valley Bank collapse is already being felt by brands. Hours after news broke that the bank, a known lender to many tech brands, was out of money, one retail chain let customers know that it, too, had no cash on hand.

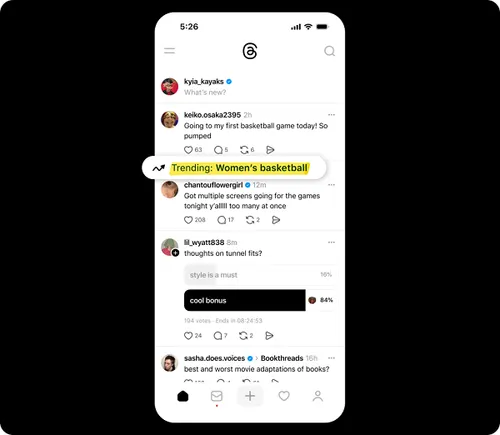

Camp, a popular children’s retailer, emailed its customers with a desperate plea for help on Friday afternoon. Signed by Co-founder Ben Kaufman, the former chief marketing officer of Buzzfeed, the email read, “Unfortunately, we had most of our company’s cash assets at a bank which just collapsed. I’m sure you’ve heard the news. We are hopeful that this will be resolved soon, but in the meantime we are turning to you, our most valuable customers, to help us.”

The email noted that all online merchandise through Friday and the weekend would be discounted by 40%. A banner ad on Camp’s retail site also advertised the sale, accessible through the appropriate code of “BANKRUN.” In the letter, Camp also suggested that patrons could pay full price without the code “which is also appreciated.”

Camp confirmed that it sent the email.

Shoppers appeared to scramble to take advantage of the deal, creating website snafus for Camp, which had slow load times and inaccessible merchandise for many trying to click to view items available for purchase.

Kaufman’s email noted that sales moving forward will deposit into Chase, which will enable the company to continue operations.

Founded five years ago as a family destination store in New York, Camp has grown to nine locations across the U.S. It recently partnered with Disney on a themed experience that includes offerings from Disney properties such as Mickey Mouse and the animated movie “Encanto.”

After efforts to find a buyer failed, SVB, which funds scores of venture-backed companies, was shut down by financial regulators on Friday morning. It had $209 billion in assets and some $175 billion in deposits, according to reports. The most recent similarly sized U.S. bank to collapse was Washington Mutual in 2008, CNBC noted.

FrankLin

FrankLin