McDonald's says it will sell its Russia business after previously pausing operations due to Ukraine war

McDonald's said it will sell its business in Russia, a little more than two months after it paused operations in the country due to its invasion of Ukraine.

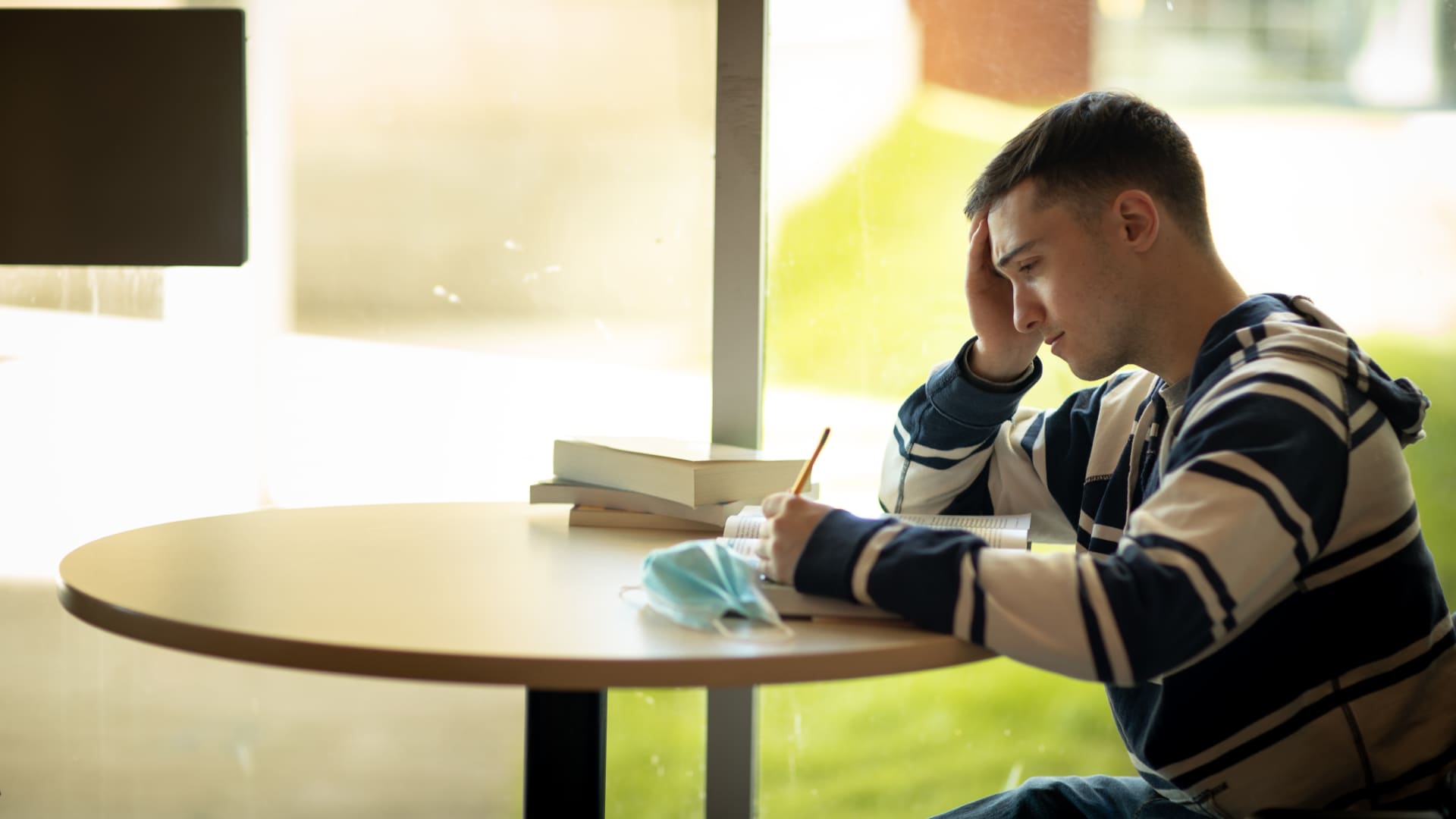

A view shows a McDonald's restaurant in Saint Petersburg, Russia March 8, 2022.

Anton Vaganov | Reuters

McDonald's said Monday that it will sell its business in Russia, a little more than two months after it paused operations in the country due to its invasion of Ukraine.

"The humanitarian crisis caused by the war in Ukraine, and the precipitating unpredictable operating environment, have led McDonald's to conclude that continued ownership of the business in Russia is no longer tenable, nor is it consistent with McDonald's values," the company said in a news release. Russian forces, directed by President Vladimir Putin, have been accused of an array of war crimes during their assault on Ukraine.

McDonald's exit from Russia is a bitter end to an era that once promised hope.

The company, among the most recognizable symbols of American capitalism, opened its first restaurant in Russia more than 32 years ago as the communist Soviet regime was falling apart and Western businesses and ideas infiltrated the Iron Curtain. At the time, hundreds of people would line up to to sample McDonald's burgers and fries at the Pushkin Square location in Moscow.

"If you can't go to America, come to McDonald's in Moscow," was a McDonald's ad slogan at the time in Russia, according to The Washington Post.

Now, McDonald's has more than 800 restaurants and 62,000 employees in Russia. Franchisees operate only 15% of its Russian locations, while the company owns the rest.

The company said it is seeking a local buyer.

"We have a commitment to our global community and must remain steadfast in our values," McDonald's CEO Chris Kempczinski said in Monday's release. "And our commitment to our values means that we can no longer keep the Arches shining there."

McDonald's announcement Monday is a stark illustration of how strongly the Western world has turned against Putin's regime. At first, following Russia's invasion of Ukraine, McDonald's kept silent about the attack. Then, after public outcry and pressure, McDonald's and major U.S. brands such as Starbucks and Coca-Cola paused their business in Russia.

McDonald's said Monday that it would start the process of "de-Arching" restaurants in Russia, meaning it would remove its name, logos, menus and branding from those locations. It will retain its trademarks in Russia, however, the company added.

The logo of the closed McDonald's restaurant in the Aviapark shopping center in Moscow.

Picture Alliance | Getty Images

The company also said it would attempt to make sure its employees in the country would continue getting paid until a deal closes, and that it would attempt to help them hold on to their jobs under the new owners.

McDonald's said its restaurants in Ukraine, which has been under attack by Moscow's forces since late February, remain closed. The company said it is continuing to pay full salaries to its employees in that country, as well.

Russia and Ukraine had accounted for about 2% of McDonald's systemwide sales, and approximately 9% of its revenue and 3% of its operating income.

McDonald's said it expects to record a primarily noncash charge of about $1.2 billion to $1.4 billion related to its decision to leave the Russian market. In March, the company said its temporary shutdown would cost it about $50 million a month, or 5 cents to 6 cents per share. McDonald's said the suspension of operations in Ukraine and Russia cost $127 million, or 13 cents per share, in the first quarter.

The decision to sell could eventually boost the stock price, despite the temporary hit, according to RBC Capital Markets analyst Christopher Carril.

"Looking ahead, the sale of MCD's Russia operations will effectively shift MCD's franchised mix to ~95%, from ~93% prior, a benefit to margins in a challenging cost environment, and ultimately the stock, in our view," Carril wrote in a note to clients on Monday.

FrankLin

FrankLin